Family Dollar 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

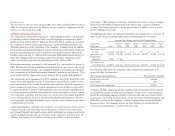

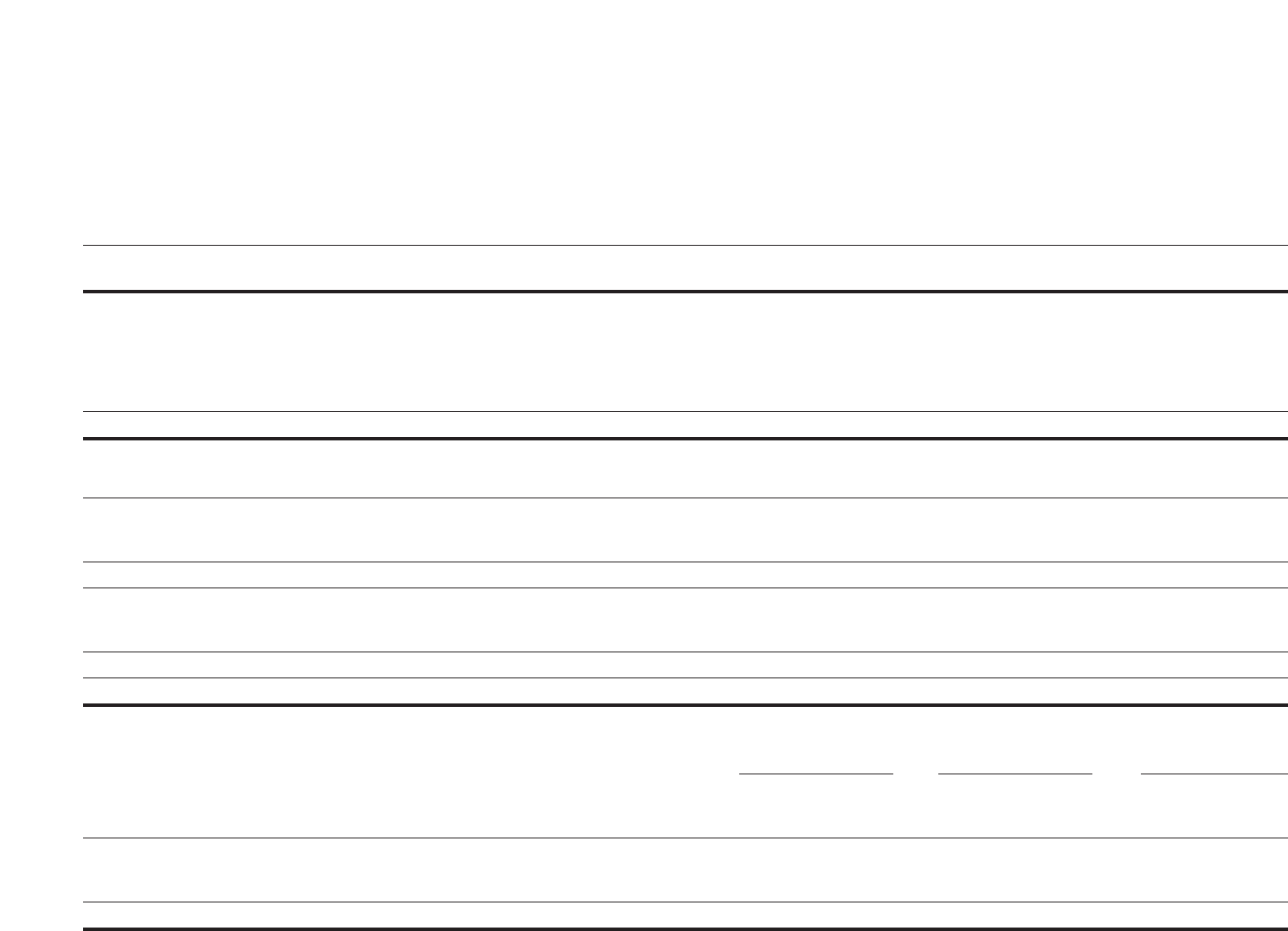

5. Income Taxes:

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax liabilities as of August 30, 2003 and August 31, 2002 were as

follows (In thousands):

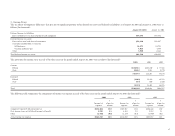

August 30, 2003 August 31, 2002

Deferred income tax liabilities:

Excess of book over tax basis of property and equipment $79,395 $68,891

Deferred income tax assets:

Excess of tax over book basis of inventories $18,280 $18,947

Currently nondeductible accruals for:

Self-insurance 34,571 24,792

Vacation and bonus pay 5,018 3,959

Other 3,900 2,243

Total deferred income tax assets $61,769 $49,941

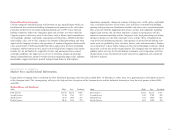

The provisions for income taxes in each of the three years in the period ended August 30, 2003 were as follows (In thousands):

2003 2002 2001

Current:

Federal $130,923 $103,210 $ 77,866

State 12,652 8,983 6,770

143,575 112,193 84,636

Deferred:

Federal (1,469) 11,839 22,761

State 144 660 1,520

(1,325) 12,499 24,281

Total $142,250 $124,692 $108,917

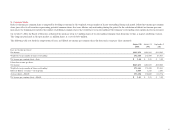

The following table summarizes the components of income tax expense in each of the three years in the period ended August 30, 2003 (In thousands):

2003 2002 2001

%%%

Income tax of pre-tax Income tax of pre-tax Income tax of pre-tax

expense income expense income expense income

Computed “expected” federal income tax $136,404 35.0 $119,567 35.0 $104,448 35.0

State income taxes, net of federal income tax benefit 8,290 2.1 6,363 1.9 5,518 1.8

Other (2,444) (0.6) (1,238) (0.4) (1,049) (0.3)

Actual income tax expense $142,250 36.5 $124,692 36.5 $108,917 36.5