Memorex 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

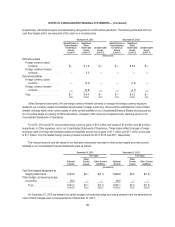

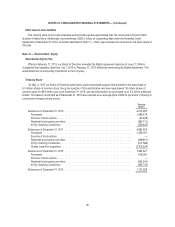

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Amount

(In Millions)

Balance at December 31, 2010 .................................................... $14.9

Additions:

Tax positions of current years ................................................... 0.3

Tax positions of prior years ..................................................... 0.1

Reductions:

Settlements with taxing authorities ............................................... —

Lapse of statute of limitations ................................................... (0.2)

Balance at December 31, 2011 .................................................... 15.1

Additions:

Tax positions of current year .................................................... 0.3

Tax positions of prior years ..................................................... 0.6

Reductions:

Tax positions of prior years ..................................................... (11.3)

Settlements with taxing authorities ............................................... (0.2)

Lapse of statute of limitations ................................................... (0.1)

Balance at December 31, 2012 .................................................... 4.4

Additions:

Tax positions of current year .................................................... 0.3

Tax positions of prior years ..................................................... 1.1

Reductions:

Tax positions of prior years ..................................................... (0.4)

Settlements with taxing authorities ............................................... —

Lapse of statute of limitations ................................................... (0.1)

Balance at December 31, 2013 .................................................... $ 5.3

The total amount of unrecognized tax benefits, which excludes accrued interest and penalties described below, as of

December 31, 2013 was $5.3 million. The $11.3 million reduction made during 2012 related to prior year tax positions

included $10.5 million of tax benefit that was offset by a corresponding increase in valuation allowance against deferred tax

assets. If the unrecognized tax benefits remaining at December 31, 2013 were recognized in our consolidated financial

statements, $5.3 million would ultimately affect income tax expense and our related effective tax rate.

It is reasonably possible that the amount of the unrecognized tax benefits could increase or decrease significantly during

the next twelve months; however, it is not possible to reasonably estimate the effect on the unrecognized tax benefit at this

time.

Interest and penalties recorded for uncertain tax positions are included in our income tax provision. During the years

ended December 31, 2013, 2012 and 2011, we recognized approximately $0.8 million expense, $1.3 million benefit and

$0.2 million expense, respectively, in interest and penalties. We had approximately $1.1 million, $0.3 million and $2.5 million

accrued, excluding the tax benefit of deductible interest, for the payment of interest and penalties at December 31, 2013,

2012 and 2011, respectively. The reversal of accrued interest and penalties would affect income tax expense and our related

effective tax rate.

Our federal income tax returns for 2010 through 2012 are subject to examination by the Internal Revenue Service (IRS).

The IRS completed its field examination of our U.S. federal income tax returns for the years 2006 through 2008 in the second

85