Holiday Inn 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 IHG Annual Report and Financial Statements 2009

Remuneration report continued

2 Remuneration policy and structure

IHG’s overall remuneration is intended to:

• attract and retain high-quality executives in an environment

where compensation levels are based on global market practice;

• drive aligned focus of the senior executive team and reward the

achievement of business targets and key strategic objectives;

• align rewards of executives with returns to shareholders;

• support equitable treatment between members of the same

executive team; and

• facilitate global assignments and relocation.

The Committee believes that it is important to reward

management, including the Executive Directors, for targets

achieved, provided those targets are stretching and aligned with

shareholders’ interests.

IHG’s remuneration structure for senior executives places a strong

emphasis on performance-related reward. The individual elements

are designed to provide the appropriate balance between fixed

remuneration and variable ‘risk’ reward, linked to both the

performance of the Group and the achievements of the individual.

Approximately two-thirds of variable reward is delivered in the form

of shares, to enhance alignment with shareholders.

In reaching its decisions, the Committee takes into account

a number of factors, including the relationship between

remuneration and risk, strategic direction and affordability.

Performance-related measures are chosen carefully to ensure a

strong link between reward and underlying financial performance,

and emphasis is placed on achievement of key strategic priorities.

The normal policy for all Executive Directors and Executive

Committee members is that, using ‘target’ or ‘expected value’

calculations, their performance-related incentives will equate to

approximately 70% of total annual remuneration (excluding

pensions and benefits).

The Company recognises that its Executive Directors may be invited

to become Non-Executive Directors of other companies and that

such duties can broaden experience and knowledge, and benefit

the Company. Executive Directors are, therefore, permitted to

accept one non-executive appointment (in addition to any positions

where the Director is appointed as the Group’s representative),

subject to Board approval, as long as this is not, in the reasonable

opinion of the Board, likely to lead to a conflict of interest. Executive

Directors are generally authorised to retain the fees received.

Current Executive Directors hold no Non-Executive Directorships

of other companies.

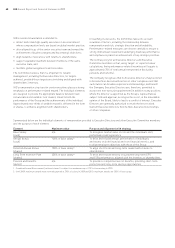

Summarised below are the individual elements of remuneration provided to Executive Directors and other Executive Committee members

and the purpose of each element.

Element Maximum value Purpose and alignment with strategy

Base Salary n/a To recognise market value of role and the individual’s skill,

(cash) performance and experience

Annual Bonus 100% of base salary1To drive and reward annual performance of individuals

(cash) and teams on both financial and non-financial metrics, and

to align employee objectives with those of the Group

Deferred Annual Bonus 100% of base salary1To align short-term and long-term reward with returns to

(shares) shareholders

Long Term Incentive Plan 205% of base salary2To drive and reward delivery of sustained long-term EPS

(shares) and TSR performance, aligned with the interests of shareholders

Pension and benefits n/a To provide a competitive level of benefits, providing short-term

(varied) protection and long-term savings opportunities

1 Combined Annual Bonus award (cash and shares) is subject to a maximum cap of 175% of base salary in 2010.

2 Until 2009, maximum awards were normally granted at 270% of salary. In 2009 and 2010, maximum awards are 205% of base salary.