Family Dollar 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

Vendor allowances:

In January 2003, the Emerging Issues Task Force (“EITF”) issued EITF 02-16,

“Accounting by a Customer (Including a Reseller) for Certain Consideration

Received from a Vendor.” Under this EITF, cash consideration received from

a vendor is presumed to be a reduction of the purchase cost of merchandise

and should be reflected as a reduction of cost of sales or revenue unless it can

be demonstrated this offsets an incremental expense, in which case it can be

netted against that expense. The provisions of this consensus have been applied

prospectively. The adoption of EITF 02-16 did not have a material impact on

the Company’s financial position or results of operations.

Store opening and closing costs:

The Company charges pre-opening costs against operating results when incurred.

For properties under operating lease agreements, the present value of any remain-

ing liability under the lease, net of expected sublease and lease termination

recoveries, is expensed when the closing has occurred.

Selling, general and administrative expenses:

Buying, warehousing and occupancy costs, including depreciation, are included

in selling, general and administrative expenses.

Income taxes:

The Company records deferred income tax assets and liabilities for the expected

future tax consequences of temporary differences between the financial report-

ing bases and the income tax bases of its assets and liabilities.

Stock options:

The Company accounts for stock-based compensation using the intrinsic value

method prescribed in Accounting Principles Board Opinion No. 25, “Accounting

for Stock Issued to Employees,” and related Interpretations. The exercise price

of options awarded under the Company’s non-qualified stock option plan has

been equal to the fair market value of the underlying common stock on the date

of grant. Accordingly, no compensation expense has been recognized for options

granted under the plan. Income tax benefits attributable to stock options exercised

are credited to capital in excess of par.

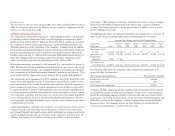

The Company utilizes the disclosure-only provisions of Statement of Financial

Accounting Standards No. 148, “Accounting for Stock-Based Compensation—

Transition and Disclosure.” If compensation cost for the Company’s stock-based

compensation plan had been determined based on fair value at the grant date

for awards under this plan consistent with the methodology prescribed under

this statement, net income and net income per share would have been reduced

to the pro forma amounts indicated in the table below (In thousands, except

per share amounts):

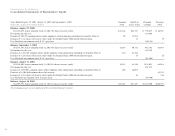

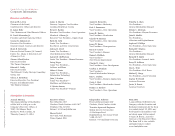

August 30, August 31, September 1,

2003 2002 2001

Net income—as reported $247,475 $216,929 $189,505

Pro forma stock-based compensation cost (5,988) (4,280) (3,458)

Net income—pro forma $241,487 $212,649 $186,047

Net income per share—as reported

basic $1.44 $1.26 $1.10

diluted $1.43 $1.25 $1.10

Net income per share—pro forma

basic $1.40 $1.23 $1.08

diluted $1.39 $1.22 $1.08

Fiscal year:

The Company’s fiscal year generally ends on the Saturday closest to August 31.

Fiscal years 2003 and 2002 included 52 weeks, and fiscal year 2001 included

53 weeks.

Use of estimates:

The preparation of the Company’s consolidated financial statements, in conform-

ity with accounting principles generally accepted in the United States of America,

requires management to make estimates and assumptions. These estimates and

assumptions affect the reported amounts of assets and liabilities, the disclosure

of contingent assets and liabilities at the date of the financial statements, and

the reported amounts of revenues and expenses during the reporting period.

Actual results could differ from these estimates.