Konica Minolta 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Konica Corporation/ Annual Report 200 1

29

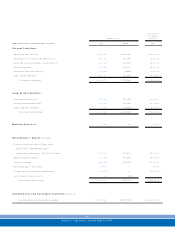

2 . Operating Leases

The scheduled maturities of future lease rental payments on such lease

contracts as of March 3 1 , 2 0 0 1 and 2 0 0 0 are as follows:

Thousands of

Millions of yen U.S. dollars

2001 2 0 0 0 2001

Due within one year ................... ¥14,805 ¥15,235 $138,781

Due over one year ...................... 1 2 ,1 3 3 1 7 ,0 2 5 97,926

¥ 1 6 ,9 3 9 ¥ 2 2 ,2 6 0 $136,715

Lessor

Finance Leases

Thousands of

Millions of yen U.S. dollars

2001 2 0 0 0 2001

Leased tools & furniture:

Purchase cost .......................... ¥972 ¥ 1 ,9 1 9 $7,845

Acc umulated depreciation ....... ( 8 9 6 ) ( 1 ,5 6 4 ) (7,232)

Net book value ................................. ¥17 6 ¥1 ,355 $1,613

The scheduled maturities of future lease rental inc ome on such lease

contracts as of March 3 1 , 2 0 0 1 and 2 0 0 0 are as follows:

Thousands of

Millions of yen U.S. dollars

2001 2 0 0 0 2001

Due within one year ......................... ¥0 ,0 8 7 ¥0 , 300 $0 ,702

Due over one year ........................... — 107 —

¥0 ,0 8 7 ¥0 ,408 $0 ,702

Lease rental income

for the year ...................................... ¥ 1 ,0 3 0 ¥ 1 ,3 1 8 $8,313

Deprec iation for the year ................. 896 1,146 7 ,2 3 2

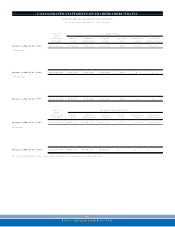

1 3 . Retir ement Benefits Plan

The Company and its subsidiaries have defined benefit retirement plans:

the plan which is governed by the Japanese Welfare Pension Insurance

Law, the tax-qualified pension plan and the lump-sum payment plan. In

addition, in some c ases when employees retire, the Company provides

for additional retirement benefits that are not in accordance with the

retirement benefit accounting.

The reserve for retirement benefits as of March 3 1 , 2 0 0 1 is analyzed

as follows:

Thousands of

Millions of yen U.S. dollars

a. Retirement benefit obligations ............................. ¥ ( 107 ,0 39 ) $( 8 6 3,9 1 4)

b. Plan assets ............................................................ 6 5,7 9 5 5 31,0 33

c.

Unfunded retirement benefit obligations ( a+ b)

....... ( 4 1,2 4 3) ( 3 32,8 73)

d. Unrecognized transition amount ........................... 5 ,8 33 4 7,0 7 8

e. Unrecognized actuarial differences

.............................

5,106 41,211

f. Unrecognized prior service cost............................ — —

g.

Net amount on consolidated balance sheets ( c+ d+ e+ f) .........

( 3 0 , 3 0 3 ) ( 2 4 4 , 5 7 6 )

h. Prepaid pension cost ............................................. 840 6 ,780

i. Ac crued retirement benefits ( g – h) ...................... ¥ ( 13 1 ,1 4 4 ) $ ( 2 5 1 , 3 6 4 )

Note: The above table includes the amounts related to the portion subject to the Japanese

Welfare Pension Insurance Law.

Net pension expense related to the retirement benefits for the year

ended March 3 1 , 2 0 0 1 is as follows:

Thousands of

Millions of yen U.S. dollars

a. Service costs ....................................................................... ¥ 5,5 9 7 $ 145,174

b. Interest costs ...................................................................... 3,283 26,497

c.

Expected return on plan assets

...... .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. ( 1 , 1 7 9 ) ( 9 ,5 1 6 )

d. Amortization of transition amount ..................................... 2 2,0 9 6 1 78 ,3 37

e.

Actuarial differences that are ac counted for as expenses........

— —

f. Prior servic e cost that are accounted for as expenses ........ — —

g. Retirement benefit costs ( a+ b+ c + d+ e+ f) ........................ ¥ 2 9,2 9 7 $ 23 6 ,457

h.

Gains on sec urities c ontribution to employees’ retirement benefit trust .....

8,873 71,614

i. Retirement benefit costs related to unrecognized differences

arising from acc ounting c hanges, net ( h – d) ..............................

¥(13,223) $(106,723)

Assumptions used in calculation of the above information are as follows:

a. Method of attributing the retirement benefits

to periods of services Straight- line basis

b. Discount rate Mainly 3 .5 %

c. Expected rate of return on plan assets Mainly 2 .5 %

d. Amortization of unrecognized prior service cost Mainly 1 0 years

e. Amortization of unrecognized actuarial differences Mainly 10 years

f. Amortization of transition amount The Company: Fully-amortized

Subsidiaries: 5 years

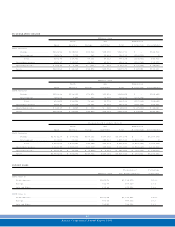

1 4 . Related Party Transactions

Material transactions of the Company with its related companies and

individuals, excluding transactions with c onsolidated subsidiaries which

are eliminated in the c onsolidated financial statements and other than

those disclosed elsewhere in these financial statements, for the year

ended March 3 1 , 2 0 0 1 are as follows:

Thousands of

Millions of yen U.S. dollars

Name of related c ompany ............................................ SECONIC CORPORATION

Paid-in capital .............................................................. ¥ 1,5 0 3 $ 1 2,1 3 1

Princ ipal business .......................................................

Production & sales of copy mac hines

Equity ownership percentage by the Company............. 38 %

Description of the Company’s transaction ...................

Purchases amounts from April 2 0 00 to March 200 1 .. ¥ 3 1,5 2 6 $25 4 ,44 7

Balance of accounts payable – trade as of March 3 1 , 200 1

.....

¥1 0,7 0 7 $ 86 ,4 16

The terms and c onditions of the above transactions are on an arm’s-length basis.

1 5 . Segment Information

Segment information is reported in ac cordance with the requirements of

the MOF. The photographic materials segment includes photographic

film, photographic paper, photofinishing equipment and chemicals,

videotapes and others. The business mac hines segment includes plain-

paper copiers, printers, facsimile machines, cameras, optical products

and others.