Konica Minolta 2001 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2001 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Konica Corporation/ Annual Report 200 1

10

Medical and Graphic Company

Expanding the Market with Highly Regarded Imaging Equipment and Dry Film

Sales fell 1.9 %, to ¥ 1 2 0 .8 billion, but

operating income advanced 1 1 .9 %, to

¥ 9 .4 billion.

In the medical imaging field,

increased networking and digitization

in hospitals has fueled rapid growth in

the market for dry-film X-ray imagers.

We enjoyed significant sales growth in

this area, thanks especially to highly

regarded new produc ts such as the

Konica Direct Digitizer REGIUS Model

1 5 0 ( a cassette-type digital imaging

system with high levels of fineness) and

the Konica Laser Imager DRYPRO

Model 7 2 2 ( a digital image output

system with high levels of fineness) . We

posted significantly higher sales of our

dry film, which has earned an

outstanding reputation for image

quality. Overseas, energetic sales

promotion efforts helped boost sales

of our graphic imaging products.

However, sales fell in Japan, whic h is

our main market, due to stagnant

demand in the printing industry caused

by the continued rec ession and

intensified competition resulting from

new models introduced by other

industries.

As for future business development,

the medic al imaging produc ts field has

the potential to see continued annual

growth of around 5 % to 6%, with most

of that growth in digital products. We

will focus on marketing our X-ray

imaging equipment and dry film, both

of whic h stand above the competition in

quality and performanc e. Our dry film

in particular has carved out a generous

share of the market in Japan, and

eventually we will undertake aggressive

business development efforts in

Western markets. In addition, we are

constructing new dry-film production

fac ilities to meet the expected rapid

increase in demand. Sinc e these new

fac ilities will focus on state-of-the-art

equipment, they will help us slash

production costs when they commenc e

operation in April 2 0 0 2 . In the graphic

imaging products field, we expect

business conditions to become

increasingly bleak due to Japan’s

lingering recession and the trend

toward filmless imaging promoted by

digital technology. Our approach here

will be to continue c utting costs by

centralizing our production sites and

generating more business from the

printing and prepress markets, where

we enjoy a strong reputation.

22.2%

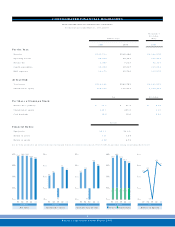

Net Sales

0

30

97 98 99 00 01

136.7 139.5 129.8 123.0 120.8

60

90

120

150

Net Sales ( ¥ billions)

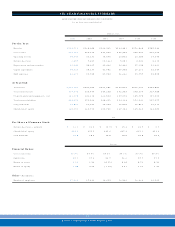

Konica Laser Im ager

DRYPRO Model 722

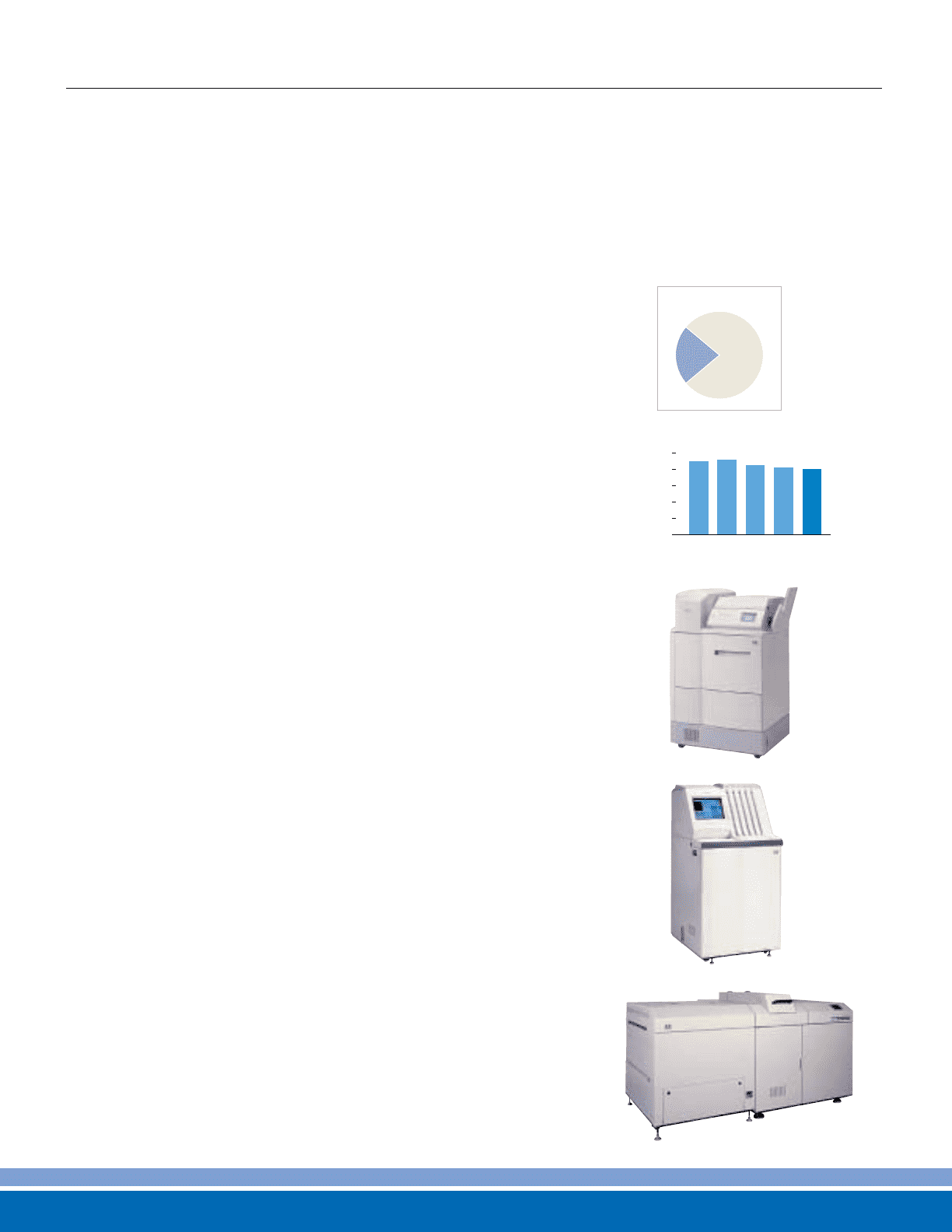

Konica Direct Digitizer

REGIUS Mo de l 150

Konica Digital Ko nsensus