Holiday Inn 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 IHG Annual Report and Financial Statements 2009

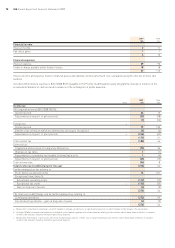

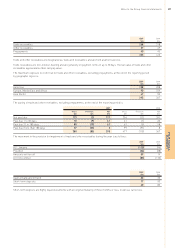

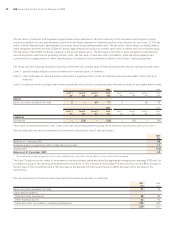

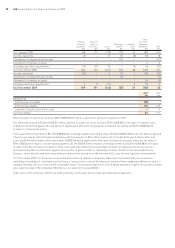

19 Trade and other payables

2009 2008

$m $m

Current

Trade payables 99 111

Other tax and social security payable 29 31

Other payables 278 322

Accruals 262 272

Derivatives 20 10

688 746

Non-current

Other payables 408 392

Trade payables are non-interest-bearing and are normally settled within an average of 45 days.

Other payables include $470m (2008 $471m) relating to the future redemption liability of the Group’s loyalty programme, of which $86m

(2008 $96m) is classified as current and $384m (2008 $375m) as non-current.

Derivatives are held in the Group statement of financial position at fair value. Fair value is estimated using discounted future cash flows

taking into consideration interest and exchange rates prevailing on the last day of the reporting period.

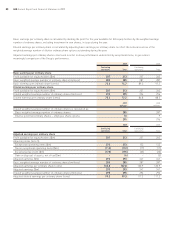

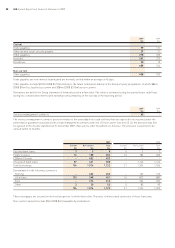

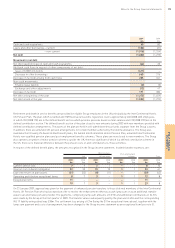

20 Provisions

2009 2008

$m $m

Onerous management contracts 65 –

The onerous management contracts provision relates to the unavoidable net cash outflows that are expected to be incurred under the

performance guarantee associated with certain management contracts with one US hotel owner (see note 5). As the provision was first

recognised in the income statement at 31 December 2009, there are no other movements to disclose. The provision is expected to be

utilised within 12 months.

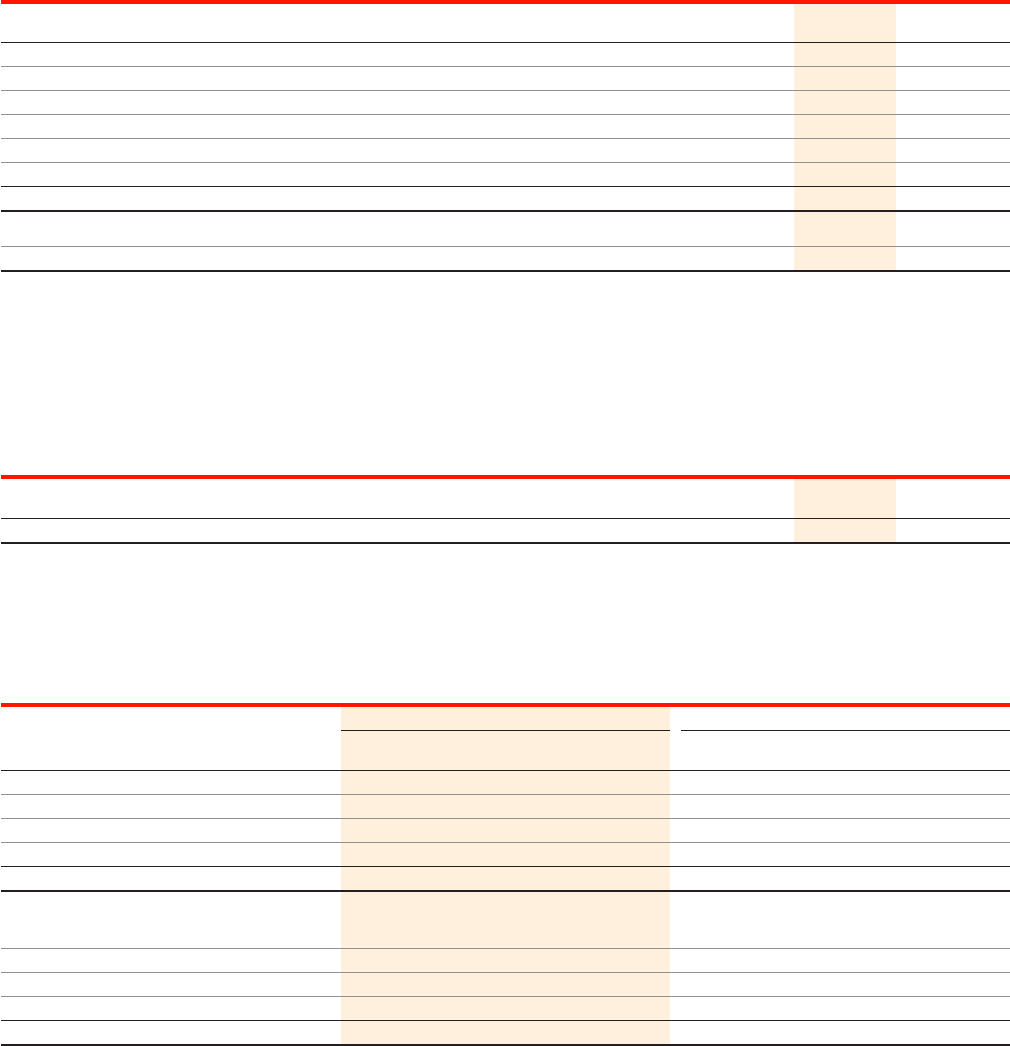

21 Loans and other borrowings

2009 2008

Current Non-current Total Current Non-current Total

$m $m $m $m $m $m

Secured bank loans 358527

Finance leases 16 188 204 16 186 202

£250m 6% bonds – 402 402 –––

Unsecured bank loans 87 421 508 – 1,146 1,146

Total borrowings 106 1,016 1,122 21 1,334 1,355

Denominated in the following currencies:

Sterling – 402 402 – 152 152

US dollars 103 348 451 16 873 889

Euro – 216 216 – 224 224

Other 35053 58590

106 1,016 1,122 21 1,334 1,355

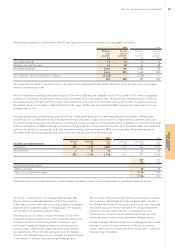

Secured bank loans

These mortgages are secured on the hotel properties to which they relate. The rates of interest and currencies of these loans vary.

Non-current amounts include $5m (2008 $nil) repayable by instalments.

Notes to the Group financial statements continued