Food Lion 2012 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126 // DELHAIZE GROUP FINANCIAL STATEMENTS’12

operations also entered into cross-currency interest rate swaps, exchanging the principal amounts (€500 million for $670 million)

and interest payments (both variable), in order to cover the foreign currency exposure of the entity in connection with the

transaction described above. Delhaize Group did not apply hedge accounting to this transaction because this swap constitutes

an economic hedge with Delhaize America, LLC’s underlying €500 million term loan.

Also, Delhaize Group enters into foreign currency swaps with various commercial banks to hedge foreign currency risk on

intercompany loans denominated in currencies other than its reporting currency.

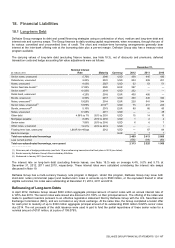

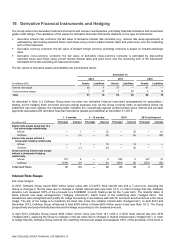

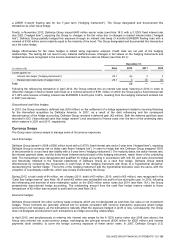

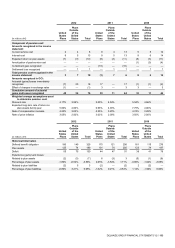

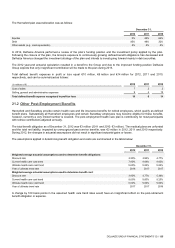

The table below indicates the principal terms of the currency swaps outstanding at December 31, 2012. Changes in fair value of

these swaps are recorded in “Finance costs” or “Income from investments” in the income statement:

(in millions)

Foreign Currency Swaps

Year Trade

Date

Year

Expiration

Date

Amount

Received

from Bank at

Trade Date,

and to be

Delivered to

Bank at

Expiration

Date

Interest Rate

Amount

Delivered to

Bank at

Trade Date,

and to

Receive from

Bank at

Expiration

Date

Interest Rate

Fair Value

Dec. 31,

2012 (€)

Fair Value

Dec. 31,

2011 (€)

Fair Value

Dec. 31,

2010 (€)

2012

2019

€225

3m EURIBOR

+2.06%

$300

3m LIBOR

+2.31%

1

—

—

2012

2013

€ 30

12m EURIBOR

+3.77%

$ 40

12m LIBOR

+3.85%

—

—

—

2012

2013

€1

12m EURIBOR

+4.30%

$ 1

12m LIBOR

+4.94%

—

—

—

2011

2012

€12

12m

EURIBOR

+4.83%

$17

12m LIBOR

+4.94%

—

1

—

2010

2011

€53

6m EURIBOR

+3.33%

$75

6m LIBOR

+3.40%

—

—

3

2010

2011

€26

12m

EURIBOR

+5.02%

$35

12m LIBOR

+4.94%

—

—

1

2009

2014

€76

6.60%

$100

5.88%

(4)(1)

(11)

(13)

2007

2014

$670

3m LIBOR

+0.98%

€500

3m EURIBOR

+0.94%

(6)

(9)

(2)

_______________

(1) As of December 31, 2012, $100 million €76 million remained outstanding from the $300 million/€228 million currency swap. Following the redemption on the $300

million senior notes due 2014, the remaining outstanding amount of this swap was unwound and settled on January 3, 2013.

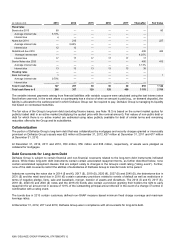

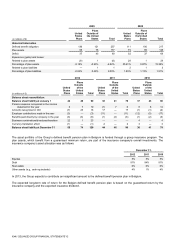

Debt Covenants for Derivatives

The Group has several ISDAs in place containing customary provisions related to events of default and restrictions in terms of

sale of assets, merger and rating.

The maximum exposure of derivative financial instruments to credit risk at the reporting date equals their carrying values at

balance sheet date (i.e., €61 million at December 31, 2012). See Note 12 in connection with collateral posted on derivative

financial liabilities.