Konica Minolta 2001 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2001 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Konica Corporation/ Annual Report 200 1

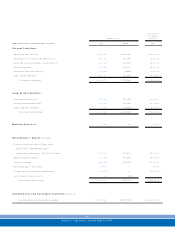

24

$ 89,257

2 0 9 ,3 6 2

3 0 ,0 4 0

( 9 ,6 6 9 )

7 4 ,7 9 4

( 5 3 ,3 1 7 )

2 1 ,0 0 9

1 0 6 ,7 2 3

2 4 ,7 5 4

4 1 ,5 7 4

( 6 1 ,0 1 7 )

( 5 ,9 7 3 )

4 6 ,3 5 2

5 1 3 ,9 0 6

7,853

( 7 4 ,6 0 9 )

( 3 6 ,1 5 0 )

4 1 1 ,0 0 1

—

9 6 9

( 1 8 6 ,0 3 7 )

9 7 ,7 5 6

( 4 ,6 2 5 )

5 4 ,6 2 5

( 2 8 ,2 2 4 )

( 6 5 ,5 2 9 )

( 1 8 7 ,2 4 8 )

2 0 7 ,2 7 2

( 3 3 5 ,3 5 9 )

—

( 8 )

( 2 8 ,8 6 2 )

—

( 3 4 4 ,2 1 3 )

7,797

9,048

4 4 4 ,0 8 4

3,462

$ 4 5 6 ,6 0 2

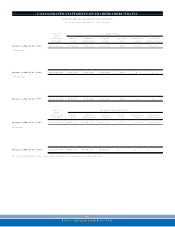

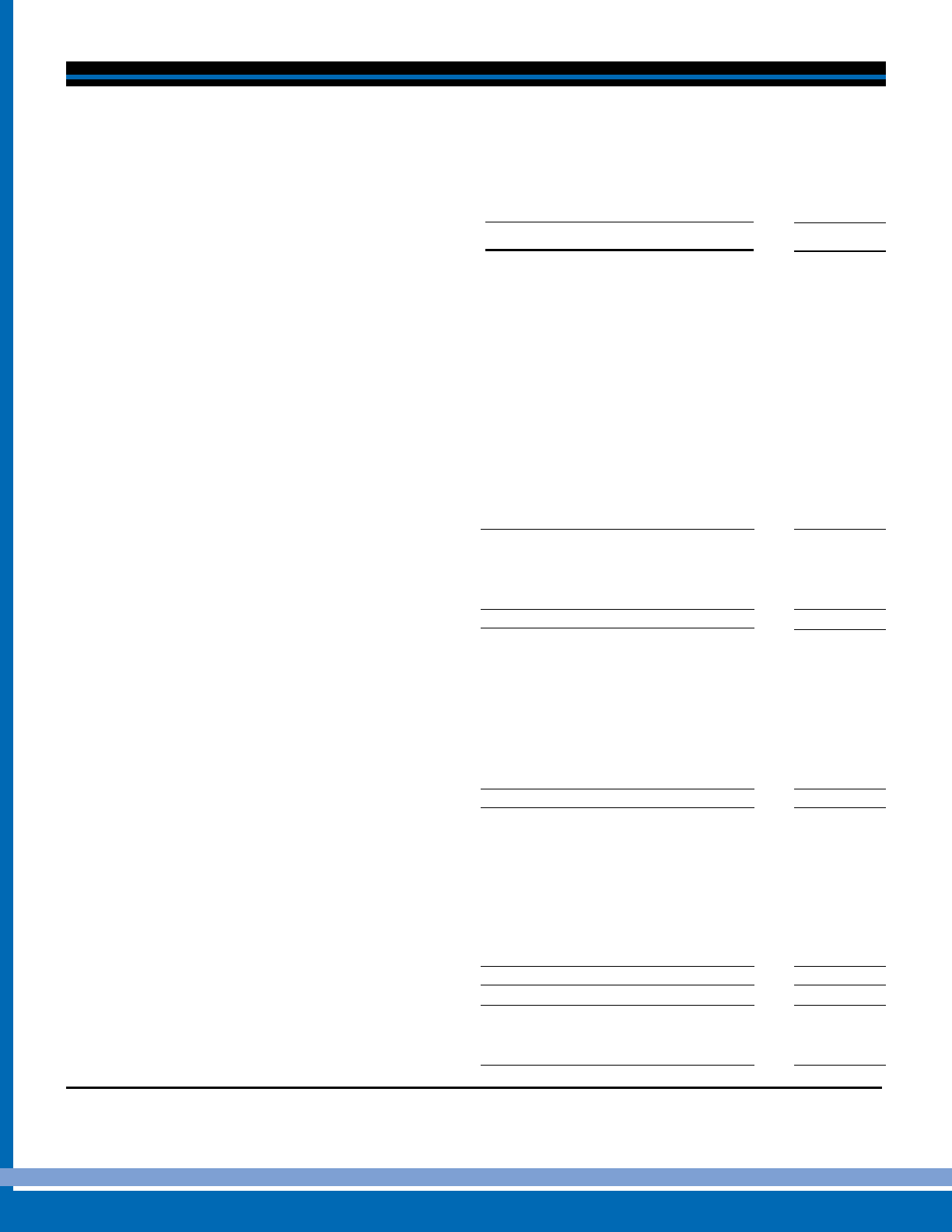

CONSOLIDATED STATEMENTS OF CASH FLOWS

KONICA CORPORATION AND CONSOLIDATED SUBSIDIARIES

For the fiscal years ended March 3 1, 2 0 01 and 2 0 0 0

Thousands of

U.S. dollars

Millions of yen ( Note 3)

2 0 0 1 2 0 0 0 2 0 0 1

Cash Flows from Operating Activities:

Income before income taxes

Depreciation and amortization

Increase in allowance for doubtful receivables

Interest and dividend income

Interest expenses

Loss ( gain) on sales or disposals of fixed assets, net

Write-down on investment securities

Amortization of unrecognized net obligation at transition

Dec rease in notes and accounts receivable

Dec rease in inventories

Dec rease in notes and accounts payable

Dec rease in ac crued consumption tax payable

Other

Subtotal

Interest and dividend income rec eived

Interest expenses paid

Income taxes paid

Net cash provided by operating activities

Cash Flows from Investing Activities:

Payment for acquisition of marketable securities

Proceeds from the sale of marketable securities

Payment for acquisition of fixed assets

Proceeds from the sale of fixed assets

Payment for acquisition of investment securities

Proceeds from the sale of investment sec urities

Other

Net cash used in investing ac tivities

Cash Flows from Financing Activities:

Dec rease in short-term debt

Proceeds from long-term debt

Redemption of long-term debt

Proceeds from the issuance of bonds

Payments for repurchase of treasury stoc ks

Dividends paid

Other

Net cash used in financing activities

Translation differ ences on cash and cash equivalents

Incr ease in cash and cash equivalents

Cash and cash equivalents at the beginning of the year

Incr ease in cash and cash equivalents by new consolidation

Cash and cash equivalents at fiscal year-end

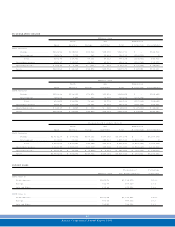

¥ 1 1 ,0 5 9

2 5 ,9 4 0

3 ,7 2 2

( 1 ,1 9 8 )

9 ,2 6 7

( 6 ,6 0 6 )

2 ,6 0 3

1 3 ,2 2 3

3 ,0 6 7

5 ,1 5 1

( 7 ,5 6 0 )

( 7 4 0 )

5 ,7 4 3

6 3 ,6 7 3

9 7 3

( 9 ,2 4 4 )

( 4 ,4 7 9 )

5 0 ,9 2 3

—

1 2 0

( 2 3 ,0 5 0 )

1 2 ,1 1 2

( 5 7 3 )

6 ,7 6 8

( 3 ,4 9 7 )

( 8 ,1 1 9 )

( 2 3 ,2 0 0 )

2 5 ,6 8 1

( 4 1 ,5 5 1 )

—

( 1 )

( 3 ,5 7 6 )

—

( 4 2 ,6 4 8 )

9 6 6

1 ,1 2 1

5 5 ,0 2 2

4 2 9

¥ 5 6 ,5 7 3

¥ 1 5 ,2 0 6

3 0 ,6 8 7

( 1 ,4 9 4 )

( 1 ,7 2 2 )

1 0 ,4 5 4

1,172

1,657

—

( 7 ,8 2 1 )

7,493

1 3 ,9 7 3

1,264

2,583

7 3 ,4 5 2

1,662

( 1 0 ,3 4 5 )

( 3 ,5 0 5 )

6 1 ,2 6 4

( 6 7 4 )

3,416

( 2 2 ,9 6 2 )

7,179

( 1 6 7 )

5 0 6

1,499

( 1 1 ,2 0 3 )

( 2 3 ,4 2 2 )

2 2 ,0 9 0

( 1 3 ,4 7 2 )

3,000

—

( 3 ,5 7 6 )

( 1 8 ,6 6 7 )

( 3 4 ,0 4 8 )

( 1 ,0 4 2 )

1 4 ,9 6 9

4 0 ,0 5 3

—

¥ 5 5 ,0 2 2

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.