Holiday Inn 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Remuneration report 49

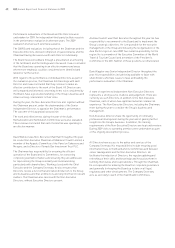

Variable compensation is based on objectives linked to the

Company’s strategy:

Measure Alignment with strategy

Short Term:

EBIT • Provides focus on the core

operating inputs influenced by

management, namely rooms

growth, RevPAR, and cost

control

Individual Overall • Provides focus on key

Performance Rating (OPR) performance objectives and

leadership competencies

relative to the individual role

Long Term:

EPS growth • Ensures delivery of a growing

profit base over the long term

TSR relative to Dow • Aligned with our goal to be the

Jones World Hotels index world’s best hotel company

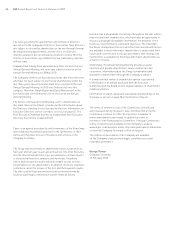

The OPR is linked to personal performance rating and key

performance objectives (KPOs) linked to the corporate strategy:

Individual Performance

Measures for OPR Example KPOs

Financial returns • Total gross revenue and system

contribution revenue

Our people • Annual employee engagement

scores

Guest experience • Relaunch of Holiday Inn

• Global RevPAR growth and

RevPAR growth ahead of market

Responsible business • Tracking of reduced water,

waste and energy consumption

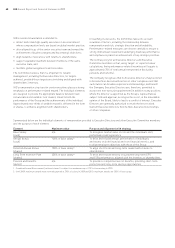

The following table shows the split of fixed and variable

compensation for the Executive Directors, assuming target

performance is achieved (where applicable):

Andrew Richard

Director Cosslett Solomons

Fixed pay 30% 30%

Short-term variable pay 35% 35%

Long-term variable pay 35% 35%

The Committee also reviews the balance of fixed and variable

remuneration provided to the wider management population, to

ensure these ratios are appropriate, given the relativities to the

Executive Directors and to market practice.

3 Base salary and benefits

The salary for each Executive Director is reviewed annually and is

based on both individual performance and on relevant competitive

market data. Internal relativities and salary levels in the wider

employment market are also taken into account. Base salary is

the only element of remuneration which is pensionable. In addition,

benefits are provided to Executive Directors in accordance with

local market practice.

In assessing levels of pay and benefits, IHG analyses those offered

by different groups of comparator companies. These groups are

chosen having regard to participants’:

• size – market capitalisation, turnover, profits and the number

of people employed;

• diversity and complexity of business;

• geographical spread of business; and

• relevance to the hotel industry.

In reaching its decisions, the Committee also considers the

remuneration levels and approaches provided to the wider

IHG workforce.

Executive Directors’ salaries are shown in the table below:

2010 salary 2009 salary

Andrew Cosslett £826,000 £802,000

Richard Solomons £523,000 £510,000

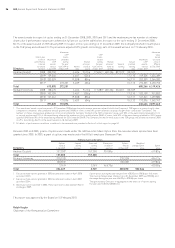

4 Annual Bonus Plan (ABP)

Structure in 2009

Awards under the ABP require the achievement of challenging

performance goals before target bonus is payable.

The maximum bonus an Executive Director or Executive Committee

member can receive in any one year is 200% of salary. Achievement

of target performance results in a bonus of 115% of salary. Half of

any bonus earned is compulsorily deferred in the form of shares

for three years. No matching shares are awarded by the Company.

For 2009, awards under the ABP were linked to individual

performance (30% of total award) and EBIT (70% of total award).

In order to increase focus on cost savings and margins, net annual

rooms additions was removed as an ABP performance measure

for 2009 as outlined in last year’s Report. Individual performance

was measured by the achievement of specific key performance

objectives that are linked directly to the Group’s strategic priorities,

and an assessment of performance against leadership

competencies and behaviours.

The individual performance measures comprise several factors

linked to strategic objectives, a selection of which is set out in the

Individual Performance Measures for OPR and Example KPOs table

on this page.

THE BOARD,

SENIOR MANAGEMENT AND

THEIR RESPONSIBILITIES