Memorex 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Note 10 — Income Taxes

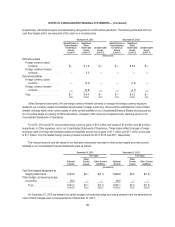

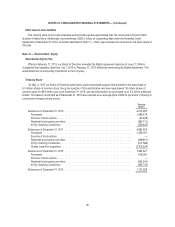

The components of loss from continuing operations before income taxes were as follows:

Years Ended December 31,

2013 2012 2011

(In millions)

U.S. .......................................................... $(25.2) $(266.1) $(57.1)

International .................................................... 2.2 (57.3) 26.9

Total ....................................................... $(23.0) $(323.4) $(30.2)

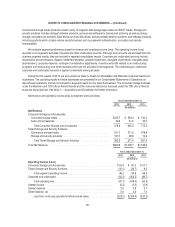

The components of the income tax provision from continuing operations were as follows:

Years Ended December 31,

2013 2012 2011

(In millions)

Current

Federal .................................................... $(0.7) $(11.5) $ 2.2

State ...................................................... — — —

International ................................................. 5.9 6.3 6.0

Deferred

Federal .................................................... — 8.8 —

State ...................................................... — — —

International ................................................. (3.8) (2.2) (3.2)

Total ......................................................... $1.4 $ 1.4 $5.0

The income tax provision from continuing operations differs from the amount computed by applying the statutory United

States income tax rate (35 percent) because of the following items:

Years Ended December 31,

2013 2012 2011

(In millions)

Tax at statutory U.S. tax rate ......................................... $(8.1) $(113.2) $(10.6)

State income taxes, net of federal benefit ............................. (0.2) (6.3) (1.9)

Net effect of international operations ................................. 3.1 25.0 (0.8)

Settlement of UK pension plan ..................................... (2.3) — —

Valuation allowances ............................................ (3.2) 89.2 11.6

U.S. tax on foreign earnings ....................................... 6.2 3.9 4.8

Stock-based compensation ........................................ 3.1 2.4 1.6

Uncertain tax positions ........................................... 2.2 0.3 0.2

Other ........................................................ 0.6 0.1 0.1

Income tax provision ............................................... $1.4 $ 1.4 $ 5.0

Our 2013 tax provision of $1.4 million primarily represents tax expense related to operations outside the United States

and unrecognized tax benefits recorded during the year offset by the tax benefit related to the settlement of our UK pension

plan during the year.

Our 2012 tax provision of $1.4 million primarily represents tax expense related to operations outside the United States,

offset by tax benefit from settlements with taxing authorities concluded during 2012 and activity in other comprehensive

income during 2012.

82