Food Lion 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP ANNUAL REPORT ‘12 // 53

In 2012, the CEO and the mem-

bers of the Executive Management

received payment of their annual

bonus related to their performance

during 2011.

The table below shows an overview of

the Annual Bonus amounts paid dur-

ing 2012, 2011 and 2010 (based on the

performance of the previous year).

Annual

Bonus(1) CEO Other Members

of Executive

Management

(in millions of €)Payout Number of

persons Payout

2010 0.68 7 1.63

2011 0.66 6 1.29

2012 0.39 8 1.01

2013 0.39 61.04

(1) Amounts are gross before deduction of withholding

taxes and social security levy.

Performance during 2012

With respect to annual bonuses

paid in 2013 based on performance

in 2012, the annual bonus for the

members of management having

the level of Director, Vice President,

Senior Vice President, Executive Vice

President and CEO is funded based

on the following elements:

•Company Performance – 50% of

the funding is based on Company

performance as measured by Profit

from Operations and other relevant

metrics. For the 2012 payment, 90%

of the target performance level

needed to be achieved in order to

receive a bonus payment equal to

75% of the target bonus payment.

The bonus payment levels increase

as performance exceeds 90% of

the target performance level. If per-

formance reaches or exceeds 110%

of the target performance level, the

bonus payment will equal 125% of

the target bonus payment, which

represents the maximum payment

level. If the Company’s actual perfor-

mance does not achieve 90% of the

target performance level, the pay-

ment of the Company Performance

component of the annual bonus is

entirely at the discretion of the Board

of Directors upon recommendation

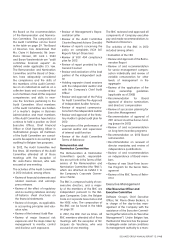

of the RNC. The following graph illus-

trates how this scale works.

BONUS PAYOUT (in %)

Funding Percent

Percent to Budget

140

120

100

80

60

40

20

0

50 60 70 80 90 100 110 120 130 140 150

• Individual Performance – 50% of

the funding is based on individual

performance: this performance is

directly linked to the achievement

of 4-5 individual targets that are

identified through an individual

target setting process. The payout

for this part of the bonus target

(50%) can be funded from 0% to

150% depending on the individual

performance.

•

Circuit breaker – The funding for the

Individual Performance component

of the annual bonus is dependent

on the condition that the Company

achieves at least 80% of the Com-

pany’s target performance level. If

the Company’s actual performance

does not achieve 80% of its target

performance level then the Indi-

vidual Performance component of

the annual bonus is not funded and

any payment of a bonus is entirely

at the discretion of the Board of

Directors upon recommendation of

the RNC.

This system enhances a perfor-

mance-based management culture

that aims to support the Company’s

strategy through a focus on growth

and efficiency.

Taking into account the current

economic environment Executive

Management has voluntary rec-

ommended to the Board of Direc-

tors, who agreed, to reduce the

Annual bonus related to their per-

formance in 2012 and to be paid

in 2013: the bonus is set at 50%

of target for the CEO, and for the

other members of the Executive

Management the bonus has been

reduced with 20% of what they

would have been entitled to if the

regular scale was applied.

As a consequence, in 2013, the

CEO will be paid

€

0.39 million and

the other members of the Execu-

tive Management in the aggregate

will be paid

€

1.04 million (these

amounts are gross before deduc-

tion of withholding taxes and

social security levy).

Performance during 2013

and following years

With respect to annual bonuses that

will be paid based on performance

in 2013 the annual bonus for the

members of management having

the level of Director, Vice President,

Senior Vice President, Executive Vice

President and CEO will be funded

based on the following elements:

•

Company Performance – 50% of

the funding will be based on Com-

pany performance as measured

by achievement of both Underlying

Operating Profit and Revenue. The

2013 payment scales will be defined

for every operational company and

for the Group as a whole. The fund-

ing can range from 0% to 150%.

• Individual Performance – 50%

of the funding will be based on

individual performance: this per-

formance is directly linked to the

achievement of 4-5 individual tar-

gets that are identified through an

individual target setting process.

The payout for this part of the

bonus target (50%) can be funded

from 0% to 150% depending on

the individual performance.

• Circuit breaker –

The funding of the

part of the bonus that is based on,

respectively, the Company perfor-

mance (50%) and the individual

performance (50%) is, compared

to previous years, dependent on

the stricter condition that the Com-

pany achieves 90% of its Under-

lying Operating Profit target. If

the Company does not meet this

target then there is no funding

of the Company or the Individual

Performance components of the

annual bonus and any payment of

a bonus is entirely at the discretion

of the Board of Directors upon rec-

ommendation of the RNC.