Konica Minolta 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Konica Corporation/ Annual Report 200 1

28

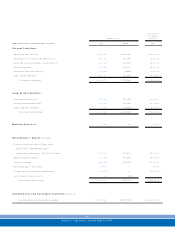

The annual maturity of long-term debt as of March 3 1 , 2 0 0 1 is as

follows:

Thousands of

Years ending Marc h 3 1 Millions of yen U.S. dollars

2 0 0 2 ...... .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .......... ¥ 15 ,0 00 $ 1 2 1,0 6 5

2 0 0 3 ...... .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 1 5 ,0 0 0 1 2 1 ,0 6 5

2 0 0 4 ...... .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 5 ,0 0 0 4 0 ,3 5 5

2 0 0 5 ...... .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 5 ,0 0 0 4 0 ,3 5 5

2 0 0 6 ...... .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 1 0 ,0 0 0 8 0 ,7 1 0

Assets pledged as collateral for short-term debt, long-term debt and

guarantees as of Marc h 3 1 , 2 0 0 1 and 2 0 0 0 are as follows:

Thousands of

Millions of yen U.S. dollars

2001 2 0 0 0 2001

Property, plant and equipment ..................... ¥ 4 ,6 5 9 ¥ 5,121 $37,603

8 . Income Taxes

The statutory tax rates used for calculating deferred tax assets and

deferred tax liabilities as of March 31, 2001 and 2 0 0 0 were 4 2 .1%.

At March 31, 2001 and 200 0 , the rec onciliation of the statutory tax

rate to the effective income tax rate is as follows:

2001 2 0 0 0

Statutory tax rate ...................................................... 42.1% 4 2 .1 %

Acc umulated defic it ......................................... —9 .9

Other, net ......................................................... ( 0 .6 ) ( 2 . 2 )

Effective tax rate ....................................................... 41.5% 4 9 .8%

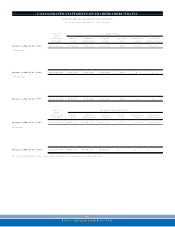

At March 31, 2001 and 200 0 , significant c omponents of deferred tax

assets and liabilities are as follows:

Thousands of

Millions of yen U.S. dollars

2 0 0 1 2 0 0 0 2 0 0 1

Gross deferred tax assets:

Tax effect on loss of a consolidated

subsidiary previously not recognized

..... ¥ 1 ,298 ¥ 2,528 $ 10,476

Tax loss carryforward ........................... 7,511 1 0 ,8 9 4 60,621

Reserve for employees’ retirement allowanc e

... 1 3 ,8 9 9 3,977 112,179

Inventories, etc ..................................... 4,936 5,015 39,839

Other, net ............................................. 1 4 ,3 4 6 9,465 115,787

Subtotal ................................................ 4 1 ,9 9 2 3 1 ,8 7 9 338,918

Valuation allowance .................................. (7,034) ( 4 ,9 8 0 ) (56,772)

Deferred tax assets total ........................ 3 4 ,9 5 7 2 6 ,8 9 9 282,139

Total gross deferred tax liabilities .......... (8,783) ( 1 , 6 1 9 ) (70,888)

Net deferred tax assets .............................. ¥ 2 6 ,1 7 4 ¥ 2 5 ,2 7 9 $211,251

9 . Research and Development Expenses

Total amounts charged to inc ome for the fisc al years ended March 3 1 ,

2 0 0 1 and 2 0 0 0 are ¥ 2 6 ,672 million ( US$ 2 1 5 ,2 7 0 thousand) and

¥ 2 5 ,7 3 0 million, respectively.

1 0 . Shar eholder s’ Equity

The Japanese Commercial Code provides that an amount equivalent to at

least 1 0 per cent of cash distributions ( cash dividends and bonuses to

directors and corporate auditors) paid in a fiscal period should be

appropriated to a legal reserve until this reserve equals 2 5 per cent of

stated capital. The legal reserve is not available for cash dividends but

may be used to reduce a deficit by a shareholders’ resolution or may be

capitalized by a Board of Directors’ resolution.

On June 2 8 , 2 0 0 1 , the shareholders approved a cash dividend to be

paid to shareholders on record as of Marc h 3 1 , 2 0 0 1 totaling ¥ 1 ,7 8 8

million ( US$ 1 4 ,431 thousand) , at the rate of ¥ 5 .0 0 ( US$ 0 .0 4 ) per share

of common stock. The related appropriation of retained earnings to the

legal reserve was made in the amount of ¥ 1 8 3 million ( US$1,4 7 7

thousand) .

1 1 . Commitments and Contingent Liabilities

The Company and its subsidiaries were contingently liable, as of March

3 1 , 2 0 0 1 , for trade notes discounted with banks of ¥ 6 3 million ( US$508

thousand) and for loans guaranteed of ¥ 3 ,3 7 6 million ( US$27,2 4 8

thousand) .

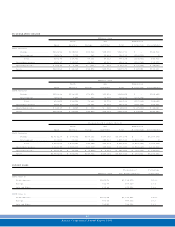

1 2 . Lease Transactions

Information on the Company’s and consolidated subsidiaries’ finance

lease transactions ( exc ept for those which are deemed to transfer the

ownership of the leased assets to the lessee) and operating lease

transactions are as follows:

Lessee

1 . Finance Leases

Thousands of

Millions of yen U.S. dollars

2001 2 0 0 0 2001

Machinery & equipment ................ ¥11,505 ¥12,154 $19 2 ,8 5 7

Tools & furniture ........................... 6 ,0 0 1 4 ,1 71 4 8 ,4 3 4

Others ........................................... 683 6 47 5 ,5 1 3

1 8 ,1 9 1 16,9 7 3 146,820

Less: Ac cumulated deprec iation .... ( 7 4 7 1 ) ( 5 ,90 7 ) (60,299)

Net book value .............................. ¥10,720 ¥11,066 $18 6 ,5 2 1

Deprec iation ................................. ¥13 ,2 7 4 ¥12 , 0 8 7 $12 6 ,4 2 5

Depreciation is based on the straight-line method over the lease

terms of the lease assets.

The scheduled maturities of future lease rental payments on such

lease c ontracts as of March 3 1 , 2 001 and 200 0 are as follows:

Thousands of

Millions of yen U.S. dollars

2001 2 0 0 0 2001

Due within one year ...................... ¥13 ,1 2 2 ¥12 ,8 6 9 $25,198

Due over one year ......................... 7 ,5 9 8 8 ,1 9 6 6 1 ,3 2 4

¥10,720 ¥ 1 1 ,0 6 6 $86,521

Lease rental expenses

for the year .................................... ¥13 ,2 7 4 ¥12 ,0 8 7 $26,425