Konica Minolta 2001 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2001 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Konica Corporation/ Annual Report 200 1

6

sales from ¥64 .4 billion in Marc h

2 0 0 1 to ¥8 3 .0 billion by

March 2 0 0 5 .

The Inkjet Business Group

Uses High Technology to

Create New Markets

The Inkjet Business Group and the EM

& ID Business Group have been

designated as strategic business fields

in photosensitive materials-related

operations. Sales of media ( paper)

have been the driving force behind the

business volume and profits of the

Inkjet Business Group. In particular,

sales of our highly regarded Photolike

QP, a Konica photo-quality inkjet paper

with an excellent glossy base and

microporous tec hnology for fast

drying, have doubled every six months.

This has led to our c apturing around a

6 0 % share of the market for high-

quality glossy paper.

In addition, printer heads are

achieving both higher speeds and

higher density as the number of

nozzles has inc reased from 1 2 8 to

5 1 2 . The Company has set a goal of

5 1 2 nozzles and is following a three-

pronged approach that calls for

developing media, printer heads and

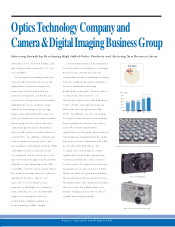

Expanding O ur Technological

Sphere with Optics Technology

We are also optimistic about the future

prospects of the Optic s Technology

Company, one of our strategic business

operations. To this point, the Optics

Tec hnology Company’s mainstay

product has been the aspherical

plastic lenses used in optical discs,

with our CD/DVD aspherical plastic

objective lenses capturing a market

share of around 7 0 %. We expect to

maintain a healthy market share and

high profitability, particularly in lenses

for DVDs and the next-generation HD-

DVDs. Plans are also under way to

reinforce our lens unit business,

especially for produc ts such as VTRs

and digital cameras.

Further, we expect that opto-

mec hatronic s technology, which we

developed for zoom lenses used in

cameras/VTRs and 3.5 -inch magneto-

optical ( MO) disk drives, will find

applications in micro-camera units,

such as those used in the personal

digital assistant field. With these areas

as our focal points, our goal in optics

technology, including camera and

digital imagimg operations, is to boost

ink. While combined sales of the Inkjet

Business Group were ¥ 4 .1 billion in

fiscal 20 0 1 , we have set an ambitious

sales target of ¥ 3 6 .0 billion by March

2005.

Advances in High-Value-Added

Products from the EM & ID

Business Group

The EM & ID Business Group is

focusing its energies on LCD polarizer

TAC film. Demand for this film, a key

component in making polarized film

for LCDs, should continue to expand.

As thin film and high-value-added

services continue to grow, we project

that sales of the EM & ID Business

Group will rise sharply from ¥ 1 2 .2

billion in March 20 0 1 to ¥3 0 .0 billion

by March 20 0 5 .

Focusing on Investment, Human

Resources and R&D Strategy

To guide our efforts in fields with high

growth potential, we are foc using on

our investment, human resourc es and

R&D strategy as outlined above. All

capital investment possible within the

limitations of cash flow is being

directed toward these fields.

Spec ifically, the LCD polarizer TAC film

business is creating high-value-added