NVIDIA 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

other liabilities had been provided for, then we would have been obligated to pay 3dfx two million shares of NVIDIA common stock.

If 3dfx could not make such a certification, but instead properly certified that its debts and liabilities could be satisfied for less than

$25.0 million, then 3dfx could have elected to receive a cash payment equal to the amount of such debts and liabilities and a reduced

number of shares of our common stock, with such reduction calculated by dividing the cash payment by $25.00 per share. If 3dfx

could not certify that all of its debts and liabilities had been provided for, or could not be satisfied, for less than $25.0 million, we

would not be obligated under the agreement to pay any additional consideration for the assets. We are currently party to litigation

relating to certain aspects of the asset purchase and 3dfx’s subsequent bankruptcy in October 2002. Please refer to Note 13 of the

Notes to the Consolidated Financial Statements for further information regarding this litigation.

21

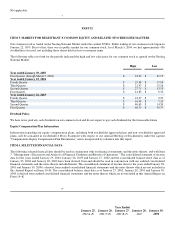

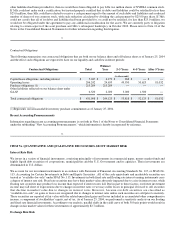

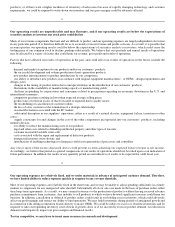

Contractual Obligations

The following summarizes our contractual obligations that are both on our balance sheet and off balance sheet as of January 25, 2004

and the effect such obligations are expected to have on our liquidity and cash flow in future periods:

Contractual Obligations Total Within 1

Year 2–3 Years 4−5 Years After 5 Years

(in thousands)

Capital lease obligations, including interest $ 5,047 $ 4,179 $ 868 $ −− $ −−

Operating leases 206,242 24,635 49,950 50,625 81,032

Purchase obligations (1) 213,289 213,289 −− −− −−

Other liabilities reflected on our balance sheet under

GAAP 6,520 2,020 3,000 1,500 −−

Total contractual obligations $ 431,098 $ 244,123 $ 53,818 $ 52,125 $ 81,032

_________________

(1)Represents our noncancelable inventory purchase commitments as of January 25, 2004.

Recent Accounting Pronouncements

Information regarding recent accounting pronouncements is set forth in Note 1 of the Notes to Consolidated Financial Statements

under the subheading "New Accounting Pronouncements," which information is hereby incorporated by reference.

22

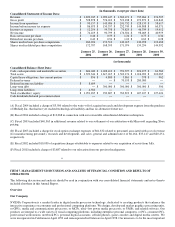

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Interest Rate Risk

We invest in a variety of financial instruments, consisting principally of investments in commercial paper, money market funds and

highly liquid debt securities of corporations, municipalities and the U.S. Government and its agencies. These investments are

denominated in U.S. dollars.

We account for our investment instruments in accordance with Statement of Financial Accounting Standards No. 115, or SFAS No.

115, Accounting for Certain Investments in Debt and Equity Securities . All of the cash equivalents and marketable securities are

treated as "available−for−sale" under SFAS No. 115. Investments in both fixed rate and floating rate interest earning instruments carry

a degree of interest rate risk. Fixed rate securities may have their market value adversely impacted due to a rise in interest rates, while

floating rate securities may produce less income than expected if interest rates fall. Due in part to these factors, our future investment

income may fall short of expectations due to changes in interest rates or we may suffer losses in principal if forced to sell securities

that decline in market value due to changes in interest rates. However, because our debt securities are classified as

"available−for−sale", no gains or losses are recognized due to changes in interest rates unless such securities are sold prior to maturity.

These securities are reported at fair value with the related unrealized gains and losses included in accumulated other comprehensive

income, a component of stockholders’ equity, net of tax. As of January 25, 2004, we performed a sensitivity analysis on our floating

and fixed rate financial investments. According to our analysis, parallel shifts in the yield curve of both 50 basis points would result in

changes in fair market values for these investments of approximately $2.7 million.

Exchange Rate Risk