GE 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(72)

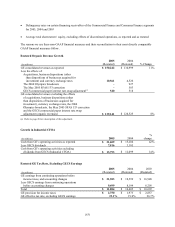

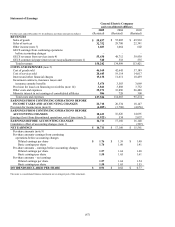

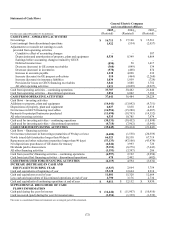

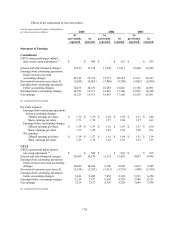

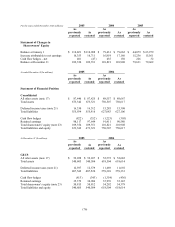

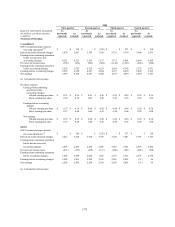

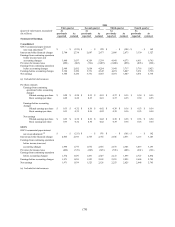

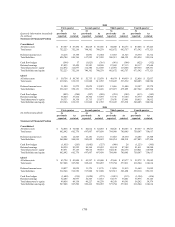

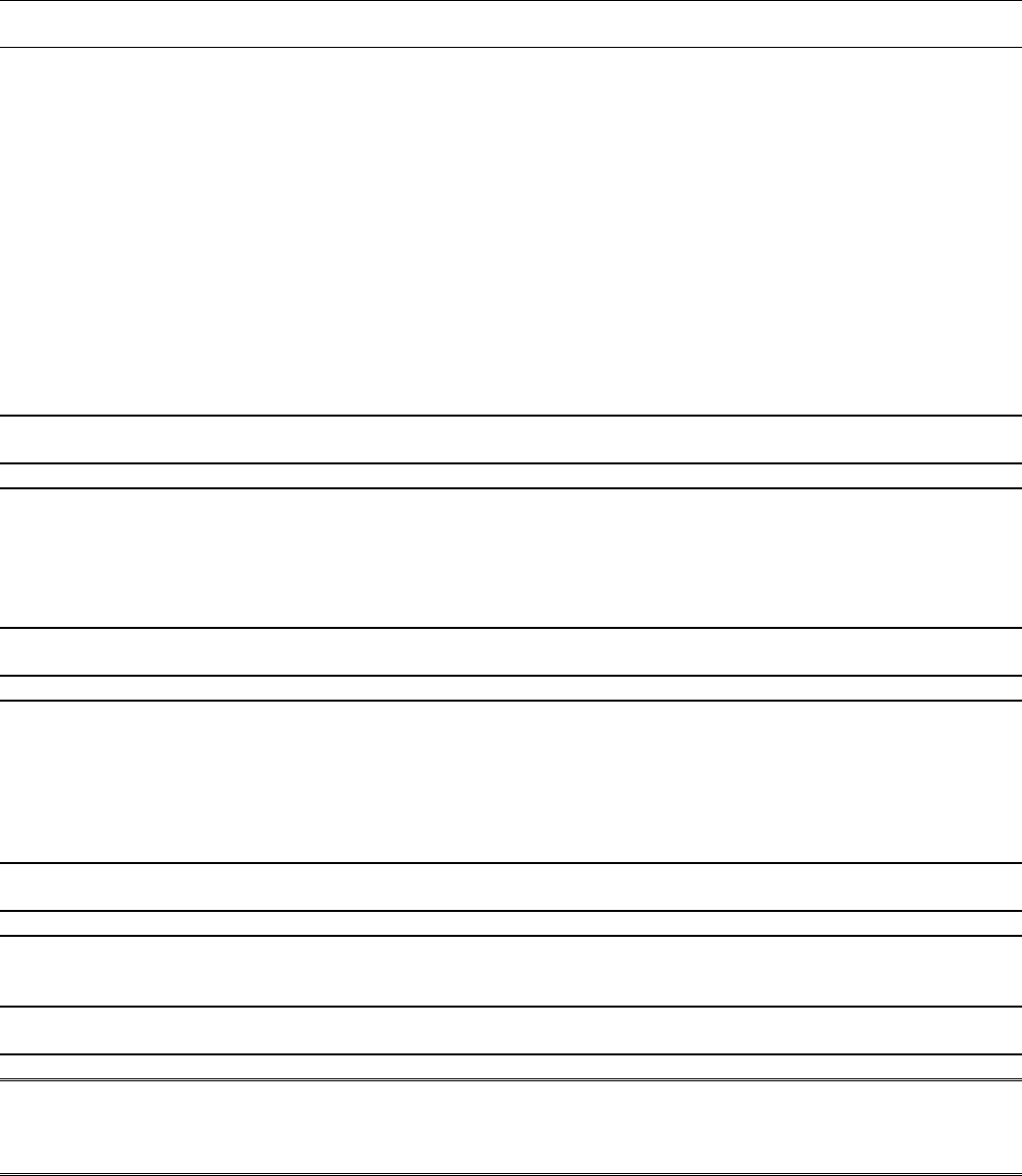

Statement of Cash Flows

General Electric Company

and consolidated affiliates

For the years ended December 31 (In millions)

2005

(Restated)

(a) 2004

(Restated)

(a) 2003

(Restated)

(a)

CASH FLOWS – OPERATING ACTIVITIES

Net earnings $16,711 $ 17,160 $ 15,561

Loss (earnings) from discontinued operations 1,922 (534) (2,057)

Adjustments to reconcile net earnings to cash

provided from operating activities

Cumulative effect of accounting changes

–

–

587

Depreciation and amortization of property, plant and equipment 8,538 8,349 6,864

Earnings before accounting changes retained by GECS

–

–

–

Deferred income taxes (890) 50 1,417

Decrease (increase) in GE current receivables (360) (849) 534

Decrease (increase) in inventories (578) (468) 874

Increase in accounts payable 1,238 4,090 232

Increase (decrease) in GE progress collections 510 (464) (2,268)

Increase (decrease) in insurance liabilities 1,034 1,959 (729)

Provision for losses on GECS financing receivables 3,841 3,888 3,752

All other operating activities 1,821 (2,699) (2,927)

Cash from operating activities – continuing operations 33,787 30,482 21,840

Cash from operating activities – discontinued operations 3,854 6,002 7,389

CASH FROM OPERATING ACTIVITIES 37,641 36,484 29,229

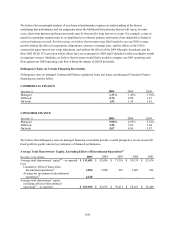

Cash flows – investing activities

Additions to property, plant and equipment (14,441) (13,092) (9,751)

Dispositions of property, plant and equipment 6,027 5,838 4,918

Net increase in GECS financing receivables (16,954) (15,280) (4,687)

Payments for principal businesses purchased (11,498) (18,703) (14,352)

All other investing activities 6,535 10,785 7,974

Cash used for investing activities – continuing operations (30,331) (30,452) (15,898)

Cash used for investing activities – discontinued operations (4,718) (7,962) (5,945)

CASH USED FOR INVESTING ACTIVITIES (35,049) (38,414) (21,843)

Cash flows – financing activities

Net increase (decrease) in borrowings (maturities of 90 days or less) (4,600) (1,558) (20,559)

Newly issued debt (maturities longer than 90 days) 66,523 58,538 67,719

Repayments and other reductions (maturities longer than 90 days) (53,133) (47,106) (43,479)

Net dispositions (purchases) of GE shares for treasury (4,844) 3,993 726

Dividends paid to shareowners (9,352) (8,278) (7,643)

All other financing activities (1,191) (3,397) 286

Cash from (used for) financing activities – continuing operations (6,597) 2,192 (2,950)

Cash from (used for) financing activities – discontinued operations 478 2,402 (682)

CASH FROM (USED FOR) FINANCING ACTIVITIES (6,119) 4,594 (3,632)

INCREASE (DECREASE) IN CASH AND

EQUIVALENTS DURING YEAR (3,527) 2,664 3,754

Cash and equivalents at beginning of year 15,328 12,664 8,910

Cash and equivalents at end of year 11,801 15,328 12,664

Less cash and equivalents of discontinued operations at end of year 2,790 3,176 2,734

Cash and equivalents of continuing operations at end of year $9,011 $ 12,152 $ 9,930

SUPPLEMENTAL DISCLOSURE OF CASH

FLOWS INFORMATION

Cash paid during the year for interest $(16,446) $(11,907) $(10,910)

Cash recovered (paid) during the year for income taxes (3,254) (1,339) (1,539)

The notes to consolidated financial statements are an integral part of this statement.