Family Dollar 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

With nearly 3,000 stores added to the chain in the last

ten fiscal years, Family Dollar has experienced explosive

growth. And with 30 consecutive quarters of record sales

and earnings on a comparable quarter basis, our growth

has been consistent and profitable. Family Dollar has come

a long way since the opening of the first store in 1959, and

while we celebrate milestones such as the opening of the

5,000th store in August 2003, our focus always is on the

opportunities ahead. The statement on the cover page of

this Annual Report that “We’ve still got a long way to grow!”

captures this focus. Our Company’s performance in fiscal

2003, coupling the highest sales and earnings in our his-

tory with record levels of reinvestment in our business,

positions Family Dollar for continued profitable growth.

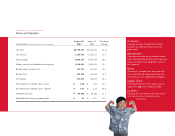

Highlights of Fiscal 2003

The year ended August 30, 2003, was highlighted by:

• Gains in sales of 14.1%, including a 3.8% increase in

existing store sales

• Growth in net income of 14.1%

• Net addition of 411 new stores, increasing the number

of stores in operation at fiscal year-end to 5,027

• Planning and beginning implementation of a multi-year

“Store of the Future” project

• Opening on-time, on-budget in Odessa, Texas, of a state-

of-the-art, automated distribution center

• Increase in cash dividends declared per share of Common

Stock of 13.7%

• Strengthening our Company’s financial condition, with

a balance sheet at fiscal year-end with no debt

Fiscal 2003 Operating Results

Sales for the fifty-two weeks in the fiscal year ended

August 30, 2003, were $4,750.2 million, or 14.1% above

sales of $4,162.7 million for the fifty-two weeks in the

fiscal year ended August 31, 2002. Net income was $247.5

million for fiscal 2003, or 14.1% above net income of

$216.9 million for fiscal 2002, and net income per diluted

share increased to $1.43 from $1.25.

In a challenging retail sales environment, in fiscal 2003

sales in existing stores increased approximately 3.8%. This

included increases of about 4.3% in sales of hardlines and

about 2.1% in sales of softlines. The average transaction

increased about 1.6% to $8.87, and the customer count,

as measured by the number of register transactions in

existing stores, increased about 1.9%.

Several merchandising initiatives contributed to the sales

gains in fiscal 2003. Over the past several seasons, our

apparel departments have done an outstanding job of

raising quality standards while at the same time hitting

the low-end price points our customers need. As a result,

we reported in fiscal 2003 increases in softline sales in

existing stores for the first time since fiscal 1999. We

expect this momentum to continue in fiscal 2004.

We have taken this same focus on quality to our home

departments (mainly domestics, housewares and giftware)

with promising initial results. Today, not only are the

goods a higher quality, they are better coordinated and

more consistent with fashions seen in higher end retailers.

In both the apparel and home departments, we are doing a

better job of meeting our customers’ needs for fashionable

yet affordable merchandise.

Consumables continue to represent a large and growing

part of our business. Investments in our supply chain in

recent years have positioned us to more aggressively man-

age inventory turns in this area. This provides us with

opportunities to expand our merchandise assortments to

drive existing store sales without increasing overall inven-

tory. The continued expansion of name brand products

also supports our quality image. Last fiscal year, nationally

advertised brand merchandise accounted for 35% of sales.

Investments

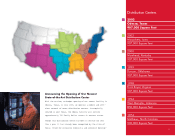

In fiscal 2003, Family Dollar continued to invest in the

future of our Company. We committed significant resources

towards key initiatives, including new store openings and

store focused technology. Four hundred seventy-five new

stores were added to the chain, including the first stores

in Wyoming and North Dakota. Sixty-four stores were

closed bringing the total number of stores in operation at

the end of the fiscal year on August 30, 2003, to 5,027

stores in 43 states.

We also announced a series of initiatives under the umbrella

of what we call the “Store of the Future.” The objective is

to build an infrastructure that will provide the capability

to improve the shopping experience for our customers

while simplifying processes for our Associates. These

initiatives will take several years to fully implement. One

immediate result is that beginning in November 2003

customers are able to use PIN-based debit cards in most

stores. We also are currently testing a software system

that will streamline the hiring process and give us consis-

tency in pre-employment assessments and interviewing.

The infrastructure investments also provide a foundation

for more interactive communications with the stores,

putting us in a position, for example, to introduce com-

puter assisted training.

Fiscal year 2003 also marked the opening in Odessa, Texas,

of our seventh distribution center. We open our state-of-

the-art distribution facilities using proven processes that

permit us to rapidly ramp-up new centers to full-service

standards.

Finally, we invested in the senior management team with

a number of promotions and new hires. Most notably,

David Alexander, who has assumed increasing responsi-

bilities since he joined Family Dollar in 1995, succeeded

me as President in January 2003. David’s leadership

ability is a great asset to our Company.

Financial Condition and Dividend Growth

Despite a challenging retail sales environment in fiscal

2003, Family Dollar continued to strengthen its financial

condition. The Company maintains its 44-year history of

no long-term debt, and there also was no short-term debt

outstanding at any time during fiscal 2003.

Family Dollar’s financial strength is reflected by the growth

of cash dividends. The first quarterly cash dividend was

paid in fiscal 1976, and dividends have been increased in

To Our Shareholders