Memorex 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

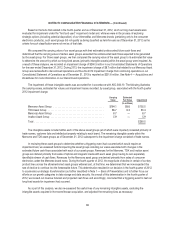

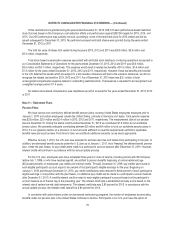

We test the carrying amount of a reporting unit’s goodwill for impairment on an annual basis during the fourth quarter of

each year or if an event occurs or circumstances change that would warrant impairment testing during an interim period. Our

reporting units for goodwill are the Mobile Security reporting unit and the Storage Solutions reporting unit which are one level

below our TSS reporting segment. We do not have any goodwill in our CSA operating segment. Goodwill resulting from the

acquisition of the MXI Security and IronKey businesses is allocated to the Mobile Security reporting unit. Goodwill resulting

from the acquisition of Nexsan is allocated to the Storage Solutions reporting unit.

2013 Goodwill Analysis

During the fourth quarter of 2013, we performed our annual impairment testing of goodwill for our Mobile Security and

Storage Solutions reporting units. In performing Step 1 of these tests, we compared the estimated fair value of these reporting

units to their carrying value. These impairment tests resulted in no impairment of goodwill as the estimated fair value of each

reporting unit exceeded the carrying value in Step 1 of the impairment tests by 25.7 percent and 34.2 percent, for the Storage

Solutions and Mobile Security reporting units, respectively. There were no triggering events that occurred during 2013 that

warranted an interim goodwill impairment test to be performed.

In determining the estimated fair value of the reporting units, we used the income approach, a valuation technique under

which we estimate future cash flows using the reporting unit’s financial forecasts and the market approach, a valuation

technique that provides an estimate of the value of the reporting unit based on a comparison to other similar businesses. Our

expected cash flows are affected by various significant assumptions, including projected revenue, gross margin and expense

expectations, terminal growth rate and a discount rate. Our analyses utilized discounted forecasted cash flows of a ten year

period with an estimation of residual growth rates thereafter. We use our business plans and projections as the basis for these

cash flow assumptions. The analysis utilized discount rates of 13.5 percent and 15.5 percent depending on the reporting unit

and a terminal growth rate of 3.0 percent.

2012 Goodwill Analysis

During the second and third quarters of 2012, we adjusted our internal financial forecast for our Mobile Security

reporting unit (referred to as our Americas-Mobile Security reporting unit in 2012) due to changes in the timing of expected

cash flows and lower than expected short-term revenues and gross margins. As we considered these factors to be an event

that warranted an interim test as to whether the goodwill was impaired we performed an impairment test as of each of these

periods. These impairment tests resulted in no impairment of goodwill as the estimated fair value of the reporting units

exceeded the carrying value in Step 1 of the impairment tests by 43.3 percent and 17.7 percent, during the second and third

quarter of 2012, respectively. During the fourth quarter of 2012, our internal financial forecast for our Mobile Security reporting

unit was again adjusted with further declines in our revenue and gross margin projections resulting from lower expectations in

the high-security market segment. In accordance with our policy, we performed our annual assessment of goodwill in the

Mobile Security reporting unit during the fourth quarter of 2012 and, as a result of this assessment, it was determined that the

carrying value of our Mobile Security reporting unit exceeded its estimated fair value as our internal financial forecasts were

again lowered. Accordingly, we performed Step 2 of the goodwill impairment test which compared the implied value of the

goodwill associated with Mobile Security to the carrying value of such goodwill. Based on this analysis, the carrying value of

the Mobile Security goodwill exceeded its implied value and, consequently, we recorded an impairment charge of

$23.3 million in our Consolidated Statements of Operations.

In determining the estimated fair value of the reporting unit, we used the income approach, a valuation technique under

which we estimate future cash flows using the reporting unit’s financial forecasts and the market approach, a valuation

technique that provides an estimate of the value of the reporting unit based on a comparison to other similar businesses. Our

expected cash flows are affected by various significant assumptions, including projected revenue, gross margin and expense

expectations, terminal growth rate and a discount rate. Our analysis utilized discounted forecasted cash flows over a 10 year

period with an estimation of residual growth rates thereafter. We use our business plans and projections as the basis for

expected future cash flows. The analysis utilized a discount rate of 16.0 percent and a terminal growth rate of 2.5 percent.

68