Dell 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

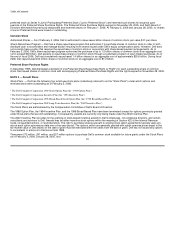

payments to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values. The

pro forma disclosures previously permitted under SFAS No. 123 will no longer be an alternative to financial statement recognition. Under

SFAS No. 123(R), Dell must determine the appropriate fair value method to be used for valuing share-based payments, the amortization

method of compensation cost and the transition method to be used at the date of adoption.

In April 2005, the Securities Exchange Commission ("SEC") amended Rule 401(a) of Regulation S-X to delay the effective date for compliance

with SFAS No. 123(R). Based on the amended rule, we are required to adopt SFAS No. 123(R) beginning with our fiscal 2007. Dell has

evaluated the requirements of SFAS No. 123(R) and will adopt SFAS No. 123(R) beginning in the first quarter of fiscal 2007. Dell currently

estimates this adoption to have a three cent impact on earnings per share in the first quarter of fiscal 2007. Dell will apply the modified

prospective method, which requires that it record compensation expense for all unvested stock option and restricted stock awards as required

by SFAS 123(R) in the periods beginning with fiscal 2007.

In June 2005, the FASB issued FSP FAS 143-1, "Accounting for Electronic Equipment Waste Obligations" ("FSP 143-1"), which provides

guidance on the accounting for certain obligations associated with the Waste Electrical and Electronic Equipment Directive (the "Directive"),

adopted by the European Union ("EU"). Under the Directive, the waste management obligation for historical equipment (products put on the

market on or prior to August 13, 2005) remains with the commercial user until the customer replaces the equipment. FSP 143-1 is required to

be applied to the later of the first reporting period ending after June 8, 2005 or the date of the Directive's adoption into law by the applicable

EU member countries in which the manufacturers have significant operations. Dell adopted FSP 143-1 in the first quarter of fiscal 2006 and has

determined that its effect did not have a material impact on its consolidated results of operations and financial condition for fiscal 2006.

In November 2005, the FASB issued FSP FAS 115-1 and FAS 124-1, "The Meaning of Other-Than-Temporary Impairment and Its Application

to Certain Investments"("FSP 115-1"), which provides guidance on determining when investments in certain debt and equity securities are

considered impaired, whether that impairment is other-than-temporary, and on measuring such impairment loss. FSP 115-1 also includes

accounting considerations subsequent to the recognition of an other-than temporary impairment and requires certain disclosures about

unrealized losses that have not been recognized as other-than-temporary impairments. FSP 115-1 is required to be applied to reporting periods

beginning after December 15, 2005 and is required to be adopted by Dell in the first quarter of fiscal 2007. Dell is currently evaluating the effect

that the adoption of FSP 115-1 will have on its consolidated results of operations and financial condition, but does not expect it to have a

material impact.

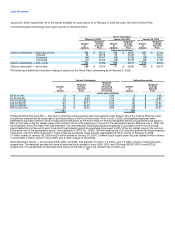

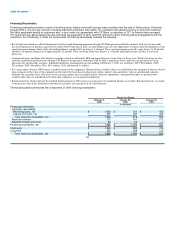

Reclassifications — Financing receivables have been separately classified on the balance sheet as of February 3, 2006. Prior periods have

been reclassified to conform to the current presentation. These reclassifications have no effect on the results of operations or stockholders'

equity as previously reported.

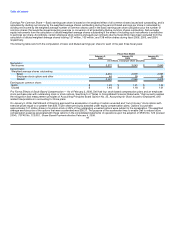

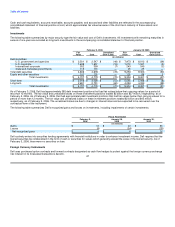

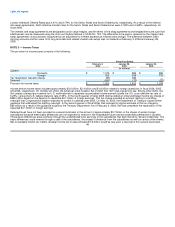

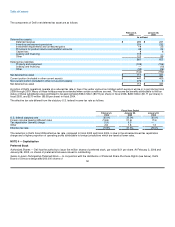

NOTE 2 — Financial Instruments

Disclosures About Fair Values of Financial Instruments

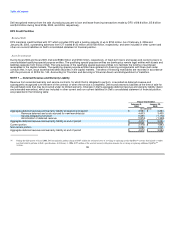

The fair value of investments, long-term debt, and related interest rate derivative instruments has been estimated based upon market quotes

from brokers. The fair value of foreign currency forward contracts has been estimated using market quoted rates of foreign currencies at the

applicable balance sheet date. The estimated fair value of foreign currency purchased option contracts is based on market quoted rates at the

applicable balance sheet date and the Black-Scholes option pricing model. The estimates presented herein are not necessarily indicative of the

amounts that Dell could realize in a current market exchange. Changes in assumptions could significantly affect the estimates.

46