GE 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(63)

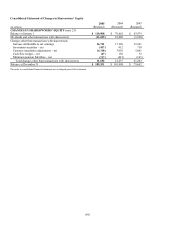

• Delinquency rates on certain financing receivables of the Commercial Finance and Consumer Finance segments

for 2005, 2004 and 2003

• Average total shareowners’ equity, excluding effects of discontinued operations, as reported and as restated

The reasons we use these non-GAAP financial measures and their reconciliation to their most directly comparable

GAAP financial measures follow.

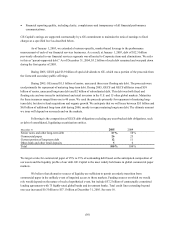

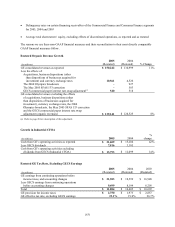

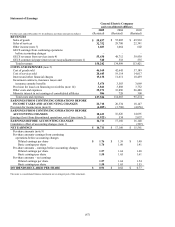

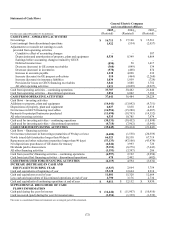

Restated Organic Revenue Growth

(In millions)

2005

(Restated)

2004

(Restated) % Change

GE consolidated revenues as reported $150,242

$ 134,999 11%

Less the effects of:

Acquisitions, business dispositions (other

than dispositions of businesses acquired for

investment) and currency exchange rates 10,561 4,526

The 2004 Olympics broadcasts – 927

The May 2005 SFAS 133 correction – 503

GECS commercial paper interest rate swap adjustment(a) 540 518

GE consolidated revenues excluding the effects

of acquisitions, business dispositions (other

than dispositions of businesses acquired for

investment), currency exchange rates, the 2004

Olympics broadcasts, the May 2005 SFAS 133 correction

and the GECS commercial paper interest rate swap

adjustment (organic revenues) $139,141

$ 128,525 8%

(a) Refer to page 28 for a description of this adjustment.

Growth in Industrial CFOA

(In millions) 2005 2004

%

change

Cash from GE’ s operating activities as reported $21,609 $ 15,204 42%

Less GECS dividends 7,816 3,105

Cash from GE’ s operating activities excluding

dividends from GECS (Industrial CFOA) $13,793 $ 12,099 14%

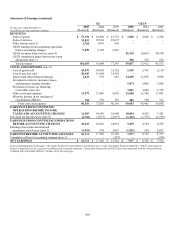

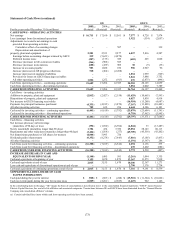

Restated GE Tax Rate, Excluding GECS Earnings

(In millions)

2005

(Restated)

2004

(Restated)

2003

(Restated)

GE earnings from continuing operations before

income taxes, and accounting changes $21,383 $ 18,599 $ 16,948

Less GECS earnings from continuing operations

before accounting changes 9,499 8,194 6,256

Total $11,884 $ 10,405 $ 10,692

GE provision for income taxes $2,750 $ 1,973 $ 2,857

GE effective tax rate, excluding GECS earnings 23.1% 19.0 % 26.7 %