Family Dollar 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003

5,000th Store

2001

4,000th Store

1998

3,000th Store

1993

2,000th Store

1985

1,000th Store

2003 Annual Report

We’ve still got a

long way to grow!

Table of contents

-

Page 1

2003 Annual Report 2003 5,000th Store We've still got a long way to grow! 2001 4,000th Store 1998 3,000th Store 1993 2,000th Store 1985 1,000th Store -

Page 2

-

Page 3

... plans to open about 565 new stores and close approximately 60 during the current fiscal year ending August 28, 2004. Family Dollar's headquarters are located in Matthews, North Carolina, just outside of Charlotte. The Company operates automated full-service distribution centers in Matthews; West... -

Page 4

... investments in our people and supply chain, we are building the foundation for continued profitable growth. Family Dollar's low overhead, self-service, small store format draws an ever growing base of value-conscious consumers looking for great values on low cost, basic family and home merchandise... -

Page 5

... to our customers Stores Growing our Company one new store at a time, while offering exceptional value and convenience to our neighborhood shoppers Supply Chain Growing efficiencies in the supply chain to support our aggressive expansion plans Locations Growing our store base to meet the needs... -

Page 6

...home departments, we are doing a better job of meeting our customers' needs for fashionable yet affordable merchandise. Consumables continue to represent a large and growing part of our business. Investments in our supply chain in recent years have positioned us to more aggressively manage inventory... -

Page 7

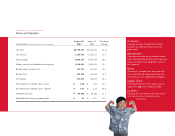

...in our business, positions Family Dollar for continued profitable growth." *After cumulative effect of accounting change Shareholders' Equity (millions of dollars) 1,311 In fiscal 2004, we plan to open approximately 565 new stores, expand or relocate about 125 stores, close about 60 stores, begin... -

Page 8

... low-end price points our customers need. Customer focus groups and surveys tell us that we are making good progress. In fact, in the Third Annual Shopper Report, a nationwide survey of 6,000 households by Chain Store Age magazine and Cap Gemini Ernst & Young, consumers picked Family Dollar as the... -

Page 9

Percent of Consumer Households That Shopped in a Dollar Store 62% 59% 55% 52% 47% Growing Customer Base After several years of coping with a difficult economy, today's discount store shopper profile may be a surprise. Independent research released in the summer of 2003 shows that dollar stores are ... -

Page 10

... income value-conscious customers know that Family Dollar provides products at everyday low prices with the convenience of relatively small stores located in their neighborhoods. The value equation at Family Dollar, however, is more than just low prices and convenience. To meet our customers' needs... -

Page 11

...such hardlines departments as household chemicals, health and beauty aids, paper goods and food. The growing assortment of name brand products, which now represents about 35% of sales, also enhances our quality image. Low prices and shopping convenience continue to be the foundation of Family Dollar... -

Page 12

...our site selection models, more effective merchandising of new stores, and new recruiting and training programs that have enabled us to better staff new stores. During fiscal 2003, Family Dollar identified a number of key store-centered initiatives that are designed to improve customer service while... -

Page 13

...-employment assessment and interview process. Looking forward to fiscal 2004, we will continue to develop, implement and execute strategic Store of the Future initiatives as we focus on satisfying the needs of our customers and workforce. Family Dollar's future is positive with growth opportunities... -

Page 14

... tools which are now being used to improve performance analysis in diverse areas from inventory turnover to distribution center productivity. The Family Dollar distribution network continued its expansion with the opening of a seventh distribution center located in Odessa, Texas, and plans call... -

Page 15

... Front Royal, Virginia 907,000 Square Feet 1994 West Memphis, Arkansas 850,000 Square Feet 1974 Matthews, North Carolina 930,000 Square Feet 11 Announcing the Opening of Our Newest State-of-the-Art Distribution Center With the on-time, on-budget opening of our newest facility in Odessa, Texas, in... -

Page 16

... store in Charlotte 44 years ago, Family Dollar has expanded rapidly from its base in North Carolina. During the past ten fiscal years, 2,992 new store locations have been added to the chain, representing nearly 60% of the stores in operation. The 475 stores added in fiscal 2003 include 70 in Texas... -

Page 17

... Indiana 314 Illinois 160 151 Kentucky Missouri 171 84 Arkansas 98 Pennsylvania 193 Virginia 191 Arizona 88 New Mexico 71 Oklahoma 103 Texas 607 North Carolina Tennessee 278 175 South Carolina 155 Georgia 256 Alabama 143 Florida 271 Mississippi 105 Louisiana 198 Number of Stores 4,616 4,141... -

Page 18

...quarter of fiscal 2003, all stores had anniversaried the fiscal 2002 program in which the Company eliminated approximately Summary of Selected Financial Data Years Ended (In thousands, except per share amounts and store data) Net sales Cost of sales and operating expenses Income before income taxes... -

Page 19

...was distributed in fiscal 2002. The adverse sales impact of discontinuing one circular was offset by the increased customer traffic generated by the everyday low pricing strategy and shift in the merchandise mix. For fiscal 2004, the Company plans to distribute one circular. The existing store sales... -

Page 20

... to shoes. The Company distributed two advertising circulars in fiscal 2002 and three advertising circulars in fiscal 2001. Hardlines merchandise includes primarily household chemical and paper products, health and beauty aids, candy, snack and other food, electronics, housewares and giftware... -

Page 21

.... The new store expansion and eighth distribution center will also require additional investment in merchandise inventories. Capital spending plans, including store expansion, are continuously reviewed and are subject to change. Cash flow from current operations is expected to be sufficient to meet... -

Page 22

... large number of the Company's retail locations and employees. The Company's self-insurance liabilities are based on the total estimated costs of claims filed and estimates of claims incurred but not reported, less amounts paid against such claims, and are not discounted. Management reviews current... -

Page 23

... that projected results expressed or implied in such statements will not be realized. Family Dollar Stores, Inc. and Subsidiaries Market Price and Dividend Information Family Dollar's Common Stock is traded on the New York Stock Exchange under the ticker symbol FDO. At November 1, 2003, there were... -

Page 24

...our opinion. September 29, 2003 Charlotte, North Carolina Family Dollar Stores, Inc. and Subsidiaries Consolidated Statements of Income Years Ended (In thousands, except per share amounts) Net sales Costs and expenses: Cost of sales Selling, general and administrative August 30, 2003 $4,750,171... -

Page 25

Family Dollar Stores, Inc. and Subsidiaries Consolidated Balance Sheets (In thousands, except share amounts) August 30, 2003 August 31, 2002 Assets Current assets: Cash and cash equivalents Merchandise inventories Deferred income taxes (Note 5) Income tax refund receivable (Note 5) Prepayments ... -

Page 26

... 1,079,092 common shares under employee stock option plan, including tax benefits (Note 8) Purchase of 2,202,200 common shares for treasury Issuance of 2,583 shares of treasury stock under the Family Dollar 2000 outside directors plan Less dividends on common stock, $.29 per share Balance, August 30... -

Page 27

Family Dollar Stores, Inc. and Subsidiaries Consolidated Statements of Cash Flows Years Ended (In thousands) Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Deferred income taxes (Gain)... -

Page 28

... the time the customer tenders payment for and takes possession of the merchandise. Insurance liabilities: The Company is primarily self-insured for health care, property loss, workers' compensation and general liability costs. These liabilities are based on the total estimated costs of claims filed... -

Page 29

...have a material impact on the Company's financial position or results of operations. Store opening and closing costs: The Company charges pre-opening costs against operating results when incurred. For properties under operating lease agreements, the present value of any remaining liability under the... -

Page 30

Family Dollar Stores, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued) Years Ended August 30, 2003, August ...31,750 $ 685,617 Buildings Furniture, fixtures and equipment Transportation equipment Leasehold improvements Construction in progress Less accumulated depreciation... -

Page 31

... 30, 2003 Deferred income tax liabilities: Excess of book over tax basis of property and equipment Deferred income tax assets: Excess of tax over book basis of inventories Currently nondeductible accruals for: Self-insurance Vacation and bonus pay Other Total deferred income tax assets $79,395 $18... -

Page 32

...plan or guarantee earnings. 7. Commitments and Contingencies: Operating leases: Except for its executive offices and primary distribution centers, the Company generally conducts its operations from leased facilities. Normally, store real estate leases are for initial terms of from five to ten years... -

Page 33

...Company. Thereafter, pursuant to the Court's ruling, notice of the pendency of the lawsuit was sent to approximately 13,000 current and former Store Managers holding the position on or after July 1, 1999. Based on currently available information, approximately 2,552 of those have filed consent forms... -

Page 34

... Statements (continued) Years Ended August 30, 2003, August 31, 2002 and September 1, 2001 8. Employee Stock Option Plan: The Company's non-qualified stock option plan provides for the granting of options to key employees to purchase shares of common stock at prices not less than fair market value... -

Page 35

... exercised. On October 9, 2002, the Board of Directors authorized the purchase of up to 5 million shares of its outstanding Common Stock from time to time as market conditions warrant. The Company purchased in the open market 2.2 million shares at a cost of $65.9 million. The following table sets... -

Page 36

... share. 11. Related Party Transactions: The Company purchased a variety of merchandise in the ordinary course of business from entities owned or represented by non-employee family members of the Company's former Chairman of the Board and the current Chairman of the Board and Chief Executive Officer... -

Page 37

...Shares Listed New York Stock Exchange Ticker Symbol: FDO Independent Auditors PricewaterhouseCoopers LLP Charlotte, North Carolina 28202 Transfer Agent and Registrar Mellon Investor Services LLC 85 Challenger Road Ridgefield Park, New Jersey 07660 1-800-851-9677 Internet: www.melloninvestor.com Form... -

Page 38

10401 Old Monroe Road Post Office Box 1017 Charlotte, North Carolina 28201-1017 www.familydollar.com