GE 2005 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2005 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(98)

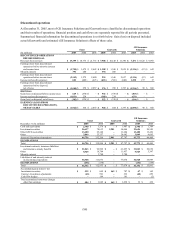

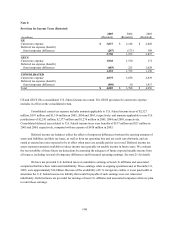

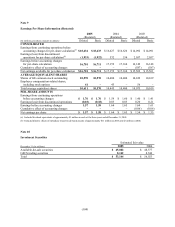

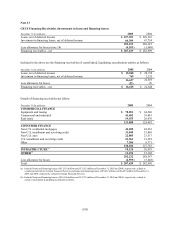

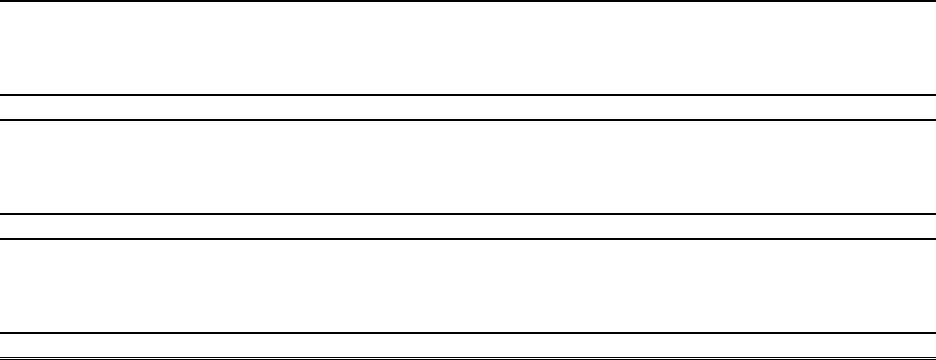

Note 8

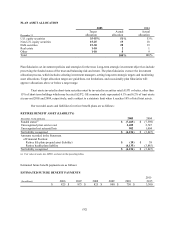

Provision for Income Taxes (Restated)

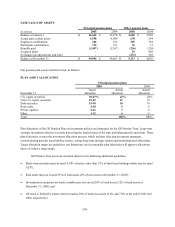

(In millions)

2005

(Restated)

2004

(Restated)

2003

(Restated)

GE

Current tax expense $3,037 $ 2,148 $ 2,468

Deferred tax expense (benefit)

from temporary differences (287) (175) 389

2,750 1,973 2,857

GECS

Current tax expense 1,938 1,510 171

Deferred tax expense (benefit)

from temporary differences (603) 225 1,028

1,335 1,735 1,199

CONSOLIDATED

Current tax expense 4,975 3,658 2,639

Deferred tax expense (benefit)

from temporary differences (890) 50 1,417

Total $4,085 $ 3,708 $ 4,056

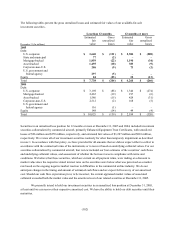

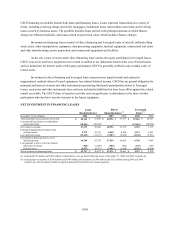

GE and GECS file a consolidated U.S. federal income tax return. The GECS provision for current tax expense

includes its effect on the consolidated return.

Consolidated current tax expense includes amounts applicable to U.S. federal income taxes of $2,527

million, $587 million and $1,314 million in 2005, 2004 and 2003, respectively, and amounts applicable to non-U.S.

jurisdictions of $2,241 million, $2,577 million and $1,276 million in 2005, 2004 and 2003, respectively.

Consolidated deferred taxes related to U.S. federal income taxes were benefits of $137 million and $27 million in

2005 and 2004, respectively, compared with an expense of $818 million in 2003.

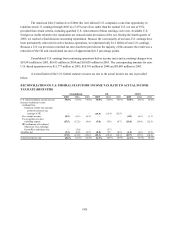

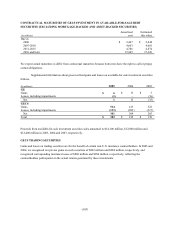

Deferred income tax balances reflect the effects of temporary differences between the carrying amounts of

assets and liabilities and their tax bases, as well as from net operating loss and tax credit carryforwards, and are

stated at enacted tax rates expected to be in effect when taxes are actually paid or recovered. Deferred income tax

assets represent amounts available to reduce income taxes payable on taxable income in future years. We evaluate

the recoverability of these future tax deductions by assessing the adequacy of future expected taxable income from

all sources, including reversal of temporary differences and forecasted operating earnings. See note 21 for details.

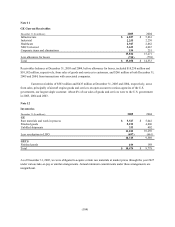

We have not provided U.S. deferred taxes on cumulative earnings of non-U.S. affiliates and associated

companies that have been reinvested indefinitely. These earnings relate to ongoing operations and, at December 31,

2005, were approximately $36 billion. Because of the availability of U.S. foreign tax credits, it is not practicable to

determine the U.S. federal income tax liability that would be payable if such earnings were not reinvested

indefinitely. Deferred taxes are provided for earnings of non-U.S. affiliates and associated companies when we plan

to remit those earnings.