Hyundai 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2015

144 145

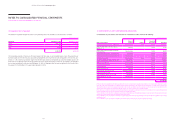

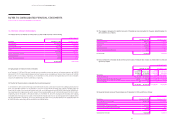

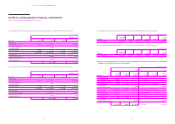

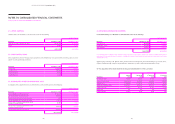

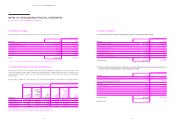

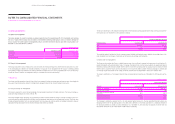

(5) Financial assets and liabilities subject to offsetting, financial instruments subject to an enforceable master netting

arrangement or similar agreement as of December 31, 2015 consist of the following:

In millions of Korean Won

Description

Gross

amounts

of recognized

financial

assets

and liabilities

Gross

amounts

of recognized

financial

assets

and liabilities

set off in the

consolidated

statement of

financial

position

Net

amounts of

financial

assets

and liabilities

presented in

the

consolidated

statement of

financial

position

Related

amounts not

set

off in the

consolidated

statement of

financial

position -

financial

instruments

Related

amounts not

set off in the

statement of

financial

position -

collateral

received

(pledged) Net amounts

Financial assets:

Trade notes and accounts receivable ₩ 4,662,777 ₩ 126,835 ₩ 4,535,942 - - ₩ 4,535,942

Other receivables 3,409,550 237,160 3,172,390 - - 3,172,390

Financial assets at FVTPL (*) 31,335 -31,335 8,142 -23,193

Derivative assets that are

effective hedging instruments (*) 220,824 -220,824 94,642 -126,182

₩ 8,324,486 ₩ 363,995 ₩ 7,960,491 ₩ 102,784 -₩ 7,857,707

Financial liabilities:

Trade notes and accounts payable ₩ 7,433,110 ₩ 351,986 ₩ 7,081,124 - - ₩ 7,081,124

Other payables 4,725,557 12,009 4,713,548 - - 4,713,548

Financial liabilities at FVTPL (*) 37,448 -37,448 8,142 -29,306

Derivative liabilities that are

effective hedging instruments (*) 161,290 -161,290 94,642 -66,648

₩ 12,357,405 ₩ 363,995 ₩ 11,993,410 ₩ 102,784 -₩ 11,890,626

(*) These are derivative assets and liabilities that the Group may have the right to offset in the event of default, insolvency or bankruptcy of the counterparty although these

do not meet the criteria of offsetting under K-IFRS 1032.

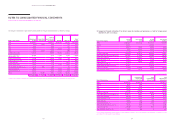

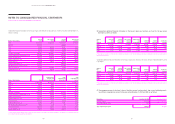

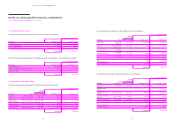

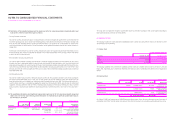

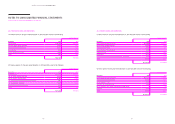

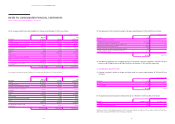

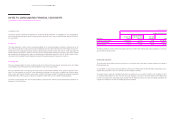

Financial assets and liabilities subject to offsetting, financial instruments subject to an enforceable master netting arrangement

or similar agreement as of December 31, 2014 consist of the following:

In millions of Korean Won

Description

Gross

amounts

of recognized

financial

assets

and liabilities

Gross

amounts

of recognized

financial

assets

and liabilities

set off in the

consolidated

statement of

financial

position

Net

amounts of

financial

assets

and liabilities

presented in

the

consolidated

statement of

financial

position

Related

amounts not

set

off in the

consolidated

statement of

financial

position -

financial

instruments

Related

amounts not

set off in the

statement of

financial

position -

collateral

received

(pledged) Net amounts

Financial assets:

Trade notes and accounts receivable ₩ 3,917,901 ₩ 116,275 ₩ 3,801,626 - - ₩ 3,801,626

Other receivables 3,421,842 277,916 3,143,926 - - 3,143,926

Financial assets at FVTPL (*) 66,947 -66,947 - - 66,947

Derivative assets that are

effective hedging instruments 39,002 -39,002 28,980 -10,022

₩ 7,445,692 ₩ 394,191 ₩ 7,051,501 ₩ 28,980 -₩ 7,022,521

Financial liabilities:

Trade notes and accounts payable ₩ 7,319,804 ₩ 278,275 ₩ 7,041,529 - - ₩ 7,041,529

Other payables 4,804,728 115,916 4,688,812 - - 4,688,812

Financial liabilities at FVTPL (*) 10,331 -10,331 - - 10,331

Derivative liabilities that are

effective hedging instruments 414,029 -414,029 28,980 -385,049

₩ 12,548,892 ₩ 394,191 ₩ 12,154,701 ₩ 28,980 -₩ 12,125,721

(*) There are no derivative assets and liabilities that can be offset as of December 31, 2014. Therefore, the derivative assets and liabilities do not meet the criteria for

offsetting in K-IFRS 1032, but the Group has a right of offsetting them in the event of default, insolvency or bankruptcy of the counterparty.

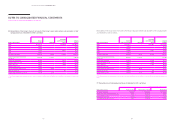

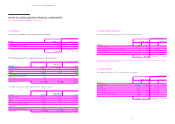

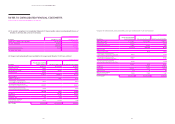

(6) The commission income (financial services revenue) arising from financial assets or liabilities other than financial

assets or liabilities at FVTPL for the years ended December 31, 2015 and 2014 are ₩ 1,717,992 million and ₩ 1,646,656

million, respectively. In addition, the fee expenses (cost of sales from financial services) occurring from financial

assets or liabilities other than financial assets or liabilities at FVTPL for the years ended December 31, 2015 and 2014

are ₩ 837,455 million and ₩ 787,994 million, respectively.

(7) The Group recognizes transfers between levels of the fair value hierarchy at the date of the event or change in

circumstances that caused the transfer. There are no significant transfers between Level 1 and Level 2 for the year

ended December 31, 2015.

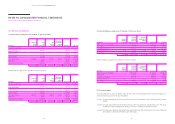

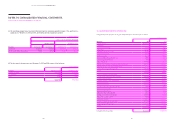

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014