Food Lion 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.116 // DELHAIZE GROUP FINANCIAL STATEMENTS’12

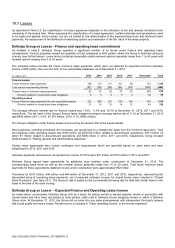

17. Dividends

On May 24, 2012, the shareholders approved the payment of a gross dividend of €1.76 per share (€1.32 per share after

deduction of the 25% Belgian withholding tax) or a total gross dividend of €179 million (including the dividend on treasury

shares). On May 26, 2011, the shareholders approved the payment of a gross dividend of €1.72 per share (€1.29 per share after

deduction of the 25% Belgian withholding tax) or a total gross dividend of €175 million.

With respect to the financial year 2012, the Board of Directors proposes a gross dividend of €1.40 per share to be paid to owners

of ordinary shares against coupon no. 51 on May 31, 2013. This dividend is subject to approval by shareholders at the Ordinary

General Meeting of May 23, 2013 and, therefore, has not been included as a liability in Delhaize Group’s consolidated financial

statements prepared under IFRS. The financial year 2012 dividend, based on the number of shares issued at March 6, 2013, is

€143 million. The payment of this dividend will not have income tax consequences for the Group.

As a result of the potential exercise of warrants issued under the Delhaize Group 2002 and 2012 Stock Incentive Plans, the

Group may have to issue new ordinary shares, to which payment in 2013 of the 2012 dividend is entitled, between the date of

adoption of the annual accounts by the Board of Directors and the date of their approval by the Ordinary General Meeting of May

23, 2013. The Board of Directors will communicate at this Ordinary General Meeting the aggregate number of shares entitled to

the 2012 dividend and will submit at this meeting the aggregate final amount of the dividend for approval. The annual statutory

accounts of Delhaize Group SA for 2012 will be modified accordingly. The maximum number of shares which could be issued

between March 6, 2013, and May 23, 2013, assuming that all vested warrants were to be exercised, is 2 786 792. This would

result in an increase in the total amount to be distributed as dividends to a total of €4 million. Total outstanding non-vested

warrants at March 6, 2013 amounted to 666 974, representing a maximum additional dividend to be distributed of €1 million.