Memorex 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Off-Balance Sheet Arrangements

Other than the operating lease commitments discussed in Note 15 — Litigation, Commitments and Contingencies in our

Notes to Consolidated Financial Statements, we are not using off-balance sheet arrangements, including special purpose

entities.

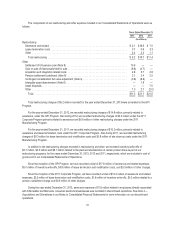

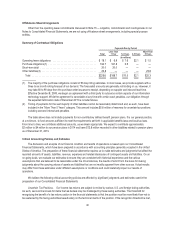

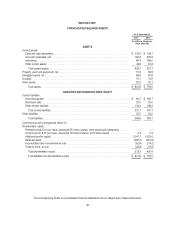

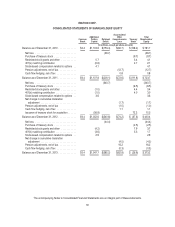

Summary of Contractual Obligations

Payments Due by Period

Total

Less Than

1 Year 1-3 Years 3-5 Years

More Than

5 Years

(In millions)

Operating lease obligations ................................ $ 18.1 $ 6.9 $ 7.6 $2.1 $ 1.5

Purchase obligations(1) ................................... 164.7 161.8 2.9 — —

Short-term debt ......................................... 20.0 20.0 — — —

Other liabilities(2) ........................................ 23.8 — — — 23.8

Total ............................................... $226.6 $188.7 $10.5 $2.1 $25.3

(1) The majority of the purchase obligations consist of 90-day rolling estimates. In most cases, we provide suppliers with a

three to six month rolling forecast of our demand. The forecasted amounts are generally not binding on us. However, it

may take 60 to 90 days from the purchase order issuance to receipt, depending on supplier and inbound lead time.

Effective December 8, 2009, we began an agreement with a third party to outsource certain aspects of our information

technology support. While the agreement is cancelable at any time with certain cash penalties, our obligation through

the expected termination date of December 2015 is included above.

(2) Timing of payments for the vast majority of other liabilities cannot be reasonably determined and, as such, have been

included in the “More Than 5 Years” category. This amount includes $5.8 million of reserves for uncertain tax positions

including accrued interest and penalties.

The table above does not include payments for non-contributory defined benefit pension plans. It is our general practice,

at a minimum, to fund amounts sufficient to meet the requirements set forth in applicable benefits laws and local tax laws.

From time to time, we contribute additional amounts, as we deem appropriate. We expect to contribute approximately

$2 million to $4 million to our pension plans in 2014 and have $12.8 million recorded in other liabilities related to pension plans

as of December 31, 2013.

Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations is based upon our Consolidated

Financial Statements, which have been prepared in accordance with accounting principles generally accepted in the United

States of America. The preparation of these financial statements requires us to make estimates and judgments that affect the

reported amounts of assets, liabilities, revenue, expenses and related disclosures of contingent assets and liabilities. On an

on-going basis, we evaluate our estimates to ensure they are consistent with historical experience and the various

assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making

judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results

may differ from these estimates under different assumptions or conditions and could materially impact our results of

operations.

We believe the following critical accounting policies are affected by significant judgments and estimates used in the

preparation of our Consolidated Financial Statements:

Uncertain Tax Positions. Our income tax returns are subject to review by various U.S. and foreign taxing authorities.

As such, we record accruals for items that we believe may be challenged by these taxing authorities. The threshold for

recognizing the benefit of a tax return position in the financial statements is that the position must be more-likely-than-not to

be sustained by the taxing authorities based solely on the technical merits of the position. If the recognition threshold is met,

40