Family Dollar 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

Income Taxes

The effective tax rate was 36.5% in fiscal 2003, fiscal 2002, and fiscal 2001. For fiscal

2004, the Company’s plan is for the effective tax rate to remain at approximately the

same level as the rate in fiscal 2003.

Liquidity and Capital Resources

The Company has consistently maintained a strong liquidity position. Cash provided

by operating activities during fiscal 2003 was $295.0 million as compared to $402.6

million in fiscal 2002 and $165.9 million in fiscal 2001. These amounts have enabled

the Company to fund its regular operating needs, capital expenditure program, cash

dividend payments and any repurchase of the Company’s Common Stock. In addition,

the Company maintains $200 million of unsecured revolving credit facilities with banks

for short-term financing of seasonal cash needs. One hundred million dollars of the

facilities expires on May 27, 2004 and the remaining $100 million expires on May 31,

2005. The Company had no borrowings against these facilities during fiscal 2003.

There were no long-term borrowings during fiscal 2003, 2002 or 2001.

Merchandise inventories at August 30, 2003 increased 11.4% over the level at August 31,

2002. This increase was due to additional inventory for 411 net new stores, early receipt

of certain seasonal merchandise, and a buildup to support a transition in the merchan-

dise assortments of the home departments (domestics, houseware and giftware). This

was partially offset by improved inventory turnover due to supply chain initiatives.

The increase in capital expenditures to $219.8 million in fiscal 2003 from $186.7 mil-

lion in fiscal 2002 primarily was due to expenditures incurred in fiscal 2003 to com-

plete construction of the seventh distribution center and costs incurred to purchase a

greater number of owned stores. Capital expenditures for fiscal 2004 are expected to

be approximately $275 million, which primarily represent estimated expenditures for

new store expansion, including construction of an increased number of stores, existing

store expansion, relocation, and renovation, the construction of the eighth distribution

center and expenditures related to store-focused technology infrastructure. The new

store expansion and eighth distribution center will also require additional investment

in merchandise inventories.

Capital spending plans, including store expansion, are continuously reviewed and are

subject to change. Cash flow from current operations is expected to be sufficient to

meet planned liquidity and capital resource needs, including store expansion and other

capital spending programs and any repurchase of the Company’s Common Stock. In

addition, the Company has available revolving credit facilities as discussed above.

On October 9, 2002, the Board of Directors authorized the purchase of up to 5 million

shares of its outstanding Common Stock from time to time as market conditions

warrant. The Company purchased in the open market 2.2 million shares at a cost

of $65.9 million in fiscal 2003.

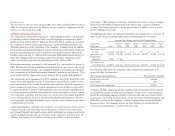

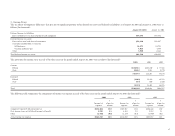

The following table shows the Company’s obligations and commitments as of August 30,

2003, to make future payments under contractual obligations (In thousands):

Payments Due During One Year Fiscal Period Ending

Contractual August August August August August There-

Obligations Total 2004 2005 2006 2007 2008 after

Merchandise letters

of credit $ 56,430 $ 56,430 $ — $ — $ — $ — $ —

Operating leases 796,565 190,840 167,434 136,444 102,997 67,204 131,646

Construction

obligations 17,044 17,044 — — — — —

Total Contractual

Cash Obligations $870,039 $264,314 $167,434 $136,444 $102,997 $67,204 $131,646

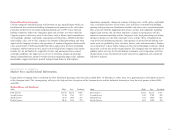

The following table shows the Company’s other commercial commitments as of

August 30, 2003 (In thousands):

Other Commercial Commitments Total Amounts Committed

Standby letters of credit $50,600

Surety bonds 6,018

Total Commercial Commitments $56,618

At August 30, 2003, approximately $41.2 million of the merchandise letters of credit

are included in accounts payable on the Company’s balance sheet. A substantial por-

tion of the outstanding amount of standby letters of credit and surety bonds (which

are primarily renewed on an annual basis) are used as surety for future premium and

deductible payments to the Company’s workers’ compensation and general liability

insurance carrier. The Company accrues for these liabilities as described in the

“Critical Accounting Policies” section of this discussion.