GE 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(4)

After considering the staff’ s view, management recommended to the Audit Committee of our Board of

Directors that previously reported financial results be restated to eliminate hedge accounting for the interest rate

swaps entered into as part of our commercial paper hedging program from January 1, 2001. The Audit Committee

discussed and agreed with this recommendation. At a meeting on January 18, 2007, the Board of Directors adopted

the recommendation of the Audit Committee and determined that previously reported results for GE should be

restated and, therefore, that the previously filed financial statements and other financial information referred to

above should not be relied upon. The restatement resulted from a material weakness in internal control over

financial reporting, namely, that we did not have adequately designed procedures to designate, with the specificity

required under SFAS 133, each hedged commercial paper transaction.

As of January 1, 2007, we modified our commercial paper hedging program and adopted documentation for

interest rate swaps that we believe complies with the requirements of SFAS 133 and remediated the related internal

control weakness.

The SEC investigation into our application of SFAS 133 and hedge accounting is continuing. We continue

to cooperate fully.

Amendment to this Form 10-K

The following sections of this Form 10-K have been revised to reflect the restatement: Part I – Item 1 – Business;

Part II – Item 6 – Selected Financial Data, Item 7 – Management’ s Discussion and Analysis of Financial Condition

and Results of Operations, Item 7A – Quantitative and Qualitative Disclosures About Market Risk; Item 8 –

Financial Statements and Supplementary Data and Item 9A – Controls and Procedures; and Part IV – Item 15 –

Exhibits and Financial Statement Schedules. Except to the extent relating to the restatement of our financial

statements and other financial information described above, the financial statements and other disclosures in this

Form 10-K do not reflect any events that have occurred after this Form 10-K was initially filed on March 3, 2006.

Effects of Restatement

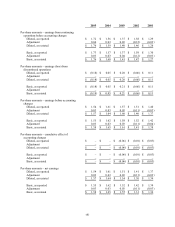

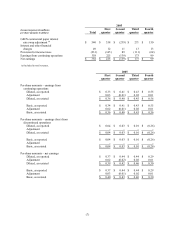

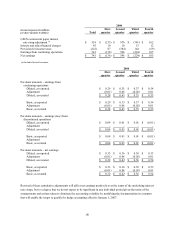

The following tables set forth the effects of the restatement relating to the aforementioned hedge accounting on

affected line items within our previously reported Statements of Earnings for the years 2005, 2004, 2003, 2002 and

2001, and for each of the quarters in the years 2005 and 2004. The restatement has no effect on our cash flows or

liquidity, and its effects on our financial position at the ends of the respective restated periods are immaterial.