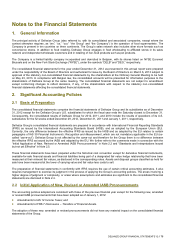

Food Lion 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.82 // DELHAIZE GROUP FINANCIAL STATEMENTS’12

Financial liabilities measured at amortized cost are measured at amortized cost after initial recognition. Amortized cost is

computed using the effective interest method less principal repayment. Associated finance charges, including premiums and

discounts are amortized or accreted to finance costs using the effective interest method and are added to or subtracted from

the carrying amount of the instrument.

An exchange between existing borrower and lenders or a modification in terms of a debt instrument is accounted for as a

debt extinguishment of the original financial liability and the recognition of a new financial liability, if the terms are

substantially different. For the purpose of IAS 39, the terms are substantially different if the discounted presented value of

the cash flows under the new terms, including any fees paid net of any fees received and discounted using the original

effective interest rate, is at least 10 percent different from the discounted present value of the remaining cash flows of the

original financial liability. If the exchange or modification is not accounted for as an extinguishment, any costs or fees

incurred adjust the carrying amount of the liability and are amortized, together with the difference in present values, over the

remaining term of the modified financial liability.

Financial liabilities are derecognized when the Group’s obligations specified in the contract expire or are discharged or cancelled.

Derivative Financial Instruments

While at recognition the initial measurement of derivative contracts is at fair value, the subsequent accounting for derivative

financial instruments depends on whether the derivative is designated as an effective hedging instrument and, if so, the nature of

the item being hedged (see “Hedge Accounting” below).

Economic hedges: Delhaize Group does not hold or issue derivatives for speculation/trading purposes. The Group uses

derivative financial instruments - such as foreign exchange forward contracts, interest rate swaps, currency swaps and other

derivative instruments - solely to manage its exposure to interest rates and foreign currency exchange rates. Derivatives not

being part of an effective designated hedge relationship are therefore only entered into in order to achieve “economic

hedging.” This means that, e.g., foreign exchange forward contracts and currency swaps are not designated as hedges and

hedge accounting is not applied as the gain or loss from re-measuring the derivative is recognized in profit or loss and

naturally offsets the gain or loss arising on re-measuring the underlying instrument at the balance sheet exchange rate (see

Note 19).

These derivatives are mandatory classified as held-for-trading and initially recognized at fair value, with attributable

transaction costs recognized in profit or loss when incurred. Subsequently, they are re-measured at fair value. Derivatives

are accounted for as assets when the fair value is positive and as liabilities when the fair value is negative (see Note 19).

The fair value of derivatives is the value that Delhaize Group would receive or have to pay if the financial instruments were

discontinued at the reporting date. This is calculated on the basis of the contracting parties’ relevant exchange rates, interest

rates and credit ratings at the reporting date. In the case of interest-bearing derivatives, the fair value corresponds to the

“dirty price” or “full fair value” (i.e., including any interest accrued).

Any gains or losses arising from changes in fair value on these derivatives are taken directly to the income statement. As

Delhaize Group enters into derivative financial instruments contracts only for economic hedging purposes, the classification

of the changes in fair value of the derivative follow the underlying (i.e., if the economically hedged item is a financial asset,

the changes in fair value of the derivative are classified as “Income from investment,” Note 29.2; if the underlying is a

financial liability, the changes in fair value of the derivative are classified as “Finance costs,” Note 29.1).

Derivatives are classified as current or non-current or separated into a current or non-current portion based on an

assessment of the facts and circumstances.

Embedded derivatives are components of hybrid instruments that include non-derivative host contracts. Such embedded

derivatives are separated from the host contract and accounted for separately, if the economic characteristics and risks of

the host contract and the embedded derivative are not closely related, a separate instrument with the same terms as the

embedded derivative would meet the definition of a derivative, and the combined instruments are not measured at fair value

through profit or loss. The accounting for any separated derivative follows the general guidance described above.

Hedge Accounting

At the inception of a hedge relationship, the Group formally designates and documents the hedge relationship to which the Group

intends to apply hedge accounting and the risk management objective and strategy for undertaking the hedge. The

documentation includes identification of the hedging instrument, the hedged item or (forecast) transaction, the nature of the risk

being hedged and how the entity will assess the hedging instrument’s effectiveness in offsetting the exposure to changes in the

hedged item’s fair value or cash flows attributable to the hedged risk. Such hedges are expected to be highly effective in

achieving offsetting changes in fair value or cash flows and are assessed on an ongoing basis to determine that they actually

have been highly effective throughout the financial reporting periods for which they were designated.

Hedges which meet the criteria for hedge accounting are accounted for as follows:

Cash flow hedges are used to protect the Group against fluctuations in future cash flows of assets and liabilities recognized

in the balance sheet, from firm commitments (in the case of currency risk) or from highly probable forecast transactions. In

such a cash flow hedge relationship, the changes in the fair value of the derivative hedging instrument are recognized

directly in OCI to the extent that the hedge is effective.