Food Lion 2012 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP FINANCIAL STATEMENTS’12 // 143

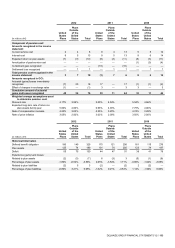

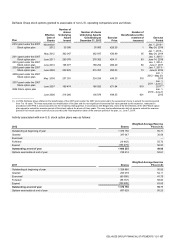

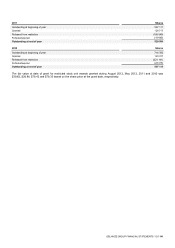

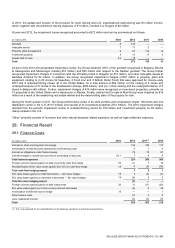

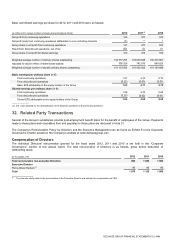

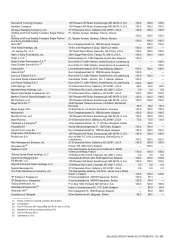

The following reconciles Delhaize Group’s Belgian statutory income tax rate to the Group’s effective income tax rate:

2012(1)

2011

2010

Belgian statutory income tax rate

34.0%

34.0%

34.0%

Items affecting the Belgian statutory income tax rate:

Different statutory tax rates in jurisdictions outside Belgium

25.7(2)

(1.2)

1.0

Non taxable income

(25.9)

(0.6)

(0.8)

Non deductible expenses

21.6

1.2

1.0

Tax charges on dividend income

6.5

0.7

-

Deductions from taxable income(3)

(35.6)

(10.0)

(5.9)

(Recognition) non recognition of tax assets

18.7

0.4

0.3

Taxes related to prior years recorded in current year

(40.5)(4)

-

(0.5)

Changes in tax rate or imposition of new taxes

10.7

0.1

0.5

Other

2.4

0.1

0.2

Effective tax rate

17.6%

24.7%

29.8%

______________

(1) The weight of each item affecting the Belgian statutory income tax rate is higher in 2012 due to the lower profit before tax.

(2) The increase is mainly due to tax losses incurred in the Balkan countries at a lower tax rate.

(3) Deductions from taxable income relate to notional interest deduction in Belgium and tax credits in other countries.

(4) Primarily related to the resolution of several tax matters in the U.S. which resulted in the recognition of an income tax benefit.

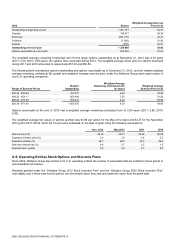

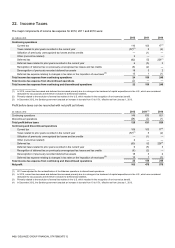

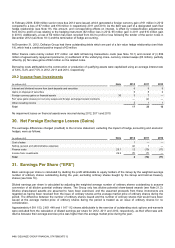

The aggregated amount of current and deferred tax charged or (credited) directly to equity was as follows:

(in millions of €)

2012

2011

2010

Current tax

2

(1)

(2)

Deferred tax

(5)

(9)

5

Total tax charged (credited) directly to equity

(3)

(10)

3

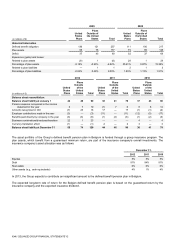

Delhaize Group has not recognized income taxes on undistributed earnings of its subsidiaries and proportionally consolidated

joint venture as the undistributed earnings will not be distributed in the foreseeable future. The cumulative amount of

undistributed earnings on which the Group has not recognized income taxes was approximately €4.1 billion at December 31,

2012, €4.2 billion at December 31, 2011 and €3.6 billion at December 31, 2010.

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset and when the deferred

income taxes relate to the same fiscal authority. Deferred income taxes recognized on the balance sheet were as follows:

(in millions of €)

December 31,

2012

2011(1)

2010

Deferred tax liabilities

570

624

543

Deferred tax assets

89

97

95

Net deferred tax liabilities

481

527

448

______________

(1) 2011 was revised to reflect the effects of the completion in the second quarter of 2012 of the purchase price allocation of the Delta Maxi acquisition.