Family Dollar 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

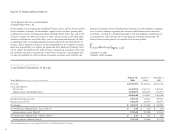

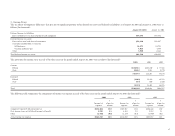

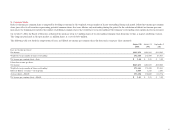

At August 30, 2003, August 31, 2002 and September 1, 2001, options for 1.0 million, 1.5 million and 1.5 million shares were exercisable, respectively. The following table

summarizes information about stock options outstanding at August 30, 2003 (In thousands, except per share amounts):

Options Outstanding Options Exercisable

Number Weighted Average Number

Range of Outstanding Remaining Weighted Average Exercisable Weighted Average

Exercise Prices at 8/30/03 Contractual Life Exercise Price at 8/30/03 Exercise Price

$14.75 to $24.24 1,797 1.60 years $18.27 928 $18.44

24.25 to 28.24 1,332 3.06 24.43 33 25.04

28.25 to 39.00 1,872 4.12 29.16 5 28.76

$14.75 to $39.00 5,001 2.94 years $23.99 966 $18.72

At August 30, 2003, August 31, 2002 and September 1, 2001, shares available for granting of stock options under the Company’s stock option plan were 7.2 million, 2.9 million

and 4.2 million shares, respectively.

30

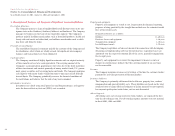

8. Employee Stock Option Plan:

The Company’s non-qualified stock option plan provides for the granting of options to

key employees to purchase shares of common stock at prices not less than fair market

value on the date of the grant. Options are exercisable to the extent of 40% after the

second anniversary of the grant, an additional 30% annually on a cumulative basis,

and expire five years from the date of the grant.

If the provisions of SFAS No. 123 expensing had been applied, the Company’s net

income and net income per common share would have been impacted as summarized

in the discussion of the Company’s stock option accounting policy in Note 1.

The average fair value of options granted during fiscal 2003, 2002 and 2001 is $9.14,

$8.61 and $6.37 per share, respectively.

The fair value of each option grant is estimated on the date of grant using the

Black-Scholes option-pricing model with the following assumptions:

August 30, August 31, September 1,

2003 2002 2001

Expected dividend yield 0.89% 1.03% 1.26%

Expected stock price volatility 41.54% 44.31% 41.43%

Weighted average risk-free interest rate 2.74% 3.99% 5.96%

Expected life of options (years) 3.5 3.5 3.5

These assumptions are evaluated and revised, as necessary, to reflect market conditions

and experience.

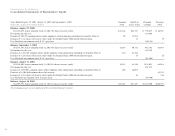

The summary of the status of the Company’s stock-based compensation plan as of

August 30, 2003, August 31, 2002 and September 1, 2001, and changes during the

years then ended were as follows (In thousands, except per share amounts):

Options Range of Option Weighted Average

Outstanding Prices Per Share Exercise Price

Balance, August 27, 2000 4,169 $ 3.83 to $24.75 $12.76

Granted 1,344 17.50 to 30.25 18.41

Exercised (902) 3.83 to 24.25 7.13

Cancelled (225) 4.08 to 24.50 16.90

Balance, September 1, 2001 4,386 $ 5.58 to $30.25 $15.44

Granted 1,475 24.25 to 35.50 25.02

Exercised (1,292) 5.58 to 24.75 10.02

Cancelled (158) 11.38 to 34.75 20.42

Balance, August 31, 2002 4,411 $11.38 to $35.50 $20.05

Granted 1,793 24.75 to 39.00 28.99

Exercised (1,079) 11.38 to 27.75 16.11

Cancelled (124) 15.00 to 37.50 24.95

Balance, August 30, 2003 5,001 $14.75 to $39.00 $23.99

Family Dollar Stores, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

Ye ars Ended August 30, 2003, August 31, 2002 and September 1, 2001