Family Dollar 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

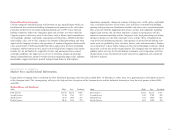

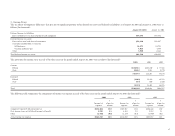

The following table shows the Company’s other commercial commitments as of

August 30, 2003 (In thousands):

Other Commercial Commitments Total Amounts Committed

Standby letters of credit $50,600

Surety bonds 6,018

Total Commercial Commitments $56,618

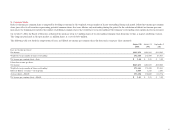

At August 30, 2003, approximately $41.2 million of the merchandise letters of

credit are included in accounts payable on the Company’s balance sheet. A sub-

stantial portion of the outstanding amount of standby letters of credit and surety

bonds (which are primarily renewed on an annual basis) are used as surety

for future premium and deductible payments to the Company’s workers’

compensation and general liability insurance carrier. The Company accrues

for these future payment liabilities based on the total estimated costs of claims

filed and claims incurred but not reported, and are not discounted.

Litigation:

On January 30, 2001, Janice Morgan and Barbara Richardson, two individuals

who have held the position of Store Manager for subsidiaries of the Company,

filed a Complaint against the Company in the United States District Court for

the Northern District of Alabama. The Complaint has been amended to add as

plaintiffs five more individuals who had held the position of Store Manager for

subsidiaries of the Company. Thereafter, pursuant to the Court’s ruling, notice

of the pendency of the lawsuit was sent to approximately 13,000 current and

former Store Managers holding the position on or after July 1, 1999. Based on

currently available information, approximately 2,552 of those have filed consent

forms and joined the lawsuit as plaintiffs, including approximately 2,297 former

Store Managers and approximately 255 current Store Managers. The case is

proceeding as a collective action under the Fair Labor Standards Act (“FLSA”).

The Complaint alleges that the Company violated the FLSA by classifying the

plaintiffs and other similarly situated current and former Store Managers as

“exempt” employees who are not entitled to overtime compensation. Plaintiffs

seek to recover unpaid overtime compensation, prejudgment interest, liquidated

damages, an award of attorneys’ fees, costs and expenses, and such other relief

as the Court may deem proper. The lawsuit is in the discovery phase and the

Company is vigorously defending this action. The trial is currently expected

to commence in early 2004. In general, the Company believes that the Store

Managers are “exempt” employees under the FLSA and have been properly

compensated and that the Company has meritorious defenses that should enable

it to ultimately prevail. However, the outcome of any litigation is inherently

uncertain. The Company bears the burden of proof at trial of establishing its

entitlement to the exemption from the overtime requirements of the FLSA, and

no assurances can be given that the Company will be successful in defending

this action; moreover, as a collective action, the determination of liability with

respect to each individual plaintiff depends in large part on the facts and cir-

cumstances which relate solely to that plaintiff. The nature of this action and

its present procedural posture mean that future rulings by the Court on both

substantive and procedural motions and issues may significantly impact the

course of proceedings, the issues in dispute, the number of plaintiffs who are

allowed to proceed to trial, and the presentation of evidence supporting the

Company’s position. Thus, those rulings may greatly affect the Company’s

effort to establish the exempt status of the plaintiff Store Managers. If there

is an adverse verdict on the merits, particularly regarding the issues generally

applicable to the collective claims, the Company may be subject to liability for

damages that could have a material adverse effect on the Company’s financial

position or results of operation.

The Company is involved in numerous other legal proceedings and claims,

including employment, tort, consumer and other litigation. While the ultimate

results of these matters cannot be determined, the Company believes that they

should not have a material adverse effect on the Company’s financial position

or results of operations.