Family Dollar 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

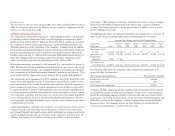

one-half of the shoe inventories. Therefore, the sales of hardlines and softlines is now

on a more comparative basis year over year. Notwithstanding this change, softline

sales in existing stores increased approximately 2.1% in fiscal 2003. For fiscal 2004,

the Company’s plan is for sales in existing stores to increase in the 4% to 6% range.

The Company reduced the number of advertising circulars distributed in fiscal 2003

to one, which was one less than was distributed in fiscal 2002. The adverse sales impact

of discontinuing one circular was offset by the increased customer traffic generated

by the everyday low pricing strategy and shift in the merchandise mix. For fiscal 2004,

the Company plans to distribute one circular.

The existing store sales increase of approximately 5.8% in fiscal 2002 was also pri-

marily attributable to the favorable customer response to everyday low pricing and

increased sales of hardlines. In fiscal 2002, the average transaction increased approxi-

mately 1.9% to $8.75 and the customer count increased approximately 3.8%. In fiscal

2002, existing store hardlines sales increased approximately 8.4% and softlines sales

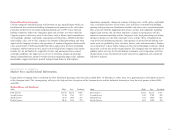

August 29, August 31, August 31, August 31, August 31,

1998 1997 1996 1995 1994

$2,361,930 $1,994,973 $1,714,627 $1,546,895 $1,428,440

2,195,942 1,873,496 1,615,861 1,452,519 1,328,323

165,988 121,477 98,766 94,376 100,117

62,700 46,800 38,178 36,266 38,157

103,288 74,677 60,588 58,110 61,960

——— —1,139

103,288 74,677 60,588 58,110 63,099

$.60 $.44 $.35 $ .34 $ .36

$.60 $.44 $.35 $ .34 $ .37

$30,116 $ 26,849 $ 24,435 $ 21,837 $ 18,656

$.17

1⁄2$.15

2⁄3$.14

1⁄3$.12

2⁄3$.11

$942,180 $ 780,294 $ 696,808 $ 636,234 $ 592,822

$303,354 $ 283,476 $ 273,694 $ 264,672 $ 230,235

$578,150 $ 500,198 $ 444,957 $ 407,751 $ 370,172

315 236 223 213 202

(65) (50) (58) (12) (22)

3,017 2,767 2,581 2,416 2,215

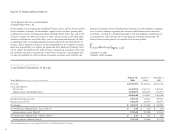

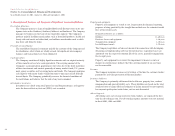

230

265 274 283

303

341 339

417

525

561

’94 ’95 ’96 ’97 ’98 ’99 ’00 ’01 ’02 ’03

Working Capital

(millions of dollars)

593 636 697

780

942

1,095

1,244

1,400

1,755

1,986

’94 ’95 ’96 ’97 ’98 ’99 ’00 ’01 ’02 ’03

Total Assets

(millions of dollars)

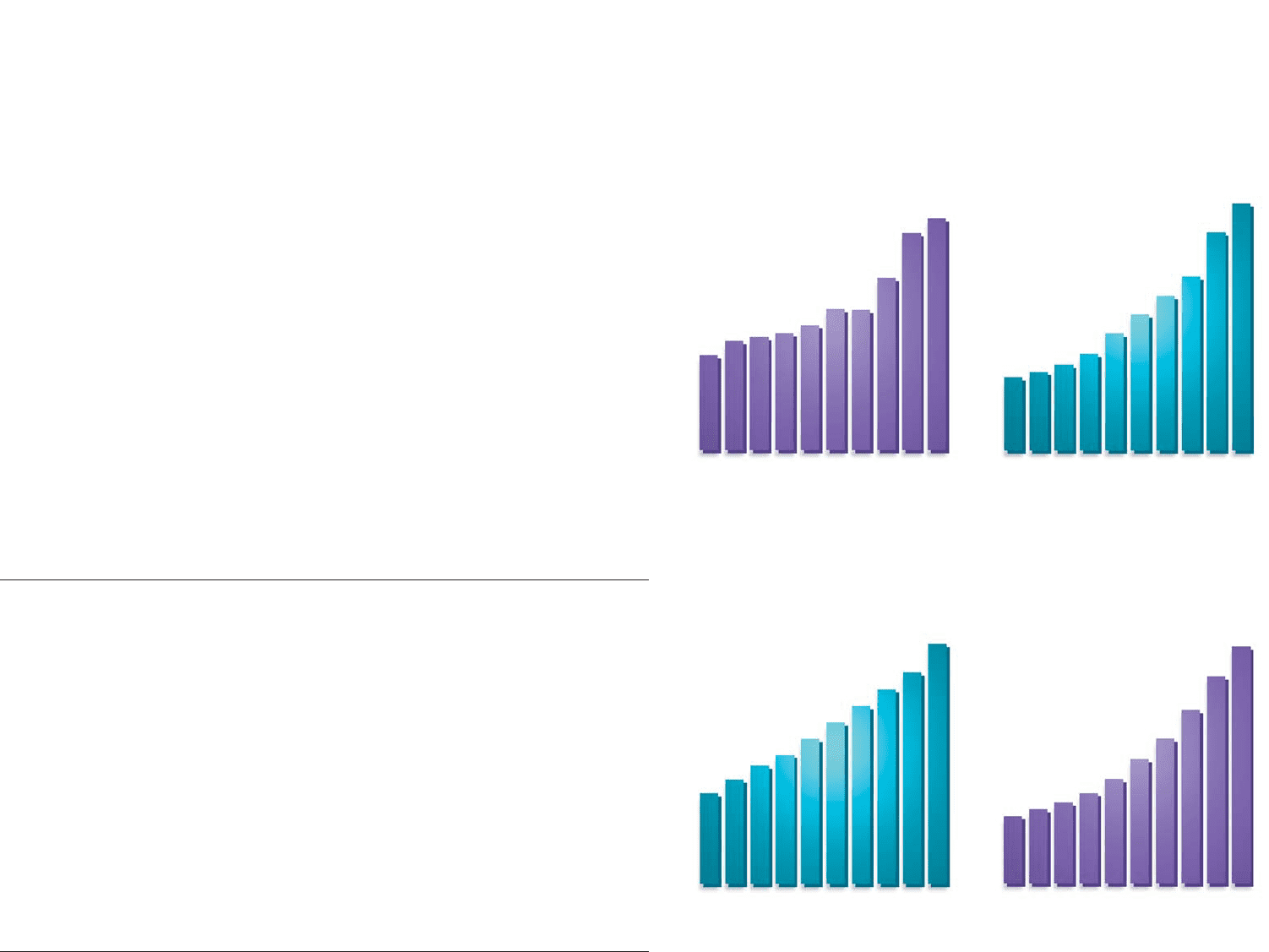

.11

.122⁄3

.141⁄3

.152⁄3

.171⁄2

.191⁄2

.211⁄2

.231⁄2

.251⁄2

.29

’94 ’95 ’96 ’97 ’98 ’99 ’00 ’01 ’02 ’03

Dividends Declared

Per Common Share

(dollars)

2.18 2.40 2.61

2.92

3.36

4.00

4.66

5.57

6.66

7.61

’94 ’95 ’96 ’97 ’98 ’99 ’00 ’01 ’02 ’03

Book Value Per Common Share

(dollars)