Konica Minolta 2001 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2001 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Konica Corporation/ Annual Report 200 1

12

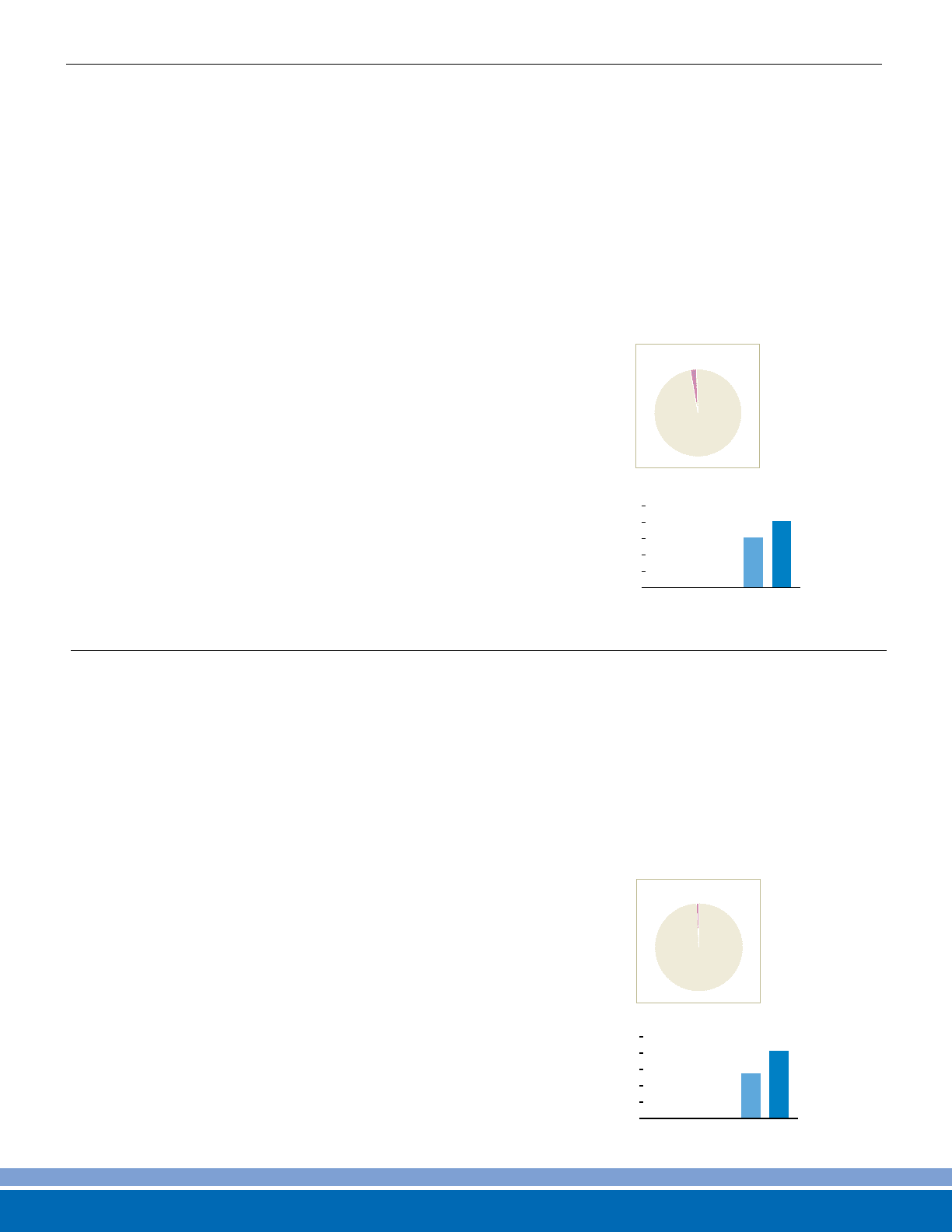

EM & ID Business Group

Strengthening Price-Competitiveness with Our Leading-Edge Fine-Filming Technology

Sales surged 3 2 .6%, to ¥ 1 2 .2 billion,

and operating income gained 4 4 .4%, to

¥ 2 .6 billion.

When our new factory c ommenc ed

operation in Marc h 20 0 0 , it marked

our full entry into the triacetyl cellulose

( TAC) film business for liquid c rystal

display ( LCD) polarizing plates— an

information technology ( IT) -related

product that shows significant growth

potential. Our sales in this area enjoyed

strong growth despite the fact that

demand for LCD panels suffered a

temporary slump following the

slowdown of the U.S. economy.

Moreover, our new factory gives us

greater production c apacity and

achieves a level of product quality that

meets even the market’s most stringent

demands.

As for future business development,

the tight supply and demand situation is

expected to continue for a while, so in

the near future we will focus on

providing a stable supply of products to

increase our market share. As part of

this move, we are now beginning to

serve as supplier to polarizing plate

manufacturers in Taiwan and South

Korea. We will also enhance our fine

filming proc esses and technology to

prepare for the intensifying pric e

competition expected ahead. As fine

filming technology is owned only by

filmmakers, this will help us reduce

costs and add value, which will improve

our price-competitiveness. In addition,

we are planning to begin production at

a second plant in April 20 0 2 , even

though we just finished expanding our

first plant in Marc h 2 0 0 1 . The second

plant became necessary due to the

market’s continued rapid growth.

Inkjet Business Group

Developing the Component Business with Our Advanced Head Technology

Sales c limbed 4 6 .4 %, to ¥ 4 .1 billion,

and the operating income ( loss)

improved to ¥0 .7 billion, a 30 %

decrease from the previous period.

Sales of media ( paper) posted

strong gains and played a large role in

our increased income in this area.

Leading the way was our Konica Inkjet

Paper Photolike QP, whose superior

gloss, high image quality and quick-

drying microporous technology have

earned high praise. Strong sales of this

product helped us capture about 6 0 % of

the market for high-quality glossy paper.

We also ac c elerated the start of our

component business ( inkjet heads and

inks) and began business negotiations

related to OEM supply.

As for future business development,

in the short term we will generate more

business focusing on media ( paper)

and seek to expand the business of

inkjet head and ink c omponents.

Especially, the industry is evolving

quickly toward higher-density, 512 -

nozzle heads and a greater range of

inks. Progress in these areas will help us

expand our component business. Also,

we are trying to gain a new foothold in

the large-format printer field, marketing

our large printers to the advertising and

light printing industries. In our

marketing ac tivities, we promote the

high-performance heads, high printing

speeds and superior image quality that

distinguish our printers.

2.2%

Net Sales

0.8%

Net Sales

0

3

97 98 99 00 01

9.2

12.2

6

9

12

15

0

1

97 98 99 00 01

2.8

4.1

2

3

4

5

Net Sales ( ¥ billions)

Note: Net sales in this category began with the fisc al

year ended Marc h 31 , 20 00.

Net Sales ( ¥ billions)

Note: Net sales in this category began with the fisc al

year ended Marc h 31 , 20 00.