GE 2005 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2005 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(135)

Securitized assets that are on-balance sheet include assets consolidated upon adoption of FIN 46. Although

we do not control these entities, consolidation was required because we provided a majority of the credit and

liquidity support for their activities. A majority of these entities were established to issue asset-backed securities,

using assets that were sold by us and by third parties. These entities differ from others included in our consolidated

financial statements because the assets they hold are legally isolated and are unavailable to us under any

circumstances. Repayment of their liabilities depends primarily on cash flows generated by their assets. Because we

have ceased transferring assets to these entities, balances will decrease as the assets repay. We refer to these entities

as “consolidated, liquidating securitization entities.”

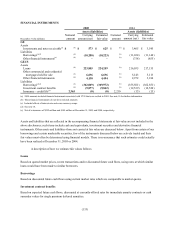

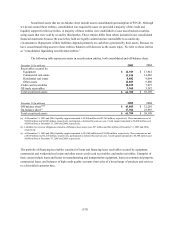

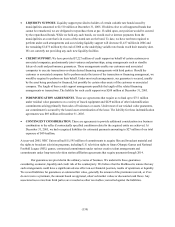

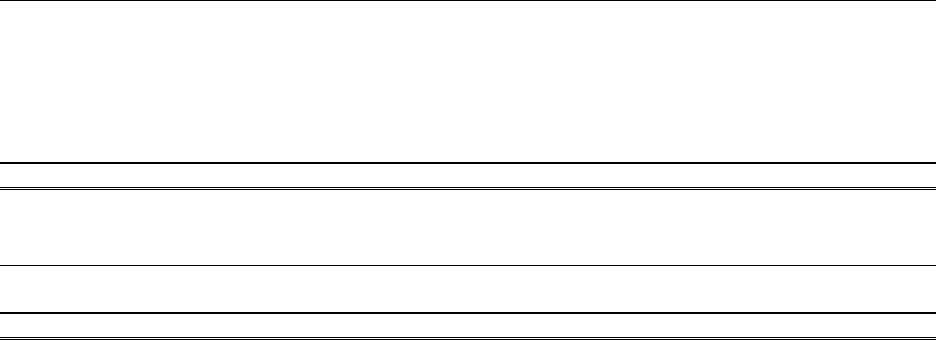

The following table represents assets in securitization entities, both consolidated and off-balance sheet.

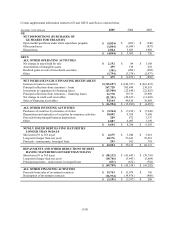

December 31 (In millions) 2005 2004

Receivables secured by:

Equipment $ 12,949 $ 13,941

Commercial real estate 13,010 14,626

Residential real estate 8,882 9,094

Other assets 12,869 9,880

Credit card receivables 10,039 7,075

GE trade receivables 3,960 3,582

Total securitized assets $ 61,709 $ 58,198

December 31 (In millions) 2005 2004

Off-balance sheet(a)(b) $ 43,805 $ 32,205

On-balance sheet(c) 17,904 25,993

Total securitized assets $ 61,709 $ 58,198

(a) At December 31, 2005 and 2004, liquidity support amounted to $2,000 million and $2,300 million, respectively. These amounts are net of

$3,800 million and $4,300 million, respectively, participated or deferred beyond one year. Credit support amounted to $6,000 million and

$6,600 million at December 31, 2005 and 2004, respectively.

(b) Liabilities for recourse obligations related to off-balance sheet assets were $93 million and $64 million at December 31, 2005 and 2004,

respectively.

(c) At December 31, 2005 and 2004, liquidity support amounted to $10,000 million and $14,400 million, respectively. These amounts are net

of $100 million and $1,200 million, respectively, participated or deferred beyond one year. Credit support amounted to $4,800 million and

$6,900 million at December 31, 2005 and 2004, respectively.

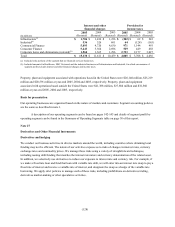

The portfolio of financing receivables consisted of loans and financing lease receivables secured by equipment,

commercial and residential real estate and other assets; credit card receivables; and trade receivables. Examples of

these assets include loans and leases on manufacturing and transportation equipment, loans on commercial property,

commercial loans, and balances of high credit quality accounts from sales of a broad range of products and services

to a diversified customer base.