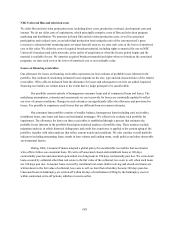

GE 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(73)

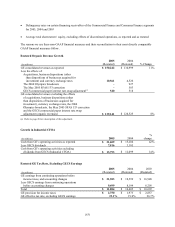

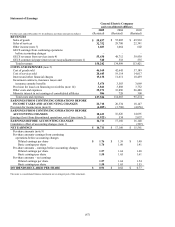

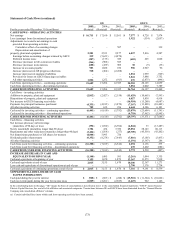

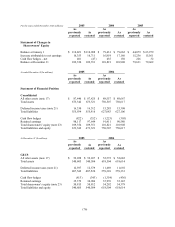

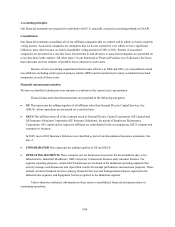

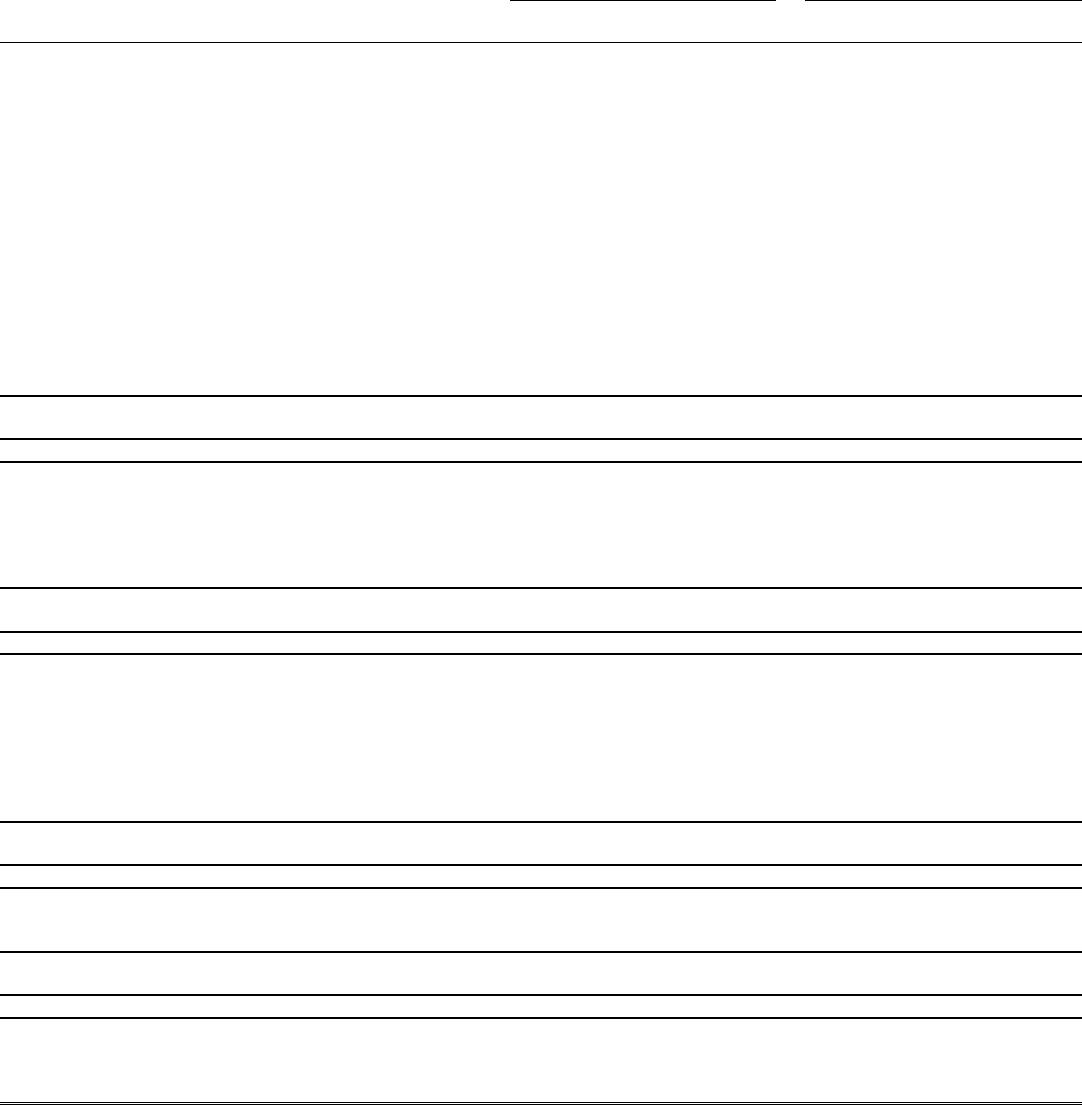

Statement of Cash Flows (continued)

GE GECS

For the years ended December 31 (In millions)

2005

(Restated

(a) 2004

(Restated)

(a) 2003

(Restated)

(a) 2005

(Restated)

(a) 2004

(Restated)

(a) 2003

(Restated)

(a)

CASH FLOWS – OPERATING ACTIVITIES

Net earnings $16,711 $ 17,160 $ 15,561 $ 7,577

$ 8,728 $ 7,974

Loss (earnings) from discontinued operations –

–

–

1,922

(534) (2,057)

Adjustments to reconcile net earnings to cash

provided from operating activities

Cumulative effect of accounting changes –

–

587 –

– 339

Depreciation and amortization of

property, plant and equipment 2,501 2,533 2,277 6,037

5,816 4,587

Earnings before accounting changes retained by GECS 239 (5,623) (4,878) –

– –

Deferred income taxes (287) (175) 389 (603 ) 225 1,028

Decrease (increase) in GE current receivables (266) (908) 585 –

– –

Decrease (increase) in inventories (608) (459) 909 30

(9) (35)

Increase in accounts payable 983 1,888 676 596

2,927 96

Increase (decrease) in GE progress collections 510 (464) (2,268) –

– –

Increase (decrease) in insurance liabilities –

–

–

1,034

1,959 (729)

Provision for losses on GECS financing receivables –

–

–

3,841

3,888 3,752

All other operating activities 1,826 1,252 (913) 476

(2,875) (896)

Cash from operating activities – continuing operations 21,609 15,204 12,925 20,910

20,125 14,059

Cash from operating activities –discontinued operations –

–

–

3,854

6,002 7,389

CASH FROM OPERATING ACTIVITIES 21,609 15,204 12,925 24,764

26,127 21,448

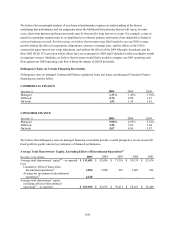

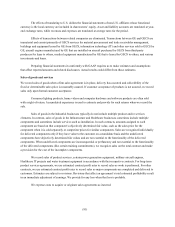

Cash flows – investing activities

Additions to property, plant and equipment (2,812) (2,427) (2,158)

(11,629 ) (10,665) (7,593)

Dispositions of property, plant and equipment –

–

–

6,027

5,838 4,918

Net increase in GECS financing receivables –

–

–

(16,954 ) (15,280) (4,687)

Payments for principal businesses purchased (4,331) (4,815) (3,870) (7,167 ) (13,888) (10,482)

All other investing activities 702 632 236 4,644

8,386 6,103

Cash used for investing activities – continuing operations (6,441) (6,610) (5,792)

(25,079 ) (25,609) (11,741)

Cash used for investing activities – discontinued operations –

–

–

(4,718 ) (7,962) (5,945)

CASH USED FOR INVESTING ACTIVITIES (6,441) (6,610) (5,792)

(29,797 ) (33,571) (17,686)

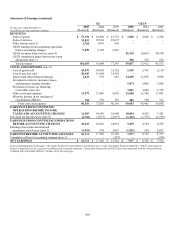

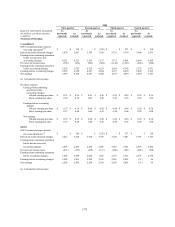

Cash flows – financing activities

Net increase (decrease) in borrowings

(maturities of 90 days or less) (392 ) (1,690) (6,704) (4,044 ) 33 (13,487)

Newly issued debt (maturities longer than 90 days) 1,704 434 7,356 65,054

58,143 60,113

Repayments and other reductions (maturities longer than 90 days) (3,424) (1,568) (277)

(49,709 ) (45,538) (43,202)

Net dispositions (purchases) of GE shares for treasury (4,844) 3,993 726 –

– –

Dividends paid to shareowners (9,352) (8,278) (7,643) (7,816 ) (3,105) (3,435)

All other financing activities –

–

–

(1,191 ) (3,397) 286

Cash from (used for) financing activities – continuing operations (16,308) (7,109) (6,542) 2,294

6,136 275

Cash from (used for) financing activities – discontinued operations –

–

–

478

2,402 (682)

CASH FROM (USED FOR) FINANCING ACTIVITIES (16,308) (7,109) (6,542) 2,772

8,538 (407)

INCREASE (DECREASE) IN CASH AND

EQUIVALENTS DURING YEAR (1,140) 1,485 591

(2,261 ) 1,094 3,355

Cash and equivalents at beginning of year 3,155 1,670 1,079 12,367

11,273 7,918

Cash and equivalents at end of year 2,015 3,155 1,670 10,106

12,367 11,273

Less cash and equivalents of discontinued operations at end of year –

–

–

2,790

3,176 2,734

Cash and equivalents of continuing operations at end of year $2,015 $ 3,155 $ 1,670 $ 7,316

$ 9,191 $ 8,539

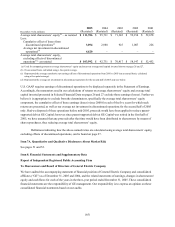

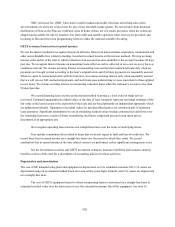

SUPPLEMENTAL DISCLOSURE OF CASH

FLOWS INFORMATION

Cash paid during the year for interest $(928) $ (603) $ (248) $ (15,518 ) $ (11,304) $ (10,662)

Cash recovered (paid) during the year for income taxes (1,829) (2,261) (2,685) (1,425 ) 922 1,146

In the consolidating data on this page, “GE” means the basis of consolidation as described in note 1 to the consolidated financial statements; “GECS” means General

Electric Capital Services, Inc. and all of its affiliates and associated companies. Transactions between GE and GECS have been eliminated from the “General Electric

Company and consolidated affiliates” columns.

(a) Certain individual lines items within cash from operating activities have been restated.