Memorex 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

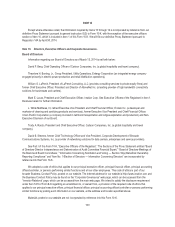

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

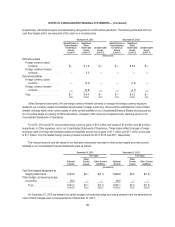

We have not provided specific asset information by segment, as it is not provided to our chief operating decision maker

for review at a segment specific level. Corporate and unallocated amounts above include non-cash goodwill impairment

charges of $23.3 million and $1.6 million for the years ended December 31, 2012, 2011, respectively, non-cash intangible

asset impairment charges of $251.8 million for the year ended December 31, 2012, restructuring and other costs of

$11.3 million, $21.1 million and $21.5 million for the years ended December 31, 2013, 2012 and 2011, respectively and

litigation settlement gains of $2.5 million for the year ended December 31, 2013 and litigation settlement charges of

$2.0 million for the year ended December 31, 2011.

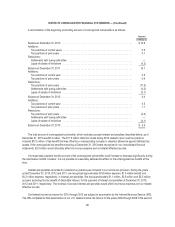

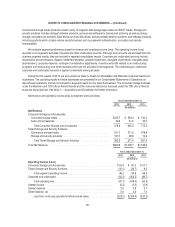

The following table presents net revenue by geographical region based on the country in which the revenue originated:

Years Ended December 31,

2013 2012 2011

(In millions)

Net Revenue

United States ......................................................... $348.1 $ 376.2 $ 420.8

International .......................................................... 512.7 630.5 745.8

Total .............................................................. $860.8 $1,006.7 $1,166.6

The United States and Japan each comprise more than 10 percent of our total net revenue. Net revenue from Japan

was 20.6 percent, 21.0 percent and 19.4 percent of total net revenue for the years ended December 31, 2013, 2012 and

2011, respectively.

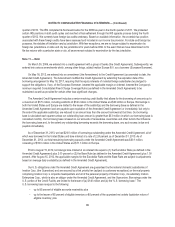

The following table presents long-lived assets by geographical region:

As of December 31,

2013 2012 2011

(In millions)

Long-Lived Assets

United States ............................................................ $150.7 $166.9 $321.0

International ............................................................. 41.6 47.4 87.4

Total ................................................................. $192.3 $214.3 $408.4

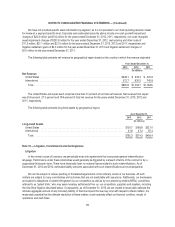

Note 15 — Litigation, Commitments and Contingencies

Litigation

In the normal course of business, we periodically enter into agreements that incorporate general indemnification

language. Performance under these indemnities would generally be triggered by a breach of terms of the contract or by a

supportable third-party claim. There have historically been no material losses related to such indemnifications. As of

December 31, 2013 and 2012, estimated liability amounts associated with such indemnifications are inconsequential.

We are the subject of various pending or threatened legal actions in the ordinary course of our business. All such

matters are subject to many uncertainties and outcomes that are not predictable with assurance. Additionally, our businesses

are subject to allegations of patent infringement by our competitors as well as by non-practicing entities (NPEs), sometimes

referred to as “patent trolls,” who may seek monetary settlements from us, our competitors, suppliers and resellers, including

the One-Blue litigation described below. Consequently, as of December 31, 2013, we are unable to reasonably estimate the

ultimate aggregate amount of any monetary liability or financial impact that we may incur with respect to these matters. It is

reasonably possible that the ultimate resolution of these matters could materially affect our financial condition, results of

operations and cash flows.

93