Food Lion 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP FINANCIAL STATEMENTS ’12 // 109

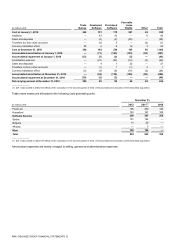

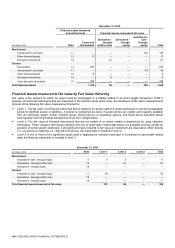

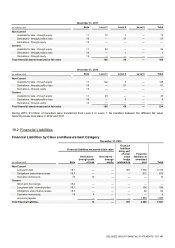

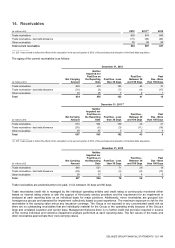

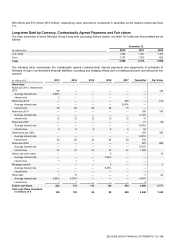

Financial Liabilities measured at fair value by Fair Value Hierarchy

December 31, 2012

(in millions of €)

Note

Level 1

Level 2

Level 3

Total

Non-Current

Derivatives - through profit or loss

19

—

10

—

10

Derivatives - through equity

19

—

—

—

—

Current

Derivatives - through profit or loss

19

—

4

—

4

Derivatives - through equity

19

—

—

—

—

Total financial liabilities measured at fair value

—

14

—

14

December 31, 2011

(in millions of €)

Note

Level 1

Level 2

Level 3

Total

Non-Current

Derivatives - through profit or loss

19

—

9

—

9

Derivatives - through equity

19

—

11

—

11

Current

Derivatives - through profit or loss

19

—

—

—

—

Derivatives - through equity

19

—

—

—

—

Total financial liabilities measured at fair value

—

20

—

20

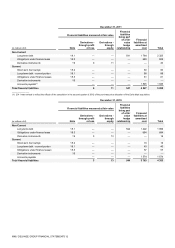

December 31, 2010

(in millions of €)

Note

Level 1

Level 2

Level 3

Total

Non-Current

Derivatives - through profit or loss

19

—

3

—

3

Derivatives - through equity

19

—

13

—

13

Current

Derivatives - through profit or loss

19

—

—

—

—

Derivatives - through equity

19

—

—

—

—

Total financial liabilities measured at fair value

—

16

—

16

During 2012, 2011 and 2010, no transfers between the different fair value hierarchy levels took place. See Note 10.1 with respect

to the definition of the fair value hierarchy levels.

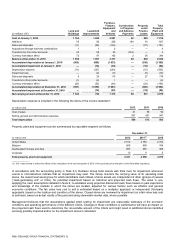

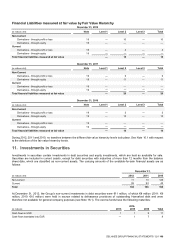

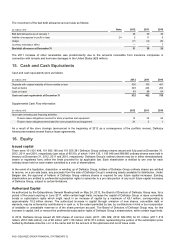

11. Investments in Securities

Investments in securities contain investments in debt securities and equity investments, which are held as available for sale.

Securities are included in current assets, except for debt securities with maturities of more than 12 months from the balance

sheet date, which are classified as non-current assets. The carrying amounts of the available-for-sale financial assets are as

follows:

December 31,

(in millions of €)

2012

2011

2010

Non-current

11

13

125

Current

93

93

43

Total

104

106

168

At December 31, 2012, the Group’s non-current investments in debt securities were €11 million, of which €8 million (2011: €9

million, 2010: €10 million) were held in escrow related to defeasance provisions of outstanding Hannaford debt and were

therefore not available for general company purposes (see Note 18.1). The escrow funds have the following maturities:

(in millions)

2013

2014-

2015

2016

Total

Cash flows in USD

1

1

9

11

Cash flows translated into EUR

—

1

7

8