GE 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(23)

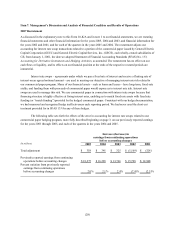

Our global growth is subject to a number of economic, political and regulatory risks

We conduct our operations in virtually every part of the world. Global economic and regulatory developments affect

businesses such as ours in many ways. Operations are subject to the effects of global competition. Particular local

jurisdiction risks include regulatory risks arising from local laws and from local liquidity regulations, including risks

of not being able to retrieve assets. Our global business is affected by local economic environments, including

inflation, recession and currency volatility. Political changes, some of which may be disruptive, can interfere with

our supply chain, our customers and all of our activities in a particular location. While some of these risks can be

hedged using derivatives or other financial instruments and some are insurable, such attempts to mitigate these risks

are costly and not always successful.

Our credit ratings are important to our cost of capital

The major debt agencies routinely evaluate our debt and have given their highest debt ratings to us. One of our

strategic objectives is to maintain these “Triple A” ratings as they serve to lower our borrowing costs and facilitate

our access to a variety of lenders. Failure to maintain our Triple A debt rating could adversely affect our cost of

funds and related margins.

The disposition of businesses that do not fit with our evolving strategy can be highly uncertain

We will continue to evaluate the potential disposition of assets and businesses that may no longer help us meet our

objectives. Our decisions to sell Genworth and GE Insurance Solutions are recent examples of disposition decisions.

When we decide to sell assets or a business, we may encounter difficulty in finding buyers or alternative exit

strategies on acceptable terms in a timely manner, which could delay the accomplishment of our strategic objectives,

or we may dispose of a business at a price or on terms which are less than we had anticipated. In addition, there is a

risk that we sell a business whose subsequent performance exceeds our expectations, in which case our decision

would have potentially sacrificed enterprise value. Correspondingly, we may be too optimistic about a particular

business’ s prospects, in which case we may be unable to find a buyer at a price acceptable to us and therefore may

have potentially sacrificed enterprise value.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

Manufacturing operations are carried out at approximately 216 manufacturing plants located in 35 states in the

United States and Puerto Rico and at 237 manufacturing plants located in 40 other countries.

Item 3. Legal Proceedings

In January 2005, the Boston District Office of the U.S. Securities and Exchange Commission (SEC) informed us

that it had commenced an investigation and requested that GE and GE Capital voluntarily provide certain documents

and information with respect to the use of hedge accounting for derivatives by us and GE Capital. The SEC Staff

advised us in August 2005 that the SEC had issued a formal order of investigation in connection with this matter,

which we believe to be a common step in the process in such matters. We and GE Capital have continued to

voluntarily provide documents and information to the SEC Staff and we are cooperating fully with its investigation.