Konica Minolta 2001 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2001 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Konica Corporation/ Annual Report 200 1

16

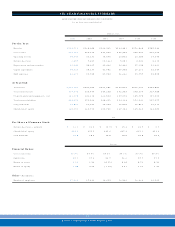

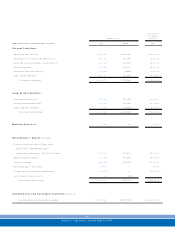

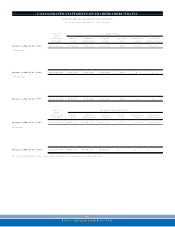

CONSOLIDATED FINANCIAL REVIEW

Sales Results

In the fiscal year ended March 31 , 2 0 0 1, consolidated net

sales totaled ¥ 5 4 3 .7 billion, a dec line of 3 .1 % from the

previous fiscal year. The world ec onomy experienced a

relatively positive trend during the first part of the fiscal year.

Beginning in autumn 2 0 00 , however, the outlook became

much cloudier as information technology ( IT) -related

industries centered on the United States, which had helped

drive the ec onomy, entered an adjustment phase. In Japan,

an inc rease in c apital investment from the private sector

sparked hopes of at least a slight recovery, but continued

stagnation in consumer spending and flat stock prices in the

latter half of the year led to continued pessimism about the

overall economy.

Unfavorable c urrency exchange fluctuation also served to

dampen Japan’s economy. The yen appreciated 3 .9% against

the U.S. dollar during the fiscal year, to an average of

¥ 1 0 8 .83 in March 20 0 1 , and 1 6 .5 % against the euro, to

an average of ¥ 9 9 .9 4 in March 20 0 1 . This had a signific ant

impact on sales, contributing to a drop of ¥2 5.3 billion.

Looking at results in our photographic materials

segment, sales increased for the Medical and Graphic

Company owing to rapidly growing demand for dry films

for X-ray imaging systems. In the EM & ID Business Group,

demand continued to develop for our triacetyl cellulose

( TAC) film, used for the polarizing filters in liquid crystal

displays ( LCDs) . Demand continued to climb in the Inkjet

Business Group as well, where we enjoy an outstanding

reputation for quic k-drying, photo-quality paper.

Nevertheless, sales by the Consumer Imaging Company were

affec ted by price declines and the graphic imaging segment

remained in an economic slump, and both segments

experienced a decrease. In particular, the consumer

imaging segment was affected by the yen’s appreciation,

falling ¥9 .4 billion, and as a result sales dropped ¥ 1 8 .7

billion.

In our business machines segment, the Optics

Tec hnology Company posted higher sales reflecting double-

digit growth in sales of aspherical plastic lenses for use in

optical disc s. For the Office Doc ument Company, however,

sales on a volume basis inc reased reflecting the completion

of our lineup of digital copiers, but the yen’s appreciation

led to a ¥ 1 3 .8 billion drop in terms of sales amount. As a

result, sales for these operations were down ¥ 7 .0 billion

compared with the previous fiscal year.

Cost of Sales, and Selling and General

Administrative Ex penses

The cost of sales during the fisc al year under review fell

1 .4% compared with the previous period, to ¥3 19 .2 billion,

due to purc hasing costs, resulting from the changes in the

currenc y exc hange rate and to the Company' s cost-reduc tion

efforts. However, due to lower sales and to price revisions,

the cost of sales ratio increased one percentage point, from

5 7 .7 % to 5 8 .7 %. As a result, gross profit declined 5 .3 %

from the previous year, to ¥ 2 2 4 .6 billion.

Selling and general administrative expenses decreased

¥ 1 0 .0 billion from the previous year, to ¥1 9 4 .0 billion, a

drop of 4 .9 %. However, bec ause net sales also fell 3.1 %, the

SG&A expenses ratio was down only 0 .7 percentage point

from the previous year, from 3 6 .4 % to 35 .7 %. The main

fac tors behind the decrease included efforts to streamline

operations, such as c utbacks in labor and incentives

centering on the Consumer Imaging Company. R&D

alloc ations were focused in three strategic areas: optics

technology, medical imaging, and inkjet technology.