Dell 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

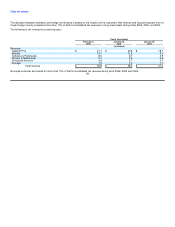

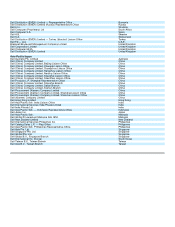

Table of Contents

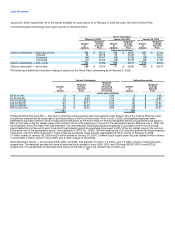

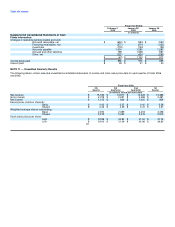

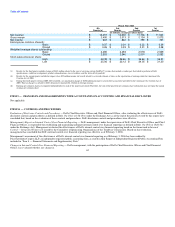

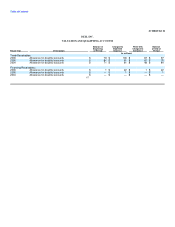

Fiscal Year 2005

4th 3rd 2nd 1st

Quarter(c) Quarter Quarter Quarter

(in millions, except per share data)

Net revenue $ 13,457 $ 12,502 $ 11,706 $ 11,540

Gross margin $ 2,495 $ 2,313 $ 2,134 $ 2,073

Net income $ 667 $ 846 $ 799 $ 731

Earnings per common share(d):

Basic $ 0.27 $ 0.34 $ 0.32 $ 0.29

Diluted $ 0.26 $ 0.33 $ 0.31 $ 0.28

Weighted average shares outstanding:

Basic 2,485 2,493 2,518 2,539

Diluted 2,553 2,546 2,574 2,593

Stock sales prices per share:

High $ 42.38 $ 36.66 $ 36.66 $ 36.31

Low $ 35.06 $ 33.12 $ 34.05 $ 31.20

(a) Results for the third quarter include charges of $442 million related to the cost of servicing certain OptiPlexTM systems that include a vendor part that failed to perform to Dell's

specifications, workforce realignment, product rationalizations, excess facilities, and the write-off of goodwill.

(b) Results for the second quarter include the impact of an $85 million income tax benefit related to a revised estimate of taxes on the repatriation of earnings under the American Jobs

Creation Act of 2004.

(c) During the fourth quarter of fiscal 2005, Dell recorded a tax repatriation charge of $280 million pursuant to a favorable tax incentive provided by the American Jobs Creation Act of

2005. This tax charge was related to Dell's decision to repatriate $4.1 billion in foreign earnings.

(d) Earnings per common share are computed independently for each of the quarters presented. Therefore, the sum of the quarterly per common share information may not equal the annual

earnings per common share.

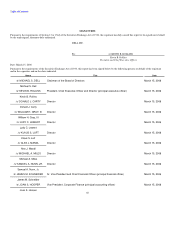

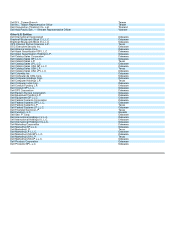

ITEM 9 — CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

Not applicable.

ITEM 9A — CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures — Dell's Chief Executive Officer and Chief Financial Officer, after evaluating the effectiveness of Dell's

disclosure controls and procedures (as defined in Rule 13a-15(e) or 15d-15(e) under the Exchange Act) as of the end of the period covered by this report, have

concluded that, based on the evaluation of these controls and procedures, Dell's disclosure controls and procedures were effective.

Management's Report on Internal Control Over Financial Reporting — Dell's management, under the supervision of Dell's Chief Executive Officer and Chief

Financial Officer, is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a-15(f) or 15d-15(f)

under the Exchange Act). Management evaluated the effectiveness of Dell's internal control over financial reporting based on the framework in Internal

Control — Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on that evaluation,

management has concluded that Dell's internal control over financial reporting was effective as of February 3, 2006.

Management's assessment of the effectiveness of Dell's internal control over financial reporting as of February 3, 2006 has been audited by

PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their Report of Independent Registered Public Accounting Firm

included in "Item 8 — Financial Statements and Supplementary Data."

Changes in Internal Control Over Financial Reporting — Dell's management, with the participation of Dell's Chief Executive Officer and Chief Financial

Officer, has evaluated whether any change in 62