Family Dollar 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

Family Dollar Stores, Inc. and Subsidiaries

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

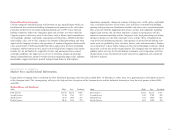

Recent Accounting Pronouncements

In March 2003, the Emerging Issues Task Force (EITF) reached final consensus on

EITF Issue No. 02-16, “Accounting by a Customer (including a Reseller) for Cash

Consideration Received from a Vendor” (EITF 02-16). Under EITF 02-16, cash con-

sideration received from a vendor is presumed to be a reduction of the purchase cost

of merchandise and should be reflected as a reduction of cost of sales or revenue as

prescribed in the consensus unless it can be demonstrated this offsets an incremental

expense, in which case it can be netted against that expense. The new guidance should

be applied to new arrangements, including modifications of existing arrangements,

entered into after December 31, 2002. The Company adopted EITF 02-16 in fiscal

2003 with no significant impact on its financial position or results of operations.

In December 2002, the Financial Accounting Standards Board issued Statement of

Financial Accounting Standards No. 148, “Accounting for Stock-Based Compensation—

Transition and Disclosure” (SFAS No. 148). SFAS No. 148 amends SFAS No. 123,

“Accounting for Stock-Based Compensation.” Although SFAS No. 148 does not require

use of fair value method of accounting for stock-based employee compensation, it does

provide alternative methods of transition. SFAS No. 148 also amends the disclosure

provisions of SFAS No. 123 and APB No. 28, “Interim Financial Reporting,” to require

disclosure in the summary of significant accounting policies of the effects of an entity’s

accounting policy with respect to stock-based employee compensation on reported net

income and net income per common share in annual and interim financial statements.

SFAS No. 148’s amendment of the transition and annual disclosure requirements is

effective for fiscal years ending after December 15, 2002. The amendment of disclo-

sure requirements of APB No. 28 is effective for interim periods beginning after

December 15, 2002. Although the Company has not changed to the fair value method,

the disclosure requirements of SFAS No. 148 have been adopted beginning with the

third quarter of fiscal 2003.

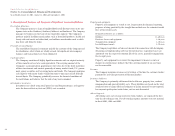

Critical Accounting Policies

Management believes the following accounting principles are critical because they

involve significant judgments, assumptions, and estimates used in the preparation of

the Company’s consolidated financial statements.

Merchandise Inventories:

Inventories are valued using the retail method, based on retail prices less

markon percentages, which approximates the lower of first-in, first-out (FIFO)

cost or market. The Company records adjustment to inventory through cost of

goods sold when permanent retail price reductions, or markdowns, are taken

against on-hand inventory. In addition, management makes estimates and judg-

ments regarding, among other things, initial markups, markdowns, future

demand for specific product categories and market conditions, all of which can

significantly impact inventory valuation. If actual demand or market conditions

are different than those projected by management, additional markdowns may

be necessary. This risk is generally higher for seasonal merchandise than for

non-seasonal goods. The Company also provides for estimated inventory losses

for damaged, lost or stolen inventory for the period from the physical inventory

to the financial statement date. These estimates are based on historical experi-

ence and other factors.

Property and Equipment:

Property and equipment is stated at cost. Depreciation for financial reporting

purposes is being provided principally by the straight-line method over the esti-

mated useful lives of the related assets. The valuation and classification of these

assets and the assignment of useful depreciable lives involves significant judg-

ments and the use of estimates. The Company generally assigns no salvage value

to property and equipment. Property and equipment is reviewed for impairment

whenever events or changes in circumstances indicate that the carrying amount

of an asset may not be recoverable. Historically, impairment losses on fixed

assets have not been material to the Company’s financial position and results

of operations.

Insurance Liabilities:

The Company is primarily self-insured for health care, property loss, workers’

compensation and general liability costs. These costs are significant primarily

due to the large number of the Company’s retail locations and employees. The

Company’s self-insurance liabilities are based on the total estimated costs of

claims filed and estimates of claims incurred but not reported, less amounts

paid against such claims, and are not discounted. Management reviews current

and historical claims data in developing its estimates. The Company also uses

information provided by outside actuaries with respect to workers’ compensation

and general liability claims. If the underlying facts and circumstances of the claims

change or the historical trend is not indicative of future trends, then the Company

may be required to record additional expense or a reduction to expense which

could be material to the reported financial condition and results of operations.