GE 2005 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2005 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(3)

Explanatory Note

Overview

General Electric Company (GE) is filing this amendment to its Annual Report on Form 10-K for the year ended

December 31, 2005, to amend and restate financial statements and other financial information for the years 2005,

2004 and 2003, and financial information for the years 2002 and 2001, and for each of the quarters in the years 2005

and 2004. In addition, we are filing amendments to our Quarterly Reports on Form 10-Q for each of the periods

ended September 30, June 30, and March 31, 2006, to amend and restate financial statements for the first three

quarters of 2006. The restatement adjusts our accounting for interest rate swap transactions related to a portion of the

commercial paper issued by General Electric Capital Corporation (GECC) and General Electric Capital Services,

Inc. (GECS), each wholly-owned subsidiaries of GE, from January 1, 2001, the date we adopted Statement of

Financial Accounting Standards (SFAS) No. 133, Accounting for Derivative Instruments and Hedging Activities, as

amended. The restatement has no effect on our cash flows or liquidity, and its effects on our financial position at the

ends of the respective restated periods are immaterial. We have not found that any of our hedge positions were

inconsistent with our risk management policies or economic objectives.

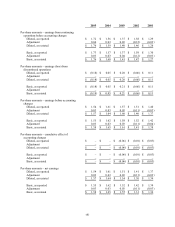

A comparison of the cumulative earnings effects of this non-cash restatement to cumulative earnings from

continuing operations before accounting changes follows.

(In millions)

Cumulative January 1, 2001-

December 31, 2005

Decrease in earnings from continuing operations before

accounting changes $ (473)

Earnings from continuing operations before accounting changes

and error corrections $ 77,072

Background

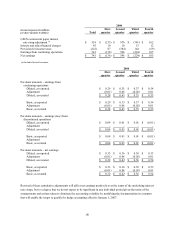

As previously disclosed, the Boston Office of the U.S. Securities and Exchange Commission (SEC) is conducting a

formal investigation of our application of SFAS 133. In the course of that investigation, the SEC Enforcement staff

raised certain concerns about our accounting for the use of interest rate swaps to fix certain otherwise variable

interest costs in a portion of our commercial paper program at GECC and GECS. The SEC Enforcement staff

referred such concerns to the Office of Chief Accountant. We and our auditors determined that our accounting for

the commercial paper hedging program satisfied the requirements of SFAS 133 and conveyed our views to the staff

of the Office of Chief Accountant. Following our discussions, however, the Office of Chief Accountant

communicated its view to us that our commercial paper hedging program as structured did not meet the SFAS 133

specificity requirement.