GE 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1 to Form 10-

K

(Mark One)

; Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2005

or

Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ___________to ___________

Commission file number 1-35

General Electric Company

(Exact name of registrant as specified in charter)

New York 14-0689340

(State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.)

3135 Easton Turnpike, Fairfield, CT 06828-0001 203/373-2211

(Address of principal executive offices) (Zip Code) (Telephone No.)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common stock, par value $0.06 per share New York Stock Exchange

Boston Stock Exchange

Securities Registered Pursuant to Section 12(g) of the Act:

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ; No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ;

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes ; No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to

the best of registrant’ s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated

filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ; Accelerated filer Non-accelerated filer

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No ;

The aggregate market value of the outstanding common equity of the registrant as of the last business day of the registrant’ s most recently completed

second fiscal quarter was $367.3 billion. Affiliates of the Company beneficially own, in the aggregate, less than one-tenth of one percent of such

shares. There were 10,423,424,768 shares of voting common stock with a par value of $0.06 outstanding at February 10, 2006.

DOCUMENTS INCORPORATED BY REFERENCE

The definitive proxy statement relating to the registrant’ s Annual Meeting of Shareowners, held on April 26, 2006, is incorporated by reference in

Part III to the extent described therein.

Table of contents

-

Page 1

... General Electric Company (Exact name of registrant as specified in charter) New York (State or other jurisdiction of incorporation or organization) 14-0689340 (I.R.S. Employer Identification No.) 3135 Easton Turnpike, Fairfield, CT (Address of principal executive offices) 06828-0001 (Zip Code... -

Page 2

... Accountants on Accounting and Financial Disclosure ...Item 9A. Controls and Procedures ...Item 9B. Other Information ...Part III Item 10. Directors and Executive Officers of the Registrant ...Item 11. Executive Compensation ...Item 12. Security Ownership of Certain Beneficial Owners and Management... -

Page 3

... of the commercial paper issued by General Electric Capital Corporation (GECC) and General Electric Capital Services, Inc. (GECS), each wholly-owned subsidiaries of GE, from January 1, 2001, the date we adopted Statement of Financial Accounting Standards (SFAS) No. 133, Accounting for Derivative... -

Page 4

After considering the staff' s view, management recommended to the Audit Committee of our Board of Directors that previously reported financial results be restated to eliminate hedge accounting for the interest rate swaps entered into as part of our commercial paper hedging program from January 1, ... -

Page 5

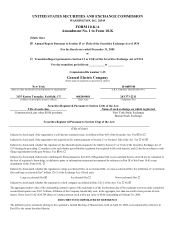

... 12/31/05 Income (expense);(in millions; per share amounts in dollars) 2005 2004 2003 2002 2001 GECS commercial paper interest rate swap adjustment(a) Interest and other financial charges Provision for income taxes Earnings from continuing operations before accounting changes Earnings before... -

Page 6

2005 Per-share amounts - earnings from continuing operations before accounting changes Diluted, as reported Adjustment Diluted, as restated Basic, as reported Adjustment Basic, as restated Per-share amounts - earnings (loss) from discontinued operations Diluted, as reported Adjustment Diluted, as ... -

Page 7

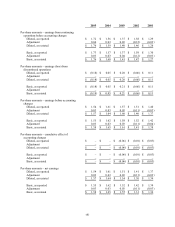

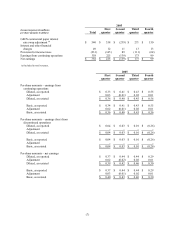

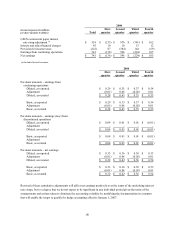

... (expense);(in millions; per share amounts in dollars) Total First quarter 2005 Second quarter Third quarter Fourth quarter GECS commercial paper interest rate swap adjustment (a) Interest and other financial charges Provision for income taxes Earnings from continuing operations Net earnings... -

Page 8

... (expense);(in millions; per share amounts in dollars) Total First quarter 2004 Second quarter Third quarter Fourth quarter GECS commercial paper interest rate swap adjustment (a) Interest and other financial charges Provision for income taxes Earnings from continuing operations Net earnings... -

Page 9

... Item 9 - Controls and Procedures Part IV: Item 15 - Exhibits and Financial Statement Schedules In light of the restatement, readers should not rely on our previously filed financial statements and other financial information for the years and for each of the quarters in the years 2005, 2004, 2003... -

Page 10

...; electrical distribution and control equipment; locomotives; power generation and delivery products; nuclear power support services and fuel assemblies; commercial and military aircraft jet engines; chemicals and equipment for treatment of water and process systems; security equipment and systems... -

Page 11

...to the consolidated financial statements. In the fourth quarter of 2005, we announced the planned sale of the property and casualty insurance and reinsurance businesses and the European life and health operations of GE Insurance Solutions Corporation (GE Insurance Solutions) and completed a Genworth... -

Page 12

...division of United Technologies Corporation. We provide maintenance, component repair and overhaul services (MRO), including sales of replacement parts, for many models of engines, including repair and overhaul of engines manufactured by competitors. The worldwide competition in aircraft jet engines... -

Page 13

... provides technology solutions for customers in a variety of industries including railroad, transit, mining, oil and gas, power generation, and marine. We serve customers in more than 100 countries. Our products include high horsepower diesel-electric locomotives as well as parts and services for... -

Page 14

... others are directed to both markets (lighting, for example). We sell and service major home appliances including refrigerators, freezers, electric and gas ranges, cooktops, dishwashers, clothes washers and dryers, microwave ovens, room air conditioners, and residential water systems for filtration... -

Page 15

... Equipment Services helps customers manage, finance and operate a wide variety of business equipment worldwide. We provide rentals, leases, sales and asset management services of commercial and transportation equipment, including tractors, trailers, railroad rolling stock, modular space units... -

Page 16

... or potential customers, and associated technology assistance have added additional market demand. Product and manufacturing process patents establish barriers to entry in many product lines. Other Our Industrial business sells structured products, silicones and high-purity quartzware. Market... -

Page 17

...technology to improve patient outcomes and productivity tools to help control healthcare costs. For information about orders and backlog, see page 41. Our headquarters are in Chalfont St. Giles, United Kingdom and our operations are located in North America, Europe, Asia, Australia and South America... -

Page 18

... are located in North America, Europe and Asia. Commercial Finance Commercial Finance (13.7%, 14.5% and 14.9% of consolidated revenues in 2005, 2004 and 2003, respectively) offers a broad range of financial services worldwide. We have particular mid-market expertise and offer loans, leases and... -

Page 19

... of financial products, including private-label credit cards; bank cards; Dual Cardsâ„¢; corporate travel and purchasing cards; personal loans; auto loans; leases and inventory financing; residential mortgages; home equity loans; debt consolidation loans; current and savings accounts and insurance... -

Page 20

...located in North America, South America, Europe, Australia and Asia. Discontinued Operations On November 18, 2005, we announced that we had entered into an agreement with Swiss Reinsurance Company (Swiss Re) to sell the property and casualty insurance and reinsurance businesses and the European life... -

Page 21

...staff employees (and a large number of freelance employees) in the United States. These agreements are with various labor unions, expire at various dates and are generally for a term ranging from three to five years. Executive Officers See Part III, Item 10 of this Form 10-K/A Report for information... -

Page 22

...of GE Revenues 2005 2004 2003 3% 3 4% 3 4% 3 GE is a trademark and service mark of General Electric Company; NBC is a trademark and service mark of NBC Universal, Inc.; and MSNBC is a trademark and service mark of MSNBC Cable, LLC. The Company' s Internet address is www.ge.com. Our annual report on... -

Page 23

... States and Puerto Rico and at 237 manufacturing plants located in 40 other countries. Item 3. Legal Proceedings In January 2005, the Boston District Office of the U.S. Securities and Exchange Commission (SEC) informed us that it had commenced an investigation and requested that GE and GE Capital... -

Page 24

... Purchases of Equity Securities With respect to "Market Information", in the United States, GE common stock is listed on the New York Stock Exchange (its principal market) and on the Boston Stock Exchange. GE common stock also is listed on The London Stock Exchange and on Euronext Paris. Trading... -

Page 25

... year ended December 31, 2005, originally filed with the U.S. Securities and Exchange Commission (SEC) on March 3, 2006. The following selected financial data should be read in conjunction with our restated financial statements and the related Notes to Consolidated Financial Statements. Information... -

Page 26

... 634,000 Employees at year end 165,000 155,000 161,000 158,000 United States 161,000 Other countries 142,000 150,000 154,000 152,000 155,000 Total employees GE DATA - AS REPORTED Short-term borrowings Long-term borrowings Minority interest Shareowners' equity Total capital invested Return on average... -

Page 27

2005 (In millions; per-share amounts in dollars) (Restated) GENERAL ELECTRIC COMPANY AND CONSOLIDATED AFFILIATES - AS RESTATED Revenues $ 150,242 $ Earnings from continuing operations before accounting changes 18,633 Earnings (loss) from discontinued operations, net of taxes (1,922 ) Earnings before... -

Page 28

... used in meeting our objective of managing interest rate risk related to our commercial paper program. Many of our financial assets - such as loans and leases - have long-term, fixed-rate yields, and funding them with proceeds of commercial paper would expose us to interest rate risk. Interest rate... -

Page 29

... accounting effective January 1, 2007. Operations Our consolidated financial statements combine the industrial manufacturing, services and media businesses of General Electric Company (GE) with the financial services businesses of General Electric Capital Services, Inc. (GECS or financial services... -

Page 30

... of large heavy-duty gas turbine units. In 2003, we sold 175 such units, compared with 122 in 2004 and 127 in 2005. During these years we invested in other lines of power generation such as wind power and developed product services that we believe will position the Energy business well for continued... -

Page 31

...On November 18, 2005, we announced that we had entered into an agreement with Swiss Reinsurance Company (Swiss Re) to sell the property and casualty insurance and reinsurance businesses and the European life and health operations of GE Insurance Solutions. The transaction is expected to close in the... -

Page 32

... future service of employees. We believe that our postretirement benefit costs will increase again in 2006 for a number of reasons, including further reduction in discount rates at December 31, 2005, and continued recognition of prior years investment losses relating to our principal pension plans... -

Page 33

...2005, GECS average assets of $487.0 billion were 10% higher than in 2004, which in turn were 15% higher than in 2003. See the Financial Resources and Liquidity section for a discussion of interest rate risk management. RESTATED INCOME TAXES Income taxes are a significant cost. As a global commercial... -

Page 34

... tax-free exchange/Puerto Rico subsidiary loss" in note 8. The tax benefits associated with the NBC Universal combination are included in the line "All other - net" in note 8. The 2004 GE effective tax rate also reflects lower pre-tax income primarily from lower earnings in the Energy business and... -

Page 35

... presented to our Corporate Risk Committee, including environmental, compliance, liquidity, credit, market and event risks. The GECS Board of Directors oversees the risk management process for financial services, and approves directly or by delegation all significant acquisitions and dispositions as... -

Page 36

... purposes. These include Aviation Financial Services, Energy Financial Services and Transportation Finance reported in the Infrastructure segment, and Equipment Services reported in the Industrial segment. In the fourth quarter of 2005, we commenced reporting businesses affected by our insurance... -

Page 37

...for Healthcare, NBC Universal and the industrial businesses of the Industrial and Infrastructure segments; included in determining segment profit, which we refer to as "net earnings," for Commercial Finance, Consumer Finance, and the financial services businesses of the Industrial segment (Equipment... -

Page 38

... Infrastructure Industrial Healthcare NBC Universal Commercial Finance Consumer Finance Total segment profit Corporate items and eliminations, as restated GE interest and other financial charges GE provision for income taxes Earnings from continuing operations before accounting changes Earnings... -

Page 39

... sales in commercial services and military engines at Aviation and locomotives at Transportation, partially offset by lower sales at Energy. Energy sold 122 large heavy-duty gas turbines in 2004, compared with 175 in 2003. Financial services activity, primarily at Aviation Financial Services... -

Page 40

...the anticipated decline in higher margin gas turbine sales and a decrease in customer contract termination fees, partially offset by higher productivity at Aviation. Segment profit from the financial services businesses, primarily Energy Financial Services, increased $0.1 billion as a result of core... -

Page 41

... received by Healthcare in 2005 were $15.6 billion, compared with $13.7 billion in 2004. The $5.4 billion total backlog at year-end 2005 comprised unfilled product orders of $3.5 billion (of which 90% was scheduled for delivery in 2006) and product services orders of $1.9 billion scheduled for 2006... -

Page 42

... 80,514 39,515 ASSETS Capital Solutions Real Estate Commercial Finance revenues and net earnings increased 6% and 20%, respectively, compared with 2004. Revenues during 2005 and 2004 included $1.0 billion and $0.3 billion from acquisitions, respectively, and in 2005 were reduced by $0.7 billion as... -

Page 43

...partially offset by the effects of The Home Depot private-label credit card receivables ($0.4 billion) and increased costs to launch new products and promote brand awareness in 2004 ($0.1 billion). RESTATED CORPORATE ITEMS AND ELIMINATIONS (In millions) 2005 (Restated) $ 6,469 540 (1,105) 5,904 131... -

Page 44

... of fair value changes associated with interest rate swaps that were designated as hedges of our commercial paper program. As more fully described beginning on page 28, the correction of our financial statements to eliminate the effects of hedge accounting for these swaps results in recognition in... -

Page 45

... lower cost outsourcing, expansion of industrial and financial services activities through purchases of companies or assets at reduced prices and lower U.S. debt financing costs. Estimated results of global activities include the results of our operations located outside the United States plus all... -

Page 46

... and acquisitions at Consumer Finance and Commercial Finance. Revenues in Other Global decreased 4% primarily as a result of the absence of a current-year counterpart to the 2004 gain on the sale of a majority interest in Genpact, partially offset by organic revenue growth at the financial services... -

Page 47

... of Edwards Systems Technology at Industrial and Ionics, Inc. at Infrastructure. GECS completed acquisitions of the Transportation Financial Services Group of CitiCapital, the Inventory Finance division of Bombardier Capital, Antares Capital Corp., a unit of Massachusetts Mutual Life Insurance Co... -

Page 48

... contractual returns. WORKING CAPITAL, representing GE inventories and receivables from customers, less trade payables and progress collections, was $8.4 billion at December 31, 2005, up $0.1 billion from December 31, 2004, reflecting the effects of 2005 acquisitions. We discuss current receivables... -

Page 49

... reserved financing receivables ($0.8 billion), principally commercial aviation loans and leases in our Infrastructure segment, and the recently strengthening U.S. dollar ($0.2 billion). During 2005, changes in U.S. bankruptcy laws prompted certain customers to accelerate filing for bankruptcy... -

Page 50

... leases, receivables due on sale of securities and various sundry items. PROPERTY, PLANT AND EQUIPMENT amounted to $67.5 billion at December 31, 2005, up $4.4 billion from 2004, primarily reflecting acquisitions of commercial aircraft at the Aviation Financial Services business of Infrastructure. GE... -

Page 51

...rates of GE Capital commercial paper were 45 days and 4.09% at the end of 2005, compared with 42 days and 2.39% at the end of 2004. The GE Capital ratio of debt to equity was 7.09 to 1 at the end of 2005 and 6.46 to 1 at the end of 2004. See note 18. EXCHANGE RATE AND INTEREST RATE RISKS are managed... -

Page 52

... 2002, as we applied our Lean Six Sigma and other working capital management tools broadly. Our GE Statement of Cash Flows shows CFOA in the required format. While that display is of some use in analyzing how various assets and liabilities affected our year-end cash positions, we believe that it is... -

Page 53

... excess capital primarily resulting from GECS business sales. Financial services cash is not necessarily freely available for alternative uses. For example, use of cash generated by our regulated activities is often restricted by such regulations. Further, any reinvestment in financing receivables... -

Page 54

... determinable cash flows such as deferred annuities, universal life, term life, long-term care, whole life and other life insurance contracts. (d) Included an estimate of future expected funding requirements related to our pension and postretirement benefit plans. Because their future cash outflows... -

Page 55

... the highest debt ratings to GE and GE Capital (long-term rating AAA/Aaa; short-term rating A-1+/P-1). One of our strategic objectives is to maintain these ratings, as they serve to lower our cost of funds and to facilitate our access to a variety of lenders. We manage our businesses in a fashion... -

Page 56

... securitization entities. December 31 Senior notes and other long-term debt Commercial paper Current portion of long-term debt Other-bank and other retail deposits Total 2005 57% 26 12 5 100% 2004 58 % 25 11 6 100 % We target a ratio for commercial paper of 25% to 35% of outstanding debt based... -

Page 57

... committed lending agreements, other sources of liquidity include medium and longterm funding, monetization, asset securitization, cash receipts from our lending and leasing activities, short-term secured funding on global assets and potential sales of other assets. PRINCIPAL DEBT CONDITIONS are... -

Page 58

... 2005 and 2004, respectively. Expenditures reported above reflect the definition of research and development required by U.S. generally accepted accounting principles. For operating and management purposes, we consider amounts spent on product and services technology to include our reported research... -

Page 59

...well as credit risk, through our knowledge of the installed base of equipment and the close interaction with our customers that comes with supplying critical services and parts over extended periods. Revisions that affect a product services agreement' s total estimated profitability will also result... -

Page 60

... cash flows expected to be generated by the asset. We test intangible assets with indefinite lives annually for impairment using a fair value method such as discounted cash flows. Further information is provided in the Financial Resources and Liquidity-Intangible Assets section and in notes... -

Page 61

... payments. We discount those cash payments using the weighted average of market-observed yields for high quality fixed income securities with maturities that correspond to the payment of benefits. Lower discount rates increase present values and subsequent year pension expense; higher discount rates... -

Page 62

... as financing, not operating, cash flows in both 2005 and 2004. Prior periods will not be restated as a result of this accounting change. Financial Measures that Supplement Generally Accepted Accounting Principles We sometimes use information derived from consolidated financial information but... -

Page 63

... millions) GE consolidated revenues as reported Less the effects of: Acquisitions, business dispositions (other than dispositions of businesses acquired for investment) and currency exchange rates The 2004 Olympics broadcasts The May 2005 SFAS 133 correction GECS commercial paper interest rate swap... -

Page 64

... cash flow without the impact of GECS dividends. Delinquency Rates on Certain Financing Receivables Delinquency rates on managed Commercial Finance equipment loans and leases and managed Consumer Finance financing receivables follow. COMMERCIAL FINANCE December 31 Managed Off-book On-book 2005... -

Page 65

...Registered Public Accounting Firm To Shareowners and Board of Directors of General Electric Company We have audited the accompanying statement of financial position of General Electric Company and consolidated affiliates ("GE") as of December 31, 2005 and 2004, and the related statements of earnings... -

Page 66

... of its operations and its cash flows for each of the years in the three-year period ended December 31, 2005 in conformity with U.S. generally accepted accounting principles. As discussed in note 1 to the consolidated financial statements, the consolidated financial statements have been restated. As... -

Page 67

... commercial paper interest rate swap adjustment (note 1) Total revenues COSTS AND EXPENSES (note 5) Cost of goods sold Cost of services sold Interest and other financial charges Investment contracts, insurance losses and insurance annuity benefits Provision for losses on financing receivables (note... -

Page 68

...consolidation as described in note 1 to the consolidated financial statements; "GECS" means General Electric Capital Services, Inc. and all of its affiliates and associated companies. Transactions between GE and GECS have been eliminated from the "General Electric Company and consolidated affiliates... -

Page 69

... Investment securities - net Currency translation adjustments - net Cash flow hedges - net Minimum pension liabilities - net Total changes other than transactions with shareowners Balance at December 31 The notes to consolidated financial statements are an integral part of this statement. 17... -

Page 70

...,000 shares outstanding at year-end 2005 and 2004, respectively) Accumulated gains (losses) - net Investment securities Currency translation adjustments Cash flow hedges Minimum pension liabilities Other capital Retained earnings Less common stock held in treasury Total shareowners' equity (notes 23... -

Page 71

... (note 22) 5,806 Common stock (10,484,268,000 and 10,586,358,000 shares outstanding at year-end 2005 and 2004, respectively) 669 Accumulated gains (losses) - net Investment securities 1,831 Currency translation adjustments 2,532 Cash flow hedges (352) Minimum pension liabilities (874) Other capital... -

Page 72

... of continuing operations at end of year SUPPLEMENTAL DISCLOSURE OF CASH FLOWS INFORMATION Cash paid during the year for interest Cash recovered (paid) during the year for income taxes The notes to consolidated financial statements are an integral part of this statement. - 8,538 - (890) (360) (578... -

Page 73

...financial statements; "GECS" means General Electric Capital Services, Inc. and all of its affiliates and associated companies. Transactions between GE and GECS have been eliminated from the "General Electric Company and consolidated affiliates" columns. (a) Certain individual lines items within cash... -

Page 74

.... After considering the staff' s view, management recommended to the Audit Committee of our Board of Directors that previously reported financial results be restated to eliminate hedge accounting for the interest rate swaps entered into as part of our commercial paper hedging program from January... -

Page 75

...earnings Diluted earnings per share $ Basic earnings per share GECS GECS commercial paper interest rate swap adjustment (a) Interest and other financial charges Earnings from continuing operations before income taxes and accounting changes Provision for income taxes (note 8) Earnings from continuing... -

Page 76

...In millions) 2005 As previously As reported restated 2004 As previously As reported restated Statement of Financial Position Consolidated All other assets (note 17) Total assets Deferred income taxes (note 21) Total liabilities Cash flow hedges Retained earnings Total shareowners' equity (note 23... -

Page 77

... Information (unaudited) (In millions; per share amounts in dollars) Statement of Earnings Consolidated GECS commercial paper interest (a) rate swap adjustment Interest and other financial charges Earnings from continuing operations before income taxes and accounting changes Provision for income... -

Page 78

... earnings per share Basic earnings per share Earnings before accounting changes Diluted earnings per share Basic earnings per share Net earnings Diluted earnings per share Basic earnings per share GECS GECS commercial paper interest (a) $ rate swap adjustment Interest and other financial charges... -

Page 79

... Information (unaudited) (In millions) Statement of Financial Position Consolidated All other assets Total assets Deferred income taxes Total liabilities Cash flow hedges Retained earnings Total shareowners' equity Total liabilities and equity GECS All other assets Total assets Deferred income... -

Page 80

... purposes. These include Aviation Financial Services, Energy Financial Services and Transportation Finance reported in the Infrastructure segment, and Equipment Services reported in the Industrial segment. • Unless otherwise indicated, information in these notes to consolidated financial... -

Page 81

...We record sales of product services, certain power generation equipment, military aircraft engines, Healthcare IT projects and water treatment equipment in accordance with their respective contracts. For long-term product services agreements, we use estimated contract profit rates to record sales as... -

Page 82

... insurance liabilities and insurance annuity benefits sections of this note for a description of accounting policies for these activities. Depreciation and amortization The cost of GE manufacturing plant and equipment is depreciated over its estimated economic life. U.S. assets are depreciated using... -

Page 83

... recoveries are added. Impaired financing receivables are written down to the extent that we judge principal to be uncollectible. Our portfolio consists entirely of homogenous consumer loans and of commercial loans and leases. The underlying assumptions, estimates and assessments we use to provide... -

Page 84

..., payment history, collateral value, industry conditions and guarantor support related to specific customers. Any delinquencies or bankruptcies are indications of potential impairment requiring further assessment of collectibility. We routinely receive financial, as well as rating agency reports... -

Page 85

Investment securities We report investments in debt and marketable equity securities, and equity securities in our insurance portfolio, at fair value based on quoted market prices or, if quoted prices are not available, discounted expected cash flows using market rates commensurate with the credit ... -

Page 86

... health insurance, we report premiums as earned income over the terms of the related agreements, generally on a pro-rata basis. For traditional long-duration insurance contracts including term, whole life and annuities payable for the life of the annuitant, we report premiums as earned income when... -

Page 87

... of GE Insurance Solutions On November 18, 2005, Swiss Reinsurance Company (Swiss Re) agreed to buy the property and casualty insurance and reinsurance businesses and the European life and health operations of GE Insurance Solutions for $8.5 billion, including the assumption of $1.7 billion of debt... -

Page 88

... cash flows are separately reported for all periods presented. Summarized financial information for discontinued operations is set forth below. Gain (loss) on disposal included actual (Genworth) and estimated (GE Insurance Solutions) effects of these sales. Total 2004 Genworth 2004 2005 GE Insurance... -

Page 89

... securities and bank deposits Other items Total $ $ 2005 630 256 227 96 555 1,764 $ $ 2004 464 191 145 92 184 1,076 $ $ 2003 110 118 135 75 207 645 Note 4 GECS Revenues from Services (In millions) Interest on loans Operating lease rentals Investment income Fees Financing leases Premiums... -

Page 90

.... PRINCIPAL RETIREE BENEFIT PLANS provide health and life insurance benefits to employees who retire under the GE Pension Plan with 10 or more years of service. Eligible retirees share in the cost of healthcare benefits. Effective January 1, 2005, we amended our principal retiree benefit plans to... -

Page 91

... and plan provisions, over a period no longer than the average future service of employees. FUNDING POLICY. We fund retiree health benefits on a pay-as-you-go basis. We expect to contribute approximately $700 million in 2006 to fund such benefits. We fund retiree life insurance benefits at... -

Page 92

... policies and strategies for the trust. Long-term strategic investment objectives include preserving the funded status of the trust and balancing risk and return. The plan fiduciaries oversee the investment allocation process, which includes selecting investment managers, setting long-term strategic... -

Page 93

.... OTHER PENSION PLANS in 2005 included 33 U.S. and non-U.S. pension plans with pension assets or obligations greater than $50 million. These defined benefit plans provide benefits to employees based on formulas recognizing length of service and earnings. To determine the expected long-term rate of... -

Page 94

... 4.20 7.67 7.56 7.47 December 31 Discount rate Compensation increases Expected return on assets 2002 5.88% 3.92 7.66 FUNDING POLICY for the GE Pension Plan is to contribute amounts sufficient to meet minimum funding requirements as set forth in employee benefit and tax laws plus such additional... -

Page 95

... earned Interest cost on benefit obligations Participant contributions Plan amendments Actuarial loss(a) Benefits paid Acquired plans Exchange rate adjustments and other Balance at December 31(b) (a) Principally associated with discount rate changes. Principal pension plans 2004 2005 $ 37,827 $ 39... -

Page 96

... policies and strategies for the GE Pension Trust. Long-term strategic investment objectives include preserving the funded status of the trust and balancing risk and return. These plan fiduciaries oversee the investment allocation process, which includes selecting investment managers, commissioning... -

Page 97

...and liabilities for pension plans are as follows: PREPAID PENSION ASSET (LIABILITY) December 31 (In millions) Funded status(a) Unrecognized prior service cost Unrecognized net actuarial loss Net amount recognized Amounts recorded in the Statement of Financial Position: Prepaid pension asset Accrued... -

Page 98

...differences GECS Current tax expense Deferred tax expense (benefit) from temporary differences CONSOLIDATED Current tax expense Deferred tax expense (benefit) from temporary differences Total $ $ $ GE and GECS file a consolidated U.S. federal income tax return. The GECS provision for current tax... -

Page 99

... in before-tax earnings of GE Tax-exempt income Tax on global activities including exports IRS settlements of Lockheed Martin tax-free exchange/ Puerto Rico subsidiary loss All other-net Actual income tax rate - (0.2) (15.5) - (0.3 ) (12.3 ) - (0.5) (9.6) (15.5 ) - (5.8 ) (15.4) - (5.8) (12... -

Page 100

...the three years ended December 31, 2005. (b) Included dilutive effects of subsidiary-issued stock-based awards of approximately $11 million in 2005 and $2 million in 2004. Note 10 Investment Securities December 31 (In millions) Available-for-sale securities GECS trading securities Total Estimated... -

Page 101

...GE Debt-U.S. corporate Equity GE available-for-sale securities GECS Debt: U.S. corporate State and municipal (a) Mortgage-backed Asset-backed Corporate... $16 million in 2005 and $684 million in 2004 of debt securities related to consolidated, liquidating securitization entities. See note 28. (101) -

Page 102

...securities' cash flows and underlying collateral values, and assessment of whether the borrower was in compliance with terms and conditions. We believe that these securities, which are current on all payment terms, were trading at a discount to market value since the respective stated interest rates... -

Page 103

... available-for-sale investment securities sales amounted to $14,100 million, $12,000 million and $12,400 million in 2005, 2004 and 2003, respectively. GECS TRADING SECURITIES Gains and losses on trading securities are for the benefit of certain non-U.S. insurance contractholders. In 2005 and 2004... -

Page 104

..., respectively, arose from sales, principally of aircraft engine goods and services on open account to various agencies of the U.S. government, our largest single customer. About 4% of our sales of goods and services were to the U.S. government in 2005, 2004 and 2003. Note 12 Inventories December 31... -

Page 105

... and 2004, respectively, related to commercial aircraft at Aviation Financial Services and loans and financing leases of $5,419 million and $4,659 million at December 31, 2005 and 2004, respectively, related to Energy Financial Services. (b) Included loans and financing leases of $10,160 million and... -

Page 106

... in financing leases consists of direct financing and leveraged leases of aircraft, railroad rolling stock, autos, other transportation equipment, data processing equipment, medical equipment, commercial real estate and other manufacturing, power generation, and commercial equipment and facilities... -

Page 107

... terms of the loan agreement. An analysis of impaired loans follows. December 31 (In millions) Loans requiring allowance for losses Loans expected to be fully recoverable Allowance for losses Average investment during year Interest income earned while impaired(a) (a) Recognized principally on cash... -

Page 108

... Finance Infrastructure Other BALANCE AT DECEMBER 31 Commercial Finance Consumer Finance Infrastructure Other Total (a) Included $889 million in 2004 related to the standardization of our write-off policy. $ $ $ See note 13 for amounts related to consolidated, liquidating securitization entities... -

Page 109

... 31 2005 2004 ALLOWANCE FOR LOSSES ON FINANCING RECEIVABLES AS A PERCENTAGE OF TOTAL FINANCING RECEIVABLES Commercial Finance Consumer Finance Infrastructure Other Total NONEARNING AND REDUCED EARNING FINANCING RECEIVABLES AS A PERCENTAGE OF TOTAL FINANCING RECEIVABLES Commercial Finance Consumer... -

Page 110

... $1,935 million and $2,243 million of original cost of assets leased to GE with accumulated amortization of $298 million and $377 million at December 31, 2005 and 2004, respectively. (c) The Aviation Financial Services business of Infrastructure recognized impairment losses of $295 million in... -

Page 111

...rentals due from customers for equipment on operating leases at December 31, 2005, are due as follows: (In millions) Due in 2006 2007 2008 2009 2010 2011 and later Total $ $ 7,615 6,099 4,743 3,375 2,642 7,840 32,314 Note...Industrial Healthcare NBC Universal Commercial Finance Consumer Finance ... -

Page 112

...Antares Capital Corp. ($407 million) by Commercial Finance, an additional interest in MSNBC ($402 million) and the previously outstanding minority interest in Vivendi Universal Entertainment LLLP (VUE) ($329 million) by NBC Universal. The amount of goodwill related to purchase accounting adjustments... -

Page 113

... we acquired all of the outstanding common shares of Amersham, a world leader in medical diagnostics and life sciences. The total purchase price of $11,279 million included 341.7 million shares of GE common stock valued at $10,674 million, cash of $150 million and assumed debt of $455 million. Final... -

Page 114

... financial interests pertaining to the IAC investments described above. As part of that agreement, NBC Universal fully settled its obligations in connection with both the Preferred A and B interests in exchange for the U.S. Treasury securities, the IAC securities and $200 million cash. NBC Universal... -

Page 115

... retail facilities (7%), industrial properties (6%), parking facilities (5%), franchise properties (3%) and other (7%). At December 31, 2005, investments were located in Europe (46%), North America (35%) and Asia (19%). (d) Assets were classified as held for sale on the date a decision was made to... -

Page 116

...-TERM BORROWINGS 2005 December 31 (Dollars in millions) 2004 Average rate(a) Amount Average rate(a) Amount GE Commercial paper U.S. Non-U.S. Payable to banks Current portion of long-term debt Other GECS Commercial paper U.S. Unsecured Asset-backed(b) Non-U.S. Current portion of long-term debt... -

Page 117

... are addressed below from the perspectives of liquidity, interest rate and currency risk management. Additional information about borrowings and associated swaps can be found in note 27. LIQUIDITY is affected by debt maturities and our ability to repay or refinance such debt. Long-term debt... -

Page 118

... current portion) Fixed rate Floating rate Total long-term (a) Included commercial paper and other short-term debt. $ $ $ At December 31, 2005, interest rate swap maturities ranged from 2006 to 2041. The following table provides additional information about derivatives designated as hedges... -

Page 119

... Unearned premiums Universal life benefits Total $ $ 2005 16,039 11,685 27,724 15,538 1,690 430 340 45,722 $ $ 2004 18,268 11,648 29,916 15,398 1,729 405 945 48,393 (a) Life insurance benefits are accounted for mainly by a net-level-premium method using estimated yields generally ranging from... -

Page 120

... 31 (In millions) GE Provisions for expenses(a) Retiree insurance plans Prepaid pension asset - principal plans Depreciation Intangible assets Other - net GECS Financing leases Operating leases Intangible assets Allowance for losses Cash flow hedges Other - net Net deferred income tax liability... -

Page 121

...settled in 2005. See note 16 for further information. (b) Included minority interest in consolidated, liquidating securitization entities, partnerships and common shares of consolidated affiliates. (c) The preferred stock primarily pays cumulative dividends at variable rates. Dividend rates in local... -

Page 122

... transactions with shareowners reduced equity by $13,249 million in 2005; increased equity by $10,009 million in 2004; and reduced equity by $5,520 million in 2003. (c) Related to the issuance of 20% of NBC Universal' s shares to a subsidiary of VU as part of the transaction described in note 16... -

Page 123

...authorized shares of preferred stock ($1.00 par value), but has not issued any such shares as of December 31, 2005. Note 24 Other Stock-Related Information We grant stock options, restricted stock units (RSUs) and performance share units (PSUs) to employees under the 1990 Long-Term Incentive Plan as... -

Page 124

...the 1990 Long-Term Incentive Plan amounted to 105.9 million shares. (b) Not applicable. (c) Total shares available for future issuance under the consultants' plan amount to 24.4 million shares. (d) In connection with various acquisitions, there are an additional 1.2 million options outstanding, with... -

Page 125

... pricing model. $ 2005 8.87 6 28% 2.5 4.1 $ 2004 8.33 6 28% 2.5 4.0 $ 2003 9.44 6 35% 2.5 3.5 Note 25 Supplemental Cash Flows Information (Restated) Changes in operating assets and liabilities are net of acquisitions and dispositions of principal businesses. Amounts reported in the "Payments... -

Page 126

... collections from customers - loans Investment in equipment for financing leases Principal collections from customers - financing leases Net change in credit card receivables Sales of financing receivables ALL OTHER INVESTING ACTIVITIES Purchases of securities by insurance activities Dispositions... -

Page 127

... Healthcare NBC Universal Commercial Finance Consumer Finance Corporate items and eliminations (restated) 5,304 5,023 (1,372) (1,286) (979) 6,590 6,002 5,904 7,276 - $ - $ 150,242 $ 134,999 $ 113,421 Total $ 150,242 $ 134,999 $ 113,421 $ - $ Revenues of GE businesses include income from sales... -

Page 128

... States were $41,388 million, $37,884 million and $32,560 million at year-end 2005, 2004 and 2003, respectively. Basis for presentation Our operating businesses are organized based on the nature of markets and customers. Segment accounting policies are the same as described in note 1. A description... -

Page 129

... future cash flows. We use interest rate and currency swaps to convert variable rate borrowings to match the nature of the assets we acquire. We use currency forwards and options to manage exposures to changes in currency exchange rates associated with commercial purchase and sale transactions... -

Page 130

... exchange rates and equity prices on certain types of assets and liabilities. We sometimes use credit default swaps to hedge the credit risk of various counterparties with which we have entered into loan or leasing arrangements. We occasionally obtain equity warrants as part of sourcing or financing... -

Page 131

... order for equipment and services. Additional information regarding the use of derivatives related to our financing activities is provided in note 18. Counterparty credit risk The risk that counterparties to derivative contracts will default and not make payments to us according to the terms of the... -

Page 132

COUNTERPARTY CREDIT CRITERIA Credit rating Moody' s S&P P-1 A-1 Aa3 (a) AA- (a) Aaa (a) AAA (a) Foreign exchange forwards and other ... in accordance with a credit support agreement must have a minimum A3/A-rating. EXPOSURE LIMITS (In millions) Minimum rating With collateral arrangements $ 100 50 ... -

Page 133

...determined using financial models. There is no assurance that such estimates could actually have been realized at December 31, 2005 or 2004. A description of how we estimate fair values follows. Loans Based on quoted market prices, recent transactions and/or discounted future cash flows, using rates... -

Page 134

..., these securitization transactions serve as funding sources for a variety of diversified lending and securities transactions. Historically, we have used both GE-supported and third-party entities to execute securitization transactions funded in the commercial paper and term bond markets. (134) -

Page 135

...; and trade receivables. Examples of these assets include loans and leases on manufacturing and transportation equipment, loans on commercial property, commercial loans, and balances of high credit quality accounts from sales of a broad range of products and services to a diversified customer base... -

Page 136

... receivables, we determine fair value of retained interests based on discounted cash flow models that incorporate, among other things, assumptions about loan pool credit losses, prepayment speeds and discount rates. These assumptions are based on our experience, market trends and anticipated... -

Page 137

... 9.1% 1.9% 2005 Cash proceeds from securitization Proceeds from collections reinvested in new receivables Cash received on retained interests Cash received from servicing and other sources Weighted average lives (in months) Assumptions as of sale date(a) Discount rate Prepayment rate Estimate of... -

Page 138

... assistance on $2,269 million of future customer acquisitions of aircraft equipped with our engines, including commitments made to airlines in 2005 for future sales under our GE90 and GEnx engine campaigns. The Aviation Financial Services business of Infrastructure had placed multiple-year orders... -

Page 139

... in a business combination to the seller if contractually specified conditions related to the acquired entity are achieved. At December 31, 2005, we had recognized liabilities for estimated payments amounting to $27 million of our total exposure of $434 million. • • • At year-end 2005, NBC... -

Page 140

...Primarily related to Infrastructure and Healthcare. $ $ 2005 1,326 448 (699) - 1,075 $ $ 2004 1,437 720 (838 ) 7 1,326 $ $ 2003 1,304 751 (749) 131 1,437 Note 30 Quarterly Information (Unaudited) (Restated) First quarter 2004 2005 (In millions; per-share amounts in dollars) Second quarter... -

Page 141

..., earnings from discontinued operations, and net earnings. As a result, the sum of each quarter' s per-share amount may not equal the total per-share amount for the respective year; and the sum of per-share amounts from continuing operations and discontinued operations may not equal the total per... -

Page 142

...aircraft purchasing and trading, loans, engine/spare parts financing, pilot training, fleet planning and financial advisory services. Power plant products and services, including design, installation, operation and maintenance services sold into global markets. Gas, steam and aeroderivative turbines... -

Page 143

...-label credit cards; bank cards; Dual Cardsâ„¢; corporate travel and purchasing cards; personal loans; auto loans; leases and inventory financing; residential mortgages; home equity loans; debt consolidation loans; current and savings accounts and insurance products for customers on a global basis... -

Page 144

..., management identified a material weakness in our internal control over financial reporting with respect to accounting for hedge transactions, namely, that we did not have adequately designed procedures to designate, with the specificity required under SFAS 133, each hedged commercial paper... -

Page 145

... internal control over financial reporting was not effective as of December 31, 2005. General Electric Company' s independent auditor, KPMG LLP, a registered public accounting firm, has issued an audit report on our management' s revised assessment of our internal control over financial reporting as... -

Page 146

... Public Accounting Firm To Shareowners and Board of Directors of General Electric Company: We have audited management' s restated assessment, included in the accompanying Management' s Annual Report on Internal Control over Financial Reporting (as restated) that General Electric Company and... -

Page 147

... Oversight Board (United States), the statement of financial position of General Electric Company and consolidated affiliates as of December 31, 2005 and 2004, and the related statements of earnings, changes in shareowners' equity and cash flows for each of the years in the three-year period ended... -

Page 148

... President, Corporate Financial Planning and Analysis Senior Vice President, GE Consumer Finance, Asia Senior Vice President, GE Healthcare Senior Vice President, GE Energy Senior Vice President, Global Research Vice Chairman of General Electric Company; President & CEO, GE Capital Services Senior... -

Page 149

... Meeting of Shareowners held on April 26, 2006. Item 11. Executive Compensation Incorporated by reference to "Information Relating To Directors, Nominees and Executive Officers," "Contingent Long-Term Performance Awards," "Summary Compensation Table," "Stock Options," "Compensation Committee Report... -

Page 150

... dated as of January 1, 2003, between GE and The Bank of New York, as trustee for the senior debt securities. (Incorporated by reference to Exhibit 4(a) to GE' s Current Report on Form 8-K filed on January 29, 2003 (Commission file number 1-35)). Form of Global Medium-Term Note, Series A, Fixed Rate... -

Page 151

... Rate Note (Incorporated by reference to Exhibit 4 of General Electric' s Current Report on Form 8-K dated October 29, 2003 (Commission file number 1-35)). Fifth Amended and Restated Fiscal and Paying Agency Agreement among GECC, GE Capital Australia Funding Pty Ltd, GE Capital European Funding, GE... -

Page 152

... Pension Plan, as amended effective January 1, 2005 (Incorporated by reference to Exhibit 10(q) to the General Electric Annual Report on Form 10-K (Commission file number 1-35) for the fiscal year ended December 31, 2004). (r) Form of GE Executive Life Insurance Agreement provided to GE officers... -

Page 153

...) Form of Agreement for RSU Career Retention Program Restricted Stock Unit Grants to Executive Officers under the General Electric 1990 Long Term Incentive Plan (Incorporated by reference to Exhibit 10 of General Electric' s Current Report on Form 8-K dated July 28, 2005 (Commission file number 1-35... -

Page 154

... Term Incentive Plan. (ee) Form of Agreement for Performance Stock Unit Grants to Executive Officers under the General Electric 1990 Long Term Incentive Plan (Incorporated by reference to Exhibit 10.5 of General Electric' s Current Report on Form 8-K dated September 15, 2004 (Commission file number... -

Page 155

... by General Electric Capital Corporation of shares of its Variable Cumulative Preferred Stock. (Incorporated by reference to Exhibit 99 (g) to General Electric Capital Corporation' s PostEffective Amendment No. 1 to Registration Statement on Form S-3, File No. 333-59707) (Commission file number... -

Page 156

... indicated, thereunto duly authorized in the Town of Fairfield and State of Connecticut on the 19th day of January 2007. General Electric Company (Registrant) By /s/ Keith S. Sherin Keith S. Sherin Senior Vice President, Finance and Chief Financial Officer (Principal Financial Officer) (156) -

Page 157

..., Finance and Chief Financial Officer Title Principal Financial Officer Date January 19, 2007 /s/ Philip D. Ameen Philip D. Ameen Vice President and Comptroller Jeffrey R. Immelt* Principal Accounting Officer January 19, 2007 Chairman of the Board of Directors (Principal Executive Officer... -

Page 158

... As reported restated (Dollars in millions) General Electric Company and consolidated affiliates (a) Earnings Plus: Interest and other financial charges included in expense (b) One-third of rental expense Adjusted "earnings" Fixed charges: Interest and other financial charges Interest capitalized... -

Page 159

...statement of financial position of General Electric Company and consolidated affiliates as of December 31, 2005 and 2004, and the related statements of earnings, changes in shareowners' equity and cash flows for each of the years in the three-year period ended December 31, 2005, and our report dated... -

Page 160

... attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead in any and all capacities, to sign one or more Annual Reports for the Company's fiscal year ended December 31, 2005, on Form 10-K under the Securities Exchange Act... -

Page 161

... /s/ Robert J. Swieringa Robert J. Swieringa Director /s/ Alan G. Lafley Alan G. Lafley Director /s/ Douglas A. Warner III Douglas A. Warner III Director /s/ Robert W. Lane Robert W. Lane Director /s/ Robert C. Wright Robert C. Wright Director A MAJORITY OF THE BOARD OF DIRECTORS (Page 2 of 2) -

Page 162

... the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; 4. The registrant' s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act... -

Page 163

... the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; 4. The registrant' s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act... -

Page 164

... the Annual Report of General Electric Company (the "registrant") on Form 10-K for the year ending December 31, 2005 as filed with the Securities and Exchange Commission on the date hereof (the "report"), we, Jeffrey R. Immelt and Keith S. Sherin, Chief Executive Officer and Chief Financial Officer...