Dell 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

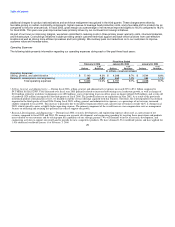

Table of Contents

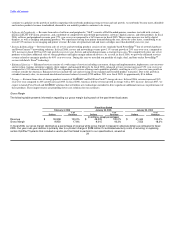

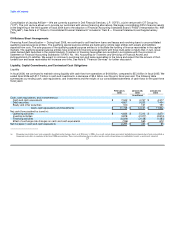

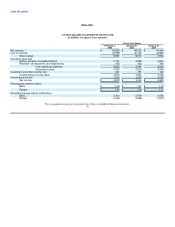

Capital Expenditures — During fiscal 2006, we spent $728 million on property, plant, and equipment primarily on our global expansion efforts

and infrastructure investments in order to support future growth. Product demand and mix, as well as ongoing efficiencies in operating and

information technology infrastructure, influence the level and prioritization of our capital expenditures. Capital expenditures for fiscal 2007

related to our infrastructure are currently expected to be approximately $800 million. Capital expenditures during fiscal 2007 are expected to be

funded by cash flows from operating activities and are estimated to increase compared to recent years due to our continued expansion

worldwide and the need for additional manufacturing capacity.

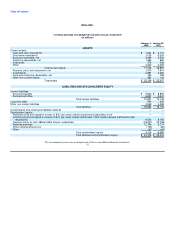

Restricted Cash — Pursuant to an agreement between DFS and CIT, DFS is required to maintain certain escrow cash accounts associated

with revolving loans originated by CIT and serviced by DFS. Due to the consolidation of DFS, $453 million and $438 million in restricted cash is

included in other current assets on our consolidated statement of financial position as of February 3, 2006 and January 28, 2005, respectively.

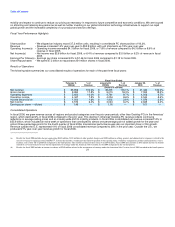

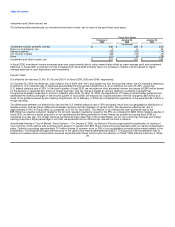

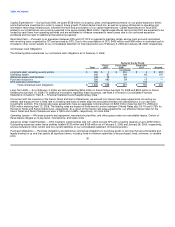

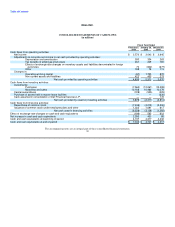

Contractual Cash Obligations

The following table summarizes our contractual cash obligations as of February 3, 2006:

Payments Due by Period

Fiscal Fiscal 2008- Fiscal 2010-

Total 2007 2009 2011 Beyond

(in millions)

Long-term debt, including current portion $ 505 $ 1 $ 204 $ 3 $ 297

Operating leases 346 67 109 63 107

Advances under credit facilities 133 78 55 — —

Purchase obligations 556 482 59 15 —

DFS purchase commitment 100 — — 100 —

Total contractual cash obligations $ 1,640 $ 628 $ 427 $ 181 $ 404

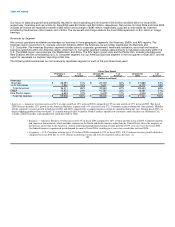

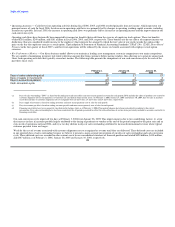

Long-Term Debt — As of February 3, 2006, we had outstanding $200 million in Senior Notes due April 15, 2008 and $300 million in Senior

Debentures due April 15, 2028. For additional information regarding these issuances, see Note 2 of Notes to Consolidated Financial

Statements included in "Item 8 — Financial Statements and Supplementary Data."

Concurrent with the issuance of the Senior Notes and Senior Debentures, we entered into interest rate swap agreements converting our

interest rate exposure from a fixed rate to a floating rate basis to better align the associated interest rate characteristics to our cash and

investments portfolio. The interest rate swap agreements have an aggregate notional amount of $200 million maturing April 15, 2008 and

$300 million maturing April 15, 2028. The floating rates are based on three-month London Interbank Offered Rates plus 0.41% and 0.79% for

the Senior Notes and Senior Debentures, respectively. As a result of the interest rate swap agreements, our effective interest rates for the

Senior Notes and Senior Debentures were 4.108% and 4.448%, respectively, for fiscal 2006.

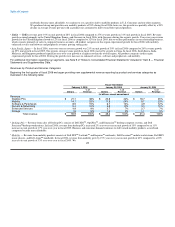

Operating Leases — We lease property and equipment, manufacturing facilities, and office space under non-cancellable leases. Certain of

these leases obligate us to pay taxes, maintenance, and repair costs.

Advances Under Credit Facilities — DFS maintains credit facilities with CIT, which provide DFS with a funding capacity of up to $750 million.

Outstanding advances under these facilities totalled $133 million and $158 million as of February 3, 2006 and January 28, 2005, respectively,

and are included in other current and non-current liabilities on our consolidated statement of financial position.

Purchase Obligations — Purchase obligations are defined as contractual obligations to purchase goods or services that are enforceable and

legally binding on us and that specify all significant terms, including fixed or minimum quantities to be purchased; fixed, minimum, or variable

price 30