Konica Minolta 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Konica Corporation/ Annual Report 200 1

25

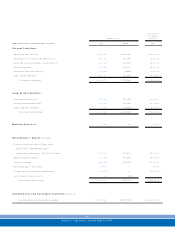

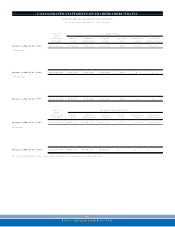

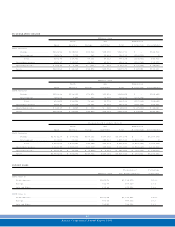

KONICA CORPORATION AND CONSOLIDATED SUBSIDIARIES

For the fiscal years ended Marc h 3 1 , 20 0 1 and 200 0

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1 . Basis of Pr esenting Financial Statements

The accompanying c onsolidated financial statements have been

prepared based on the accounts maintained by Konic a Corporation ( the

“Company”) and its c onsolidated subsidiaries in accordance with the

provisions set forth in the Japanese Commercial Code ( the “Code”) and

the Securities and Exchange Law, and in c onformity with accounting

principles and practic es generally accepted in Japan, which are different

in certain respects from the applic ation and disclosure requirements of

International Ac counting Standards.

Certain items presented in the consolidated financial statements

submitted to the Direc tor of Kanto Finance Bureau in Japan have been

rec lassified in these ac counts for the convenienc e of readers outside Japan.

Certain amounts previously reported have been rec lassified to

confirm to the current year classific ations.

As permitted under the Securities and Exchange Law of Japan,

amounts of less than one million yen have been omitted. As a result, the

totals shown in the accompanying c onsolidated financial statements

( both in yen and in dollars) do not nec essarily agree with the sums of

the individual amounts.

The consolidated financ ial statements are not intended to present

the consolidated financial position, results of operations and cash flows

in accordance with accounting princ iples and practices generally

accepted in c ountries and jurisdic tions other than Japan.

The consolidated statements of cash flows have been required to be

prepared with effect for the year ended March 3 1 , 2 0 0 0 in accordance

with new ac counting standards.

2 . Summary of Significant Accounting Policies

( a) Principles of Consolidation

The consolidated financ ial statements include the accounts of the

Company and, with c ertain exceptions which are not material, those of

its subsidiaries in which it has control. All significant interc ompany

transactions and acc ounts and unrealized profits are eliminated in

consolidation.

Investments in unconsolidated subsidiaries and significant affiliates

are accounted for by the equity method. Investments in insignific ant

affiliates are stated at cost.

The excess of cost over the underlying investments in subsidiaries is

rec ognized as goodwill and is amortized on a straight-line basis over a

five-year period.

( b) Translation of Foreign Currencies

Translation of For eign Currency Transactions

Until the year ended March 31, 2000, revenue and cost or expense items

arising from the transac tions of the Company denominated in foreign

currenc ies had been translated into Japanese yen at relevant exchange

rates prevailing at the time of transactions ( “historic al rates”) . All assets

and liabilities denominated in foreign currencies ( including short-term

monetary items) had been translated into yen at the historical rates.

Effective from the year ended March 3 1 , 2 0 0 1 , the Company and its

subsidiaries adopted the new Japanese ac counting standard for foreign

currenc y translation, which is effective for periods beginning on or after

April 1, 2 0 0 0 . Under the new standard, all monetary assets and liabilities

denominated in foreign c urrencies, whether long-term or short-term,

are translated into Japanese yen at the exchange rates prevailing at the

balance sheet date. Resulting gains and losses are included in net profit

or loss for the period. As a result of adopting the new method, income

before income taxes has increased by ¥ 7 1 4 million( US$5,7 6 3 thousand)

as compared with the amounts which would have been reported if the

previous standard had been applied consistently.

Translation of For eign Currency Financial Statements

The translations of foreign c urrency financial statements of overseas

consolidated subsidiaries and affiliates into Japanese yen are made by

applying the exc hange rates prevailing at the balance sheet dates for

balance sheet items, exc ept that the c ommon stoc k, additional paid-in

capital and retained earnings accounts are translated at the historical

rates and the statements of inc ome and retained earnings are translated

at average exchange rates.

Until the year ended March 31, 2000, the foreign currency

translation adjustments had been disc losed on the part of Assets or

Liabilities, and the new standards also c hanged the method of disclosure

on “foreign c urrency translation adjustments.”

For the c omparatively, the Foreign currency translation adjustments

March 3 1 , 2000 was rec lassified to the part of the shareholders’ equity.

( c) Cash and Cash Equivalents

Cash and c ash equivalents in the consolidated statements of cash flows

are c omposed of cash on hand, bank deposits able to be withdrawn on

demand and short-term investments with an original maturity of three

months or less and which represent a minor risk of fluctuation in value.

( d) Inventories

Inventories are valued principally on an average-c ost basis.

( e) Property, Plant and Equipment Depreciation

Depreciation of property, plant and equipment for the Company and

domestic consolidated subsidiaries is computed using the dec lining

balance method except for depreciation of buildings acquired after April

1 , 1 9 9 8 , based on the estimated useful lives of assets.

Depreciation of buildings ac quired after April 1 , 1 9 9 8 is computed

using the straight-line method. Depreciation of foreign subsidiaries is

computed using the straight-line method.

Ordinary maintenanc e and repairs are c harged to income as

incurred. Major replacements and improvements are capitalized. When

properties are retired or otherwise disposed of, the property and related

accumulated depreciation acc ounts are relieved of the applicable

amounts and any differenc es are c harged or credited to income.

( f) Income Taxes

Income taxes of the Company and its domestic subsidiaries consist of

corporate income taxes, loc al inhabitants taxes and enterprise taxes.

Deferred income taxes are provided for in respec t of temporary

differences between the tax basis of assets and liabilities and those as

reported in the consolidated financial statements.