Memorex 2013 Annual Report Download - page 72

Download and view the complete annual report

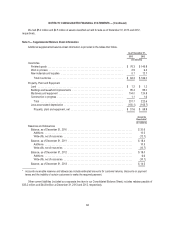

Please find page 72 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

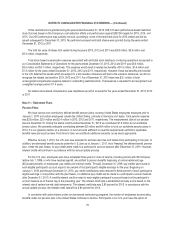

The goodwill assigned to our Storage Solutions reporting unit from the acquisition of Nexsan was not tested for

impairment during 2012 as it was acquired on December 31, 2012 and represents fair value based on the acquisition.

During 2011, we determined that the $1.6 million of carrying value of goodwill in the Mobile Security reporting unit as a

result of acquisition of the assets of Encryptx was fully impaired and as a result, a $1.6 million charge was recorded in 2011 in

our Consolidated Statements of Operations.

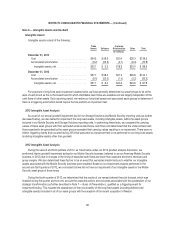

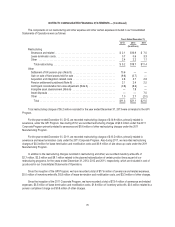

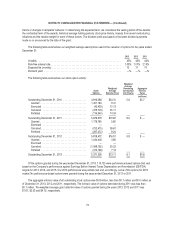

Note 7 — Restructuring and Other Expense

Restructuring expenses generally include severance and related charges, lease termination costs and other costs

related to restructuring programs. Employee-related severance charges are largely based upon distributed employment

policies and substantive severance plans. Generally, these charges are reflected in the period in which the Board approves

the associated actions, the actions are probable and the amounts are estimable which may occur prior to the communication

to the affected employee(s). This estimate takes into account all information available as of the date the financial statements

are issued. Severance amounts, for which affected employees were required to render service in order to receive benefits at

their termination dates, are measured at the date such benefits were communicated to the applicable employees and

recognized as expense over the employees’ remaining service periods.

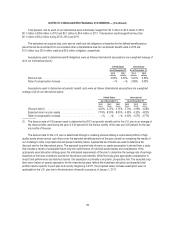

2012 Global Process Improvement Restructuring Program

On October 22, 2012, the Board of Directors approved our GPI Program in order to realign our business structure and

reduce operating expenses in excess of 25 percent over time. This restructuring program addressed product line

rationalization and infrastructure and included a planned reduction in our global workforce. The majority of these actions were

implemented during 2013. As of December 31, 2013 we have reduced operating expenses by approximately 30 percent, not

considering the incremental operating expense from the acquisition of Nexsan, and we have reduced our global workforce by

over 20 percent under the GPI Program.

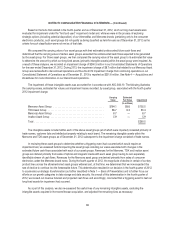

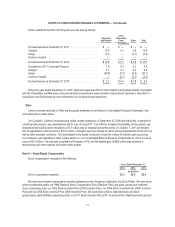

Other Prior Programs Substantially Complete

We have two additional programs, as described further below, that were initiated in prior years and are now substantially

complete.

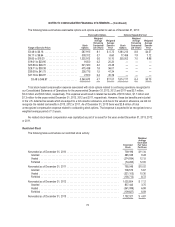

The 2011 Corporate Program was initiated during the first quarter of 2011 to rationalize certain product lines, increase

efficiency and gain greater focus in support of our go-forward strategy. Major components of the program included charges

associated with certain benefit plans, improvements to our global sourcing and distribution network, costs associated with

further rationalization of our product lines and evolution of our skill sets to align with our announced strategy. At December 31,

2012, we had approximately $15 million of authorized spending amounts remaining related to this program. At December 31,

2012, this remaining authorization was transferred and added to the GPI Program and any future charges, as well as the

remaining spend relating to the 2011 Corporate Program, will be accounted for under the 2012 GPI Program.

The 2011 Manufacturing Redesign Restructuring Program (2011 Manufacturing Program) was initiated during the first

quarter of 2011 to rationalize certain product lines and discontinue tape coating operations at our Weatherford, Oklahoma

facility and subsequently close the facility.

69