Family Dollar 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

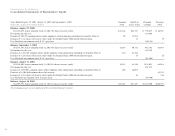

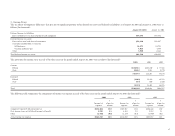

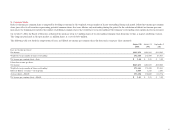

24

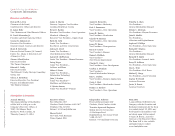

Family Dollar Stores, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

Ye ars Ended August 30, 2003, August 31, 2002 and September 1, 2001

1. Description of Business and Summary of Significant Accounting Policies:

Description of business:

The Company operates a chain of neighborhood retail discount stores in 43 con-

tiguous states in the Northeast, Southeast, Midwest and Southwest. The Company

manages its business on the basis of one reportable segment. The Company’s

products include hardlines merchandise such as household products, health and

beauty aids and snack and other food, and softlines merchandise such as cloth-

ing, shoes and domestic items.

Principles of consolidation:

The consolidated financial statements include the accounts of the Company and

its subsidiaries, all of which are wholly-owned. All significant intercompany

balances and transactions have been eliminated.

Cash equivalents:

The Company considers all highly liquid investments with an original maturity

of three months or less to be cash equivalents. The carrying amount of the

Company’s cash equivalents approximates fair value due to the short maturities

of these investments and consists primarily of money market funds, U.S. govern-

ment agency securities and tax-exempt notes and bonds. The Company maintains

cash deposits with major banks which from time to time may exceed federally

insured limits. The Company periodically assesses the financial condition of

the institutions and believes that the risk of any loss is minimal.

Merchandise inventories:

Inventories are valued using retail prices less markon percentages, and approxi-

mate the lower of first-in, first-out (FIFO) cost or market.

Property and equipment:

Property and equipment is stated at cost. Depreciation for financial reporting

purposes is being provided by the straight-line method over the estimated useful

lives of the related assets.

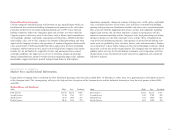

Estimated useful lives are as follows:

Buildings 33–40 years

Furniture, fixtures and equipment 3–10 years

Transportation equipment 3–10 years

Leasehold improvements 5–10 years

The Company capitalizes certain costs incurred in connection with developing,

obtaining and implementing software for internal use. Capitalized costs are

amortized over the expected economic life of the assets, generally ranging from

five to eight years.

Property and equipment is reviewed for impairment whenever events or

changes in circumstances indicate that the carrying amount of an asset may

not be recoverable.

Revenues:

The Company recognizes revenue, net of returns, at the time the customer tenders

payment for and takes possession of the merchandise.

Insurance liabilities:

The Company is primarily self-insured for health care, property loss, workers’

compensation and general liability costs. These liabilities are based on the total

estimated costs of claims filed and estimates of claims incurred but not reported,

less amounts paid against such claims, and are not discounted.

Advertising costs:

Advertising costs, net of co-op recoveries from vendors, are expensed the first

time the advertising is run. Net advertising expense amounts were not material

in fiscal 2003, 2002 and 2001.