Food Lion 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. DELHAIZE GROUP FINANCIAL STATEMENTS ’12 // 89

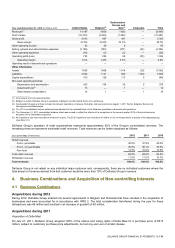

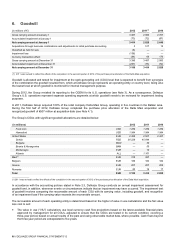

3. Segment Information

IFRS 8 applies the so-called “management approach” to segment reporting and requires the Group to report financial and

descriptive information about its reportable segments. Such reportable segments are operating segments or aggregations of

operating segments that meet specified criteria.

Operating segments are components of an entity which engage in business activities from which they may earn revenues and

incur expenses, including revenues and expenses that relate to transactions with any of the Group’s other components, about

which discrete financial information is available that is evaluated regularly by the chief operating decision maker (CODM) in

deciding how to allocate resources and in assessing performance. The Group is required to report separate information about

each operating segment that:

has been identified as described above or results from aggregating two or more of those segments if they exhibit similar

long-term financial performance and have similar economic characteristics; and

exceeds certain quantitative thresholds.

Delhaize Group identified the Executive Committee as its CODM and defined operating segments based on the information

provided to the Executive Committee. Subsequently, the Group reviewed these operating segments in order to establish if any of

these individual operating segments can be considered to have similar economic characteristics and exhibit similar long-term

financial performance as described by IFRS 8, which are then aggregated into one single aggregated operating segment. In a

final step, reportable segments have been identified, which represent (aggregated) operating segments that exceed the

quantitative thresholds defined by IFRS 8 and require individual disclosure. Operating segments that do not pass these

thresholds are by default combined into the “All Other Segments” category of IFRS 8, which the Group has labeled as

“Southeastern Europe and Asia.”

Management concluded that the reader of the Group’s financial statements would benefit from distinguishing operating from non-

operating - other business activities - and, therefore, decided to disclose separately the corporate activities of the Group in the

segment “Corporate.”

During 2012, the CODM started, in addition to the financial information of Delhaize America as a whole, to review discrete

financial information of the different U.S. banners, in order to better assess the performance and allocate resources to the main

banners of the U.S. operations. Consequently, the Group’s U.S. banners represent individual operating segments. Delhaize

Group reviewed these operating segments for similar economic characteristics and long-term financial performance, using, for

example, operating profit margin, gross margin and comparable store sales development as quantitative benchmarks and

concluded that aggregating them into the segment “United States” meets the requirements of IFRS 8 and is consistent with the

core principle of the standard. While this has no immediate impact on the segment reporting, as the composition of the reportable

segments did not change, goodwill is tested at operating segment level, before aggregation, in accordance with IAS 36 (see Note

6), i.e., separately for Food Lion and Hannaford.

Overall, this results in a geographical segmentation of the Group’s business, based on the location of customers and stores,

which matches the way Delhaize Group manages its operations.

The Executive Committee internally reviews the performance of Delhaize Group’s segments against a number of measures, of

which operating profit represents the most important measure of profit or loss. The amount of each segment item reported is

measured using the amounts reported to the CODM, which equals consolidated IFRS financial information. Therefore, as the

information provided to the CODM and disclosed as segment information represents consolidated IFRS financial information, no

reconciling items need to be disclosed.