Food Lion 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 // DELHAIZE GROUP FINANCIAL STATEMENTS’12

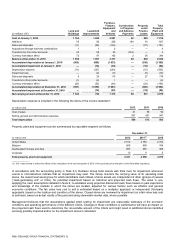

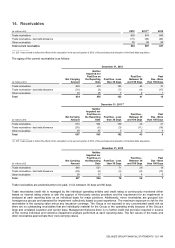

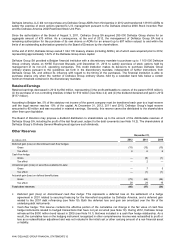

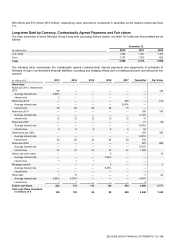

The movement of the bad debt allowance account was as follows:

(in millions of €)

Note

2012

2011

2010

Bad debt allowance as of January 1

36

29

30

Addition (recognized in profit or loss)

24

2

11

6

Usage

(7)

(4)

(8)

Currency translation effect

—

—

1

Bad debt allowance at December 31

31

36

29

The 2011 increase of other receivables was predominantly due to the amounts receivable from insurance companies in

connection with tornado and hurricane damages in the United States (€29 million).

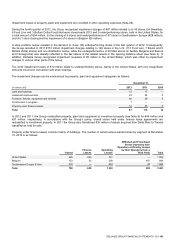

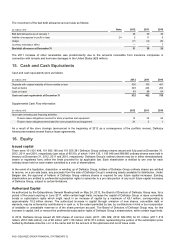

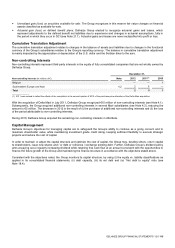

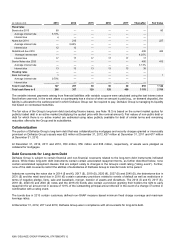

15. Cash and Cash Equivalents

Cash and cash equivalents were as follows:

(in millions of €)

2012

2011

2010

Deposits with original maturity of three months or less

500

100

491

Cash at banks

349

244

203

Cash on hand

83

88

64

Cash and cash equivalents at December 31

932

432

758

Supplemental Cash Flow information:

(in millions of €)

2012

2011

2010

Non-cash investing and financing activities:

Finance lease obligations incurred for store properties and equipment

14

35

54

Finance lease obligations terminated for store properties and equipment

24

2

1

As a result of the store closings (announced in the beginning of 2012 as a consequence of the portfolio review), Delhaize

America terminated several finance lease agreements.

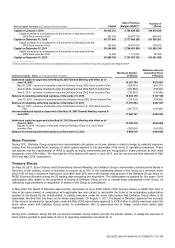

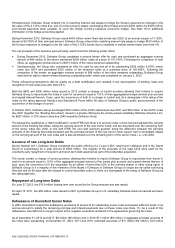

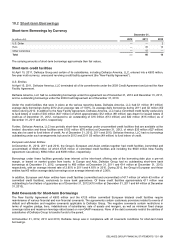

16. Equity

Issued capital

There were 101 921 498, 101 892 190 and 101 555 281 Delhaize Group ordinary shares issued and fully paid at December 31,

2012, 2011 and 2010, respectively (par value of €0.50), of which 1 044 135, 1 183 948 and 988 860 ordinary shares were held in

treasury at December 31, 2012, 2011 and 2010, respectively. Delhaize Group’s ordinary shares may be in either dematerialized,

bearer or registered form, within the limits provided for by applicable law. Each shareholder is entitled to one vote for each

ordinary share held on each matter submitted to a vote of shareholders.

In the event of a liquidation, dissolution or winding up of Delhaize Group, holders of Delhaize Group ordinary shares are entitled

to receive, on a pro-rata basis, any proceeds from the sale of Delhaize Group’s remaining assets available for distribution. Under

Belgian law, the approval of holders of Delhaize Group ordinary shares is required for any future capital increases. Existing

shareholders are entitled to preferential subscription rights to subscribe to a pro-rata portion of any such future capital increases

of Delhaize Group, subject to certain limitations.

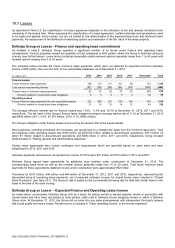

Authorized Capital

As authorized by the Extraordinary General Meeting held on May 24, 2012, the Board of Directors of Delhaize Group may, for a

period of five years expiring in June 2017, within certain legal limits, increase the capital of Delhaize Group or issue convertible

bonds or subscription rights which might result in an increase of capital by a maximum of €5.1 million, corresponding to

approximately 10.2 million shares. The authorized increase in capital through emission of new shares, convertible debt or

warrants, may be achieved by contributions in cash or, to the extent permitted by law, by contributions in kind or by incorporation

of available or unavailable reserves or of the share premium account. The Board of Directors of Delhaize Group may, for this

increase in capital, limit or remove the preferential subscription rights of Delhaize Group’s shareholders, within certain legal limits.

In 2012, Delhaize Group issued 29 308 shares of common stock (2011: 336 909; 2010: 684 655) for €1 million (2011: €13

million; 2010: €26 million), net of €0 million (2011: €6 million; 2010: €13 million) representing the portion of the subscription price

funded by Delhaize America, LLC in the name and for the account of the optionees and net of issue costs.