Holiday Inn 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

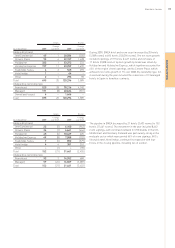

Within the global market, just under half of hotel rooms are

branded; however, there has been an increasing trend towards

branded rooms. Over the last three years, the branded market

(as represented by the nine major global branded hotel companies)

has grown at a 3.8% compound annual growth rate (CAGR), twice

as quickly as the overall market, implying an increased preference

towards branded hotels. Branded companies are therefore gaining

market share at the expense of unbranded companies. IHG is well

positioned to benefit from this trend. Hotel owners are increasingly

recognising the benefits of franchising or managing with IHG which

can offer a portfolio of brands to suit the different real estate

opportunities an owner may have, together with effective revenue

delivery through global reservations channels. Furthermore, hotel

ownership is increasingly being separated from hotel operations,

encouraging hotel owners to use third parties such as IHG to

manage their hotels.

Other factors

Potential negative trends impacting hotel industry growth include

the possibility of increased terrorism and increased security

measures, environmental considerations and economic factors

such as the longevity of the downturn.

Our business model

IHG’s future growth will be achieved predominantly through

franchising and managing rather than owning hotels.

Approximately 641,000 rooms operating under Group brands are

franchised or managed and 5,800 rooms are owned and leased.

The franchised and managed fee-based model is attractive

because it enables the Group to achieve its goals with limited

capital investment at an accelerated pace. A further advantage is

the reduced volatility of the fee-based income stream, compared

with ownership of assets.

A key characteristic of the franchised and managed business is

that it generates more cash than is required for investment in the

business, with a high return on capital employed. Currently 87%

of continuing earnings before regional and central overheads,

exceptional items, interest and tax is derived from franchised

and managed operations.

The key features of our business model are represented in the

following table and charts.

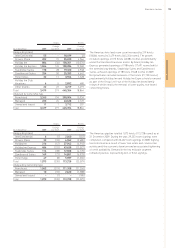

Owned

Franchised Managed and leased

Brand IHG IHG IHG

Marketing and

distribution IHG IHG IHG

Staff Third party IHG usually IHG

supplies general

manager as a

minimum

Ownership Third party Third party IHG

IHG capital None Low/none High

IHG revenue Fee % of Fee % of total All revenue

rooms revenue plus

revenue % of profit

Total hotels 3,799 622 17

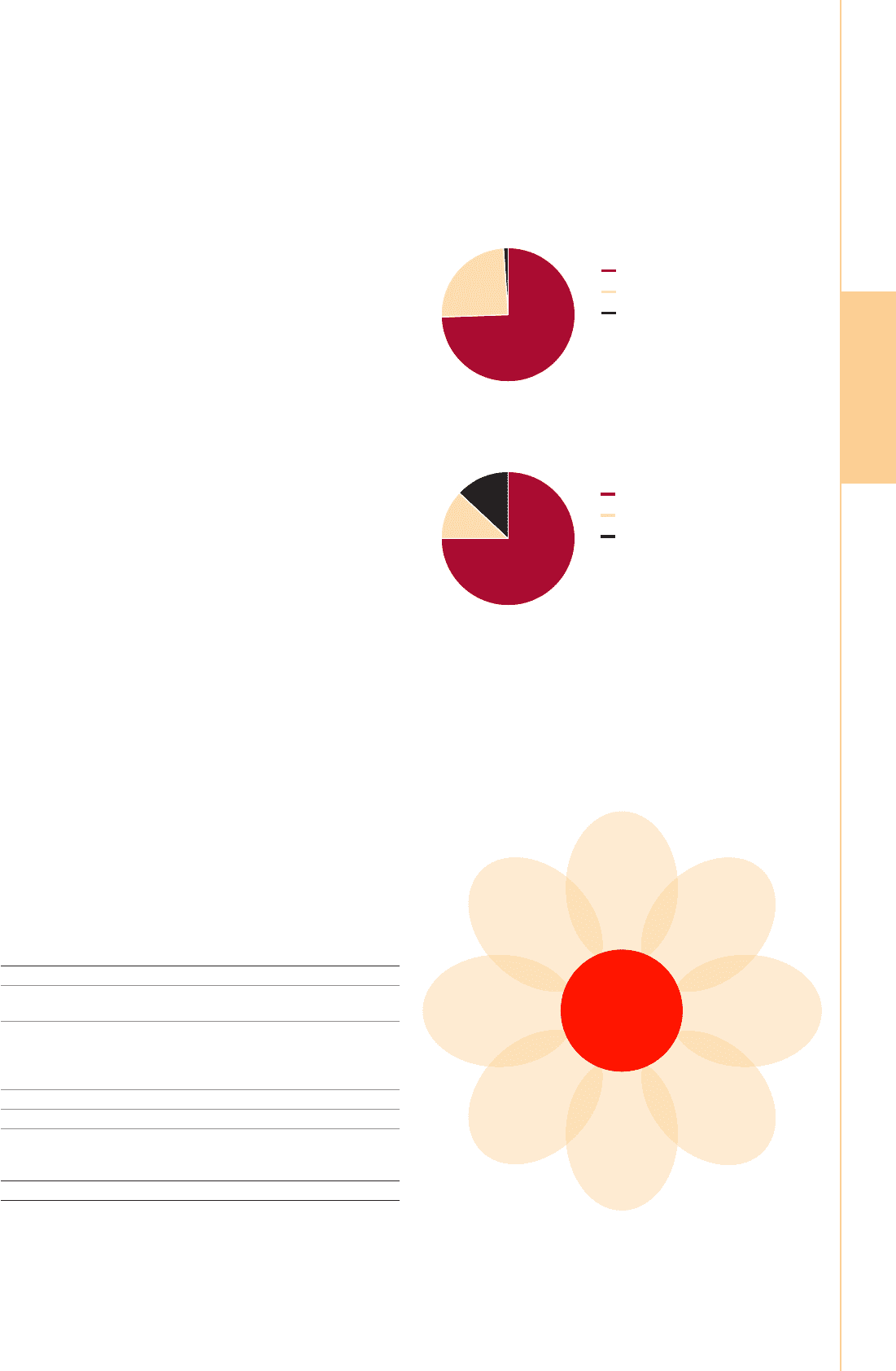

IHG global room count by ownership type

at 31 December 2009

IHG continuing operating profit* by ownership type

for the year ended 31 December 2009

* Before regional and central overheads, exceptional items,

interest and tax.

The IHG global operating system

IHG’s operating system is our means of driving demand to our

hotels. It comprises hotel distribution, brands, reservations

systems, web presence, our rewards scheme and other elements.

It is the largest such system in the industry and the engine of our

business, delivering, on average, 68% of total rooms revenue.

Franchised

Managed

Owned and leased

Franchised

Managed

Owned and leased

Business review 9Business review 9

Scale

4,438 hotels

over 130 million

room nights

per annum

System funds

Annual system

funds totalling

c.$1 billion

Loyalty

programme

Priority Club Rewards,

the largest in

the industry,

over 48 million

members

Brand portfolio

7hotel brands

covering all

major segments

Reservations

systems

10 call centres around

the world covering

29 languages

Sales force

Global sales team

of more than

8,000

professionals

Market coverage

Leadership

positions in 6largest

hotel markets, more

than any other hotel

company

Web presence

Network of global sites

across 13 languages

IHG’s system

delivers 68%

of total rooms

revenue

BUSINESS REVIEW